Executive Summary

With the pandemic fading into the background, investors shifted their focus towards inflation, geopolitical conflicts, rising interest rates, and slowing economic growth. With increased uncertainty, market volatility has been elevated throughout the quarter, but we remain cautiously optimistic on our longer-term outlook for the U.S. economy.

What Piqued Our Interest

News headlines regarding the Omicron variant of COVID were replaced by ones focused on inflation and geopolitical events. It has been a challenging start to 2022, as equity, fixed income and commodity markets all experienced elevated volatility. Monetary policy needed to adjust to reflect these new realities, and the Federal Reserve hiked interest rates in March for the first time since 2018.

Headline inflation of 7.9% reported during March was the highest print in the last 40 years and was a problem even before the war in Ukraine. However, we note that base effects will come into play as we progress through the year. The year-over-year growth rate of the Consumer Price Index (CPI) during the first quarter of 2021 ranged from 1.4% to 2.6%, providing a low base for this year’s inflation numbers. As we look forward, we recall that the second quarter of 2021 saw a range of 4.2% to 5.4%. Thus, we may be approaching a near-term peak in the year-over-year inflation prints at some point this year. Another observation to note from the March inflation data is that despite this large increase in headline inflation, the core inflation rate (excluding food and energy) saw some stabilization, as the month-over-month increase declined from 0.6% to 0.5%.

As telegraphed in prior Federal Reserve meetings, the Fed increased the Fed Funds rate by 25 basis points (bp). This rate increase came with aggressive guidance on future rate hikes and a solid commitment to fight inflation. The Fed’s release of economic projections indicated another six 25-bp rate hikes are to be expected this year—with three more in 2023. The Fed also outlined expectations for Quantitative Tightening (QT) to begin in May.

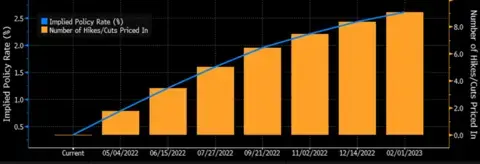

Furthermore, Fed officials raised the prospect of a 50-bp hike if inflation doesn’t slow. As shown in Figure 1 below, the bond market expects the Fed Funds rate to be near 2.00–2.25% by the end of 2022—slightly ahead of the Fed’s own projections.

Figure 1. Implied Overnight Rate & Number of Hikes/Cuts

Source: Bloomberg

For two decades, inflation expectations had been “well-anchored,” with some economists opining that inflation was too low. Over the last 10 years, forecasts for inflation had not breached 2.5%. However, forecasts for the next five years are now above 3.25%. This change in expectation can lead to inflationary psychology getting out of hand, so it makes sense for the central bank to counter it.

Additionally, as is typically the case when the Fed embarks on interest rate increases, the economy is relatively strong, with healthy consumer and corporate balance sheets and low unemployment rates likely able to absorb some of moderation of growth that comes with higher interest rates. Unless central banks tighten too much for too long, or the war in Ukraine intensifies, the U.S. economy should continue to grow, albeit at a slower pace.

Market Recap

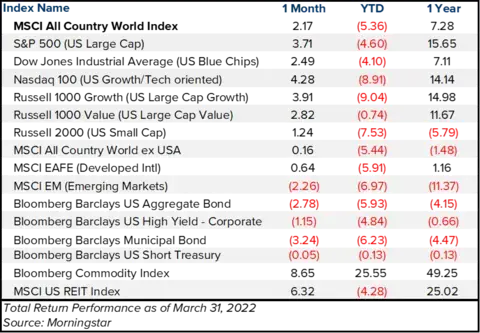

U.S. equity markets rebounded during the month of March, but first quarter returns were still negative across all markets. The S&P 500 Index rebounded 3.71% in March and closed the quarter down -4.60%. U.S. Large Cap stocks generally outperformed U.S. Small Caps, as the Russell 2000 Index only rebounded 1.24% in March and ended the quarter down -7.53%. However, we can see that Value stocks did much of the heavy lifting within the U.S. Large Cap space, as the 2.82% rebound in March almost brought the Russell 1000 Value Index close to flat on a year-to-date (YTD) basis. The Russell 1000 Value Index benefited from larger weights in sectors such as Energy and Utilities, which have posted solid gains YTD. Meanwhile, the tech-heavy Nasdaq 100 and Growth-oriented Russell 1000 Growth were both down nearly -9% for the year, despite a 4% rebound in both indices during the month of March. Higher inflation and higher interest rates impact price-to-earnings (P/E) multiples, and stocks with higher P/Es are hit hardest, as investors forecast a rise in the future cost of capital needed for growth.

One of the biggest challenges during the first quarter was in the bond markets, as most sectors remained pressured by inflation and tightening monetary policy, making it difficult for bonds to provide an offset to an equally challenged equity market. In March, the two-year yield climbed from 1.43% at the end of February to 2.33% to end the month, pricing in continued rate increases by the Fed. The 10-year Treasury moved higher as well and ended the month with nearly the same 2.33% yield. Reflecting these higher yields, the Bloomberg Barclays Aggregate Bond Index fell -2.78% in March and ended the quarter down -5.93%. Municipal bonds were hit the hardest during the month, down -3.24%. Lower-rated credits and long-duration municipal bonds, which led outperformance in 2021, were the top laggards in 2022.

Commodities continued to climb in 2022, as the Bloomberg Commodity Index was up 25.55% in the first quarter, with crude oil up over 30% and natural gas up over 50%. Agricultural commodities such as corn and wheat were up over 20% YTD. Given this rise in commodities, especially within food and energy, many continue to expect headline inflation to remain pressured to the upside as these higher prices work their way into finished goods.

Final Thoughts

The pandemic is no longer the focal concern in most markets. The war in Ukraine, higher inflation and the Federal Reserve’s expected path of monetary policy have contributed to uncertainty and volatility in every corner of the market. The timing of any resolution to these concerns is also unknown and can continue to weigh on markets and eventually slow economic growth.

Globally, economic growth prospects for Europe have deteriorated, while parts of Asia are still dealing with COVID lockdowns. However, the U.S. economy remains relatively strong with a tight labor market, and we believe there are opportunities to be captured for disciplined investors with long time horizons.

The opinions voiced in this material are for general information only, are subject to change at any time without notice, and are not intended to provide or be construed as providing specific investment advice or recommendations. Any economic forecasts presented herein may not develop as predicted and there can be no guarantee that any strategies promoted will be successful. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy.

Index returns reflect reinvestment of dividends and other income but do not reflect fees or other expenses of investing. Indices are unmanaged and are not available for direct investment. Past performance is not a guarantee of future results. Investing involves risk, including the possible loss of principal.