Every year, the IRS announces adjustments to tax brackets to account for inflation. Given the blazing rates of inflation in 2021, 2022, and 2023, many taxpayers may have become accustomed to significant bracket adjustments. However, with inflation cooling during 2024, the newly announced adjustments are smaller than those of recent years. Keep in mind that these tax rates will be used for filing in April of 2026, as they are published a year in advance.

In addition to tax bracket updates, we will also highlight important changes to standard deductions and other critical numbers.

Now, let’s dive into the updates.

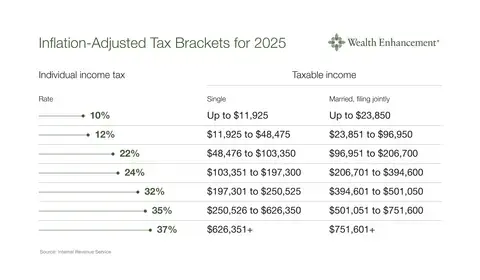

Tax Brackets for 2025

Marginal tax brackets explained

Trying to determine how much you’ll pay in taxes next year? One key to finding out is understanding marginal tax brackets.

“Marginal tax brackets” refer to the different income ranges that are taxed at progressively higher rates. Under this system, your income is divided into segments. Each segment is taxed at its corresponding rate.

Marginal tax bracket example using 2025 rates

For example, let’s say you earn $125,000 in 2025 as a single filer. While this salary would mean that you would pay some of your income in the 24% bracket, you won’t pay 24% on every dollar.

Instead, you would pay the following:

- 10% on the first $11,925

- 12% on the next $36,550

- 22% on the next $54,875

- 24% on the remainder (which, for purposes of this example, is $21,650).

This structure ensures that only the highest dollars you earn are taxed at the top rate that applies to you. This helps to make the system more equitable across different income levels.

2025 Standard Deduction increases

In addition to tax brackets, other tax-related numbers have increased for 2025, including the standard deduction. Here’s the details:

- Single filers and married individuals filing separately: The standard deduction increases to $15,000, up $400 from 2024.

- Married couples filing jointly: For joint filers, the deduction rises to $30,000, an $800 increase over 2024—and still exactly twice the single deduction.

- Heads of household: The deduction for heads of household increases by $600, bringing it to $22,500.

Other tax adjustments in 2025 (AMT, tax credits, and more)

There are a variety of other provisions in the IRS updates that pertain to different parts of the tax code. We’ve assembled some of the more notable changes here:

- Alternative Minimum Tax (AMT) exemptions: The AMT exemption amount increases to $88,100 for single filers and $137,000 for married couples filing jointly. Phase-outs for these exemptions start at $626,350 for single filers and $1,252,700 for married couples.

- Earned Income Tax Credit (EITC): The maximum EITC for families with three or more qualifying children rises to $8,046, up from $7,830 in 2024.

- Health flexible spending cafeteria plans: Employees can now contribute up to $3,300 to their FSA, up from $3,200 in 2024. For plans that allow the carryover of unused funds, that amount has risen to $660.

- Estate and gift tax exclusions: The basic estate exclusion increases to $13,990,000, up from $13,610,000 in 2024. The annual exclusion for gifts will rise to $19,000 for calendar year 2025 (up from $18,000 in 2024).

- Foreign earned income exclusion: For taxpayers working abroad, the foreign earned income exclusion rises to $130,000, up from $126,500 in 2024.

Preparing for the 2026 filing season

With next tax season right around the corner, it’s important for taxpayers to stay up to date on what they’ll be paying. To make the most of your available deductions, credits, and strategic planning opportunities, reach out to our team today.

#2024-5625