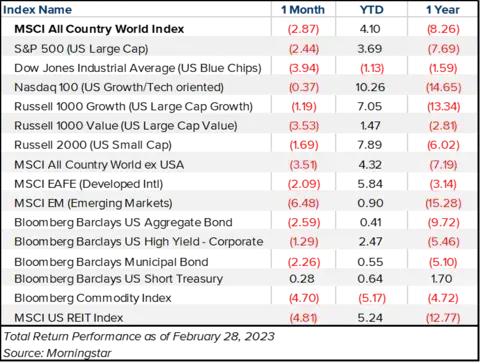

For the period March 1 – March 31, 2023

Executive Summary

Bank failures dominated the headlines for most of March. Caused by persistent high inflation and the Fed’s continued rate hiking, these failures stirred up fears that another banking crisis was on our hands. However, this is not 2008, and the overall banking system is the strongest it’s been in decades. Additionally, despite the bank failures, the markets finished positive for the month. After swift and effective action to contain a nationwide bank run, the Fed’s top priority remains getting inflation under control.

What Piqued Our Interest

There is a belief, supported by market history, that when the Fed begins an interest rate-hiking cycle, something eventually breaks. And a year into one of the fastest rate-hiking cycles in history, something broke. Beginning with Silicon Valley Bank (SVB), the Fed had to come in with emergency measures (guaranteeing all depositors’ funds and creating a lending facility for banks) to contain the risk of a nationwide bank run.

These bank failures brought back memories of the 2008 Great Financial Crisis, motivating the Fed to act fast and contain the crisis. It is important to recognize that the current financial problems are very different from those of 2008. Back then, the main issue was credit risk (primarily regarding residential real estate loans and securities) and how markets were pricing that risk. Today, the primary issue is interest-rate risk (or duration risk) on high-quality bonds. But the Fed has set up a new facility for banks that lets them, in effect, offload those securities to the Fed for a small fee, papering over balance sheet problems for banks able to take a small hit to earnings. The Fed seems to have calmed markets enough to still enact another interest rate hike of 25bps. The Fed made clear that the goal of bringing down inflation is still priority number one.

Market Recap

Most investors have heard the refrain, “Time in the market beats timing the markets.” In times of stress, investors will often feel they need to take action. But reacting after the fact is usually a sub-optimal choice, as the markets have already declined, and the majority of the damage is done. Once the stressful event has transpired, it is usually best to stay the course or invest more into the markets at depressed levels.

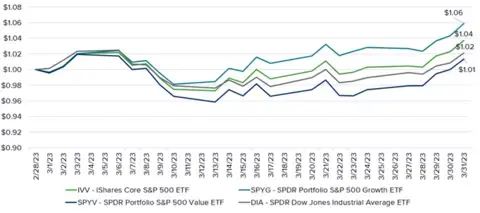

Even after the recent bank failures, beginning with SVB on March 10, the markets finished up positive for the month. If you had somehow been aware of the coming bank failures, you might have taken the other side of that bet.

Figure 1. Growth of $1 Through March 2023

Similar to 2020, if you had been told that there would be a global pandemic in which parts of the economy were shut down for months at a time, you might have thought it would be a bad year for markets. But as we all know now, the S&P 500 finished +18% for the year in 2020. These are two examples that show why market timing is nearly impossible, and reacting to recent events rarely pays—and does not pay nearly as well as letting your investments compound over long periods of time.

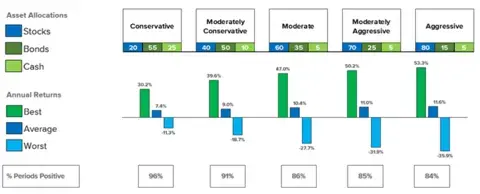

Instead of succumbing to the whims of the market and that feeling of needing to do something whenever the markets are not in your favor, you should focus on your overall strategic asset allocation. It is one of the most important decisions you make when investing your savings. By allocating across a diversified portfolio of stocks, bonds and alternatives (e.g., gold, private investments) you can create a smoother ride and (1) determine the level of risk you are comfortable with, and (2) the level of return you would like to aim for. Historical performance of traditional asset classes can help you identify what level you will be most comfortable with in terms of potential temporary declines in value and overall returns.

The image below shows five simple traditional allocation models using the S&P 500 Index for stocks, the Bloomberg Aggregate Bond Index for bonds, and the Bloomberg U.S. Treasury Bills Index for cash. It shows the average return for rolling 12-month periods, from 1976 through 2022, 540 observations total. You will notice that the more stocks there are in the allocation, the larger the historical drawdowns have been, but those have been accompanied by higher average returns. Finally, for all rolling 12-month return periods observed, the overwhelming majority have been positive. It’s usually more sunshine than clouds.

Figure 2. Returns of Traditional Asset Allocation Models, 12-Month Rolling Return Periods, 1976-2022

Disclosure: Returns shown are based on indexes rebalanced monthly; they assume reinvestment of income, no transaction costs or taxes, and that the allocation for each model remained consistent. These charts are for illustrative purposes only and do not represent the performance of any investment or group of investments. An individual cannot invest directly in an index. Past performance is not indicative of future returns. Data sourced from Bloomberg LP. Stocks are represented by the S&P 500 Index; International stocks by MSCI EAFE Index; Bonds are represented by the Bloomberg Barclays U.S. Aggregate Bond Index; Cash is represented by the Bloomberg Barclays U.S. Treasury Bill 1-3 Months Index from 1992 onward, prior to that the Ibbotson® US 30-Day Treasury Bill.

It has been over 300 days since the market made a new high, the longest streak since the 2008 Great Financial Crisis, so it makes sense investors are gloomier these days. But the reality is that every day that passes is a day closer to the next new high in the markets. Understand your strategic overall allocation, stick with it, and reap the returns it provides the patient, long-term investor.

This information is not intended as a recommendation. The opinions are subject to change at any time and no forecasts can be guaranteed. Investment decisions should always be made based on an investor's specific circumstances.

Index returns reflect reinvestment of dividends and other income but do not reflect fees or other expenses of investing. Indices are unmanaged and are not available for direct investment. Past performance is not a guarantee of future results. Investing involves risk, including the possible loss of principal.