Executive Summary

- Despite renewed fears stemming from the Delta variant of COVID-19, consumer confidence remains high, reflecting optimism surrounding jobs, spending and business conditions.

- Even with elevated inflation expectations, interest rates continue to fall as peak growth and earnings concerns percolate.

- The reflation trade, which benefitted cyclical sectors and Small Cap companies, continues to fade in favor of Growth-oriented sectors, which benefit from lower interest rates.

- China’s regulatory crackdown has pushed their equity market into bear market territory with notable implications for U.S. investors.

What Piqued Our Interest

Just as the world appeared to be turning the corner on the COVID-19 pandemic, the Delta variant has proven more formidable than first feared. With daily new cases averaging a six-month high of roughly 100,000, it is clear the global pandemic is not over yet, and the reality is now settling in that we may be forced to live with continued mandates and other safety provisions for the foreseeable future. Fortunately, the immediate impact to the economy has been minimal thus far, but some real-time indicators are showing that consumer behavior may have altered in recent weeks. Several large companies have pushed back mandates to bring employees back into the office this fall, while some large events such as the New York International Auto Show have been canceled. Data from OpenTable on dining reservations has stalled in recent weeks, as has air travel and credit card spending, according to Bank of America analysts.

Depending on how the resurgence plays out, the weaker trends may just be a short-term disruption to an otherwise red-hot economy. The U.S. added an additional 943,000 nonfarm payrolls in July, significantly besting most estimates while lowering the unemployment rate to 5.4%. The Consumer Confidence Index, which has climbed in each of the past six months, is now at its highest level since February 2020 and is buoyed by strong readings from the CEO Confidence Survey, as well as the Leading Economic Indicator Index. Within the Consumer Confidence survey, consumers expressed optimism that short-term business conditions, jobs and personal situations will improve, along with intentions to increase spending on housing, automobiles and major appliances. This obviously bodes well for growth in the second half of 2021, as the Conference Board projects GDP growth of 6.6% for calendar year 2021 and a respectable 3.8% in 2022.

One can rightfully argue that all of this is currently priced into stocks, which remain richly valued from a historical perspective. As the S&P 500 currently trades at a forward multiple of 21.2 times earnings, it’s hard to debate this fact (although, the multiple was as high as 24 this time last year). Perhaps this is why we’ve seen interest rates fall the past several months as a near-term indicator of peak growth and earnings. Second-quarter earnings season is nearly complete, with 89% of S&P 500 companies reporting, and 87% of those having positive earnings surprises–the highest level since 2008, according to FactSet. Year-over-year revenue growth has averaged a stunning 24.7% relative to an average growth rate of 3.4% over the past 10 years. Meanwhile, inflation expectations, which have surged in recent months, tapered off a bit as some material and commodity prices have come back to Earth. These factors, coupled with fears surrounding the Delta variant, help explain why the 10-year Treasury yield continues to fall, ending last month at just 1.23%–roughly 0.50% lower than its recent high in March.

As growth expectations temper, all eyes continue to be focused on the Fed for any signs of a change to their historically accommodative policies. Despite the recent strength in the labor market and economy as a whole, we don’t believe the Fed’s timeline for tapering has changed in recent weeks. Our base case remains that Chairman Powell and the Fed will communicate in September that if the economy continues to make progress at the recent pace, they will begin tapering its purchasing of $120 billion in Treasuries and agency bonds around year-end or early 2022.

Finally, there have been multiple headlines in recent weeks regarding China’s regulatory crackdown on publicly traded companies, particularly across internet-related sectors. Numerous Chinese subsectors have been hit hard by the onslaught of regulations: E-commerce, Fintech, and Private Education, just to name a few. There are plenty of reasons why China may be inflicting damage to some of its biggest and most successful companies: To limit the power of these rising monopolies, to help sever links with the U.S. and the West, to decrease the cost of education, and to attract talent away from companies that do little to further the government’s interests. Cybersecurity is another paramount reason for China’s recent actions. The Chinese Communist Party (CCP) doesn’t want any private company to be a backdoor into their databases of personal and private information.

There are notable questions and concerns for U.S. investors surrounding the recent moves by the Chinese government. A major implication of the regulatory crackdown is that Chinese companies will likely find it more challenging to raise capital in the U.S., while investors in the West may lose access to a booming growth opportunity. The key takeaway is that investing in China remains particularly challenging and that regulatory uncertainty will always be prevalent. While China’s regulatory crackdown may present considerable challenges in the short run, contagion concerns appear fairly limited at this time due to several other tailwinds for the global economy and markets. However, given the size and scope of the Chinese economy, continued uncertainty could create further volatility for global markets in the months ahead. This situation is particularly difficult to assess given that potential outcomes are dependent on decisions made by a select group of Chinese officials, although we believe it is unlikely that these actions will continue without limit.

Market Recap

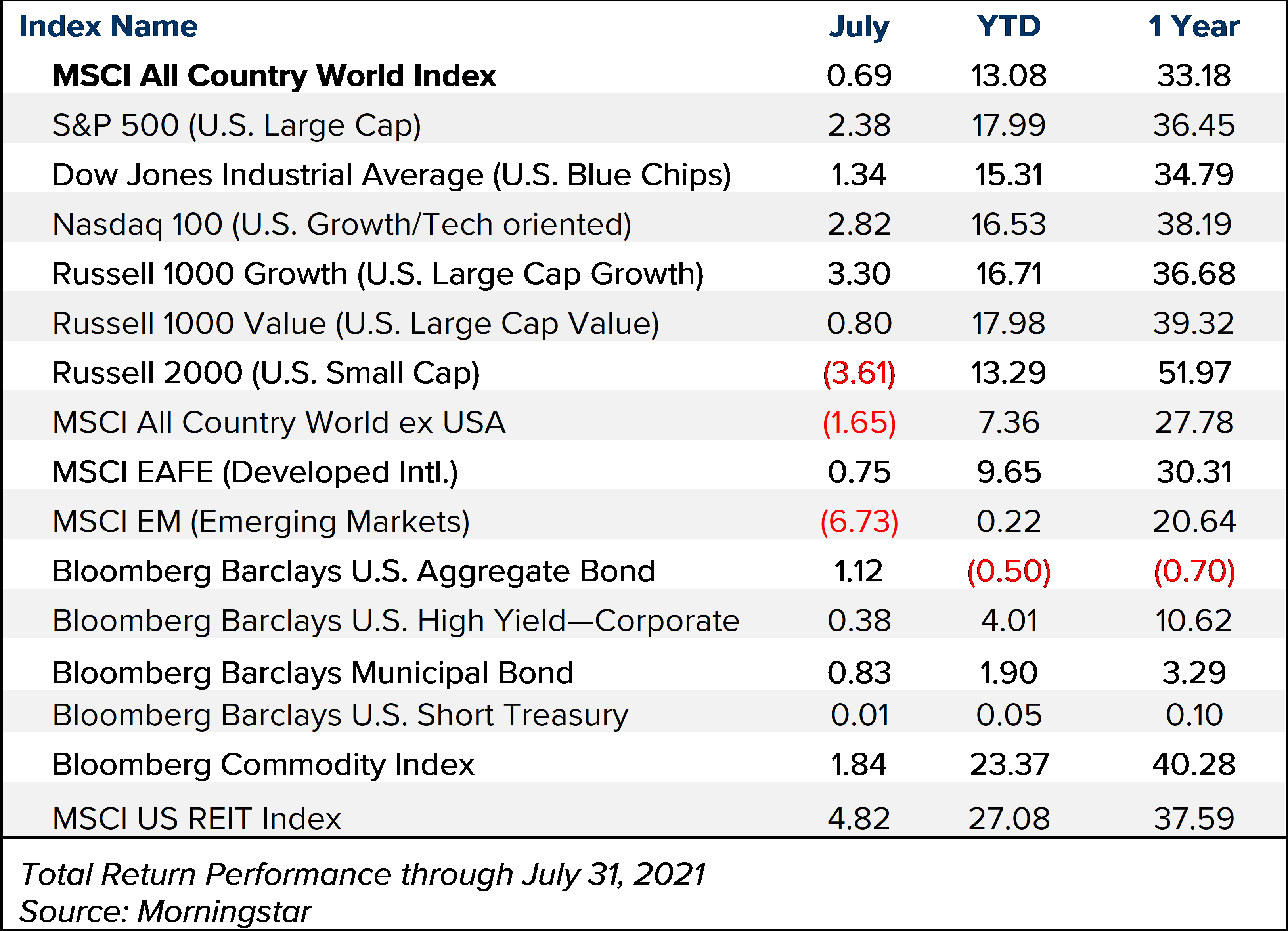

U.S. equities climbed higher in July for the sixth month in a row, as the S&;P 500 Index ended the month at 4395, just a few points below its all-time high. The Large Cap U.S. Index is now up 17.99% year to date (YTD) and just shy of +100% since the market bottomed in March of 2020. The continuing decrease in interest rates has helped longer-duration Growth stocks, in particular the Information Technology and Communication Services sectors, which have helped propel the Russell 1000 Growth Index to another month of outperformance. Year to date, the Russell 1000 Value Index is now just a hair above Growth after Value-oriented cyclical sectors dominated in the first quarter of this year. U.S. Small Caps stumbled in July as the Russell 2000 Index fell -3.86% and, for the first time this year, is now trailing the Large Cap Index. As leadership has shifted, the reflation trade that supported Small Caps lost its steam in the spring and is now struggling to keep up with more interest rate-sensitive Large Caps. From a sector standpoint, Energy dropped -8.3% last month but is still the biggest gainer YTD (+33.6%). Historically defensive sectors such as Health Care (+4.9%), Real Estate (+4.64%) and Utilities (+4.3%) were the top performers in July.

The big story for equities last month centered around China, as mentioned above. As of July 28, the China CSI 300 Index fell 21.36% from its peak on February 18, technically entering into bear market territory. As China represents approximately 40% of the MSCI Emerging Market Index, overall, the index plunged -6.73% in July and is now virtually flat on the year. Developed International fared better but is still notably trailing the U.S., as the EAFE Index gained 0.75% in July and 9.65% YTD. As with Small Caps, the fading reflation, which earlier in the year benefitted countries with higher exposure to Financial and Industrial sectors, has detracted returns for developed economies such as Europe and Japan.

The drop in rates has benefited fixed income securities, as the Bloomberg Barclay’s U.S. Aggregate Bond Index gained 1.12% in July and is now down just -0.5% YTD after being down roughly -3.5% toward the end of the first quarter. In general, both investment-grade and high-yield credit sectors have outperformed, with the High Yield Index up just over 4% this year. Spreads remain incredibly tight, so there is concern that a credit or liquidity event could quickly erase those gains, but for the time being, downgrades and defaults remain low. The Municipal Bond Index climbed 0.83% last month, but munis are outperforming the Aggregate Bond Index YTD (+1.9%), which is even higher when calculated on an after-tax basis. Also notable, TIPS, which are adjusted for inflation, gained 2.67% in July and are up 4.44% this year–one of the top-performing sectors across the bond market.

Closing Thoughts

Using history as a guide, the current six-month winning streak for the market bodes well for future returns. According to Bloomberg, after past six-month streaks, the average 12-month return on the S&;P 500 over the past 50 years was +8.3%.

That being said, September and October are known to be some of the worst-performing months for equities on average, and there are no shortages of concerns on the horizon. Between a miscalculation by the Fed, stretched valuations, inflation concerns, the Delta variant, and China’s regulatory crackdown, there are plenty of reasons to suspect another correction may be lurking. We continue to closely monitor these and all perceived risks, but overall have a constructive view on the economy as a whole. Global tailwinds such as easy monetary policies, more vaccinations across the globe, and a boom in manufacturing and consumer spending should support higher growth in months to come.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.