Executive Summary

A better-than-feared earnings season, combined with a market narrative where inflation may have peaked and future interest rate hikes may not be as large, provided some relief to markets. However, with two consecutive quarters of negative GDP growth, questions still linger about the timing of a potential recession. Despite the uncertain backdrop in the near term, we continue to focus on investments over a longer time horizon.

What Piqued our Interest

After the worst six-month start to a year since 1970, the S&P 500 Index climbed 9.2% in July, despite the hot headline number from the Consumer Price Index (CPI) that showed inflation at 9.1%. The market seemed to focus on the potential that inflation may have reached a peak and start to decelerate in magnitude in the coming months. This narrative was further supported by the University of Michigan’s longer-term inflation expectations survey, which dropped from 3.1% to 2.8%, helped by the drop in gasoline prices.

Market Recap

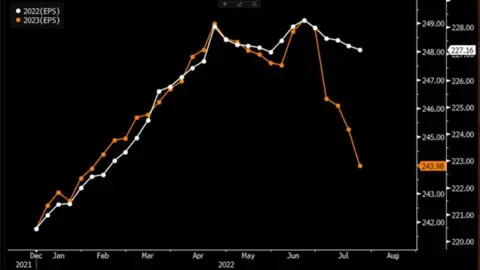

During earnings season, we saw that higher prices led to better-than-expected revenues for many companies. Inflation’s impact on corporate profits were also better than feared, as companies protected their margins. Growth stocks performed better in July versus their Value peers, but Value remains well ahead of Growth for the year. Despite the earnings relief and concurrent market rally, the outlook for earnings in coming quarters continued to get revised down. Figure 1 below shows that earnings per share (EPS) estimates for the S&P 500 Index are holding up for 2022, while analysts continue to revise 2023 estimates down.

Figure 1. 2022 Earnings Per Share (Actual) vs. 2023 Earnings Per Share (Projected)

With the backdrop of high inflation alongside a relatively strong job market, the Federal Reserve continued its endeavor to combat inflation and raised interest rates by another 0.75%, taking the Fed Funds Rate to 2.25–2.50%. At Fed chairman Jerome Powell’s press conference, he noted that interest rates have reached a “neutral” stance, where the impact to the economy would be neither helpful nor hurtful. This gave markets another reason to cheer, as many extrapolated this to believe that the Fed was taking a softer stance on future increases. The Federal Open Market Committee (FOMC) will not meet again until the third week in September, so there will be ample economic data that will get reported before then, and market expectations for additional rate increases will adjust accordingly.

The most recent report on economic growth showed that nominal GDP was a robust +7.9%, but once adjusted for inflation, GDP growth was negative for the second quarter in a row. With the focus shifting from inflation to recession, the bond market also experienced some relief in July. The U.S. Aggregate Bond Index was up +2.4%. The 2-year U.S. Treasury note yield ended the month at 2.9%, which was down from the mid-June high of 3.4%—yet another reflection of the “peak inflation” narrative. However, with the 10-year bond yield ending the month near 2.6%, yield curve inversion (which occurs when short-term instruments carry higher yields than long-term ones) added to concerns of a pending recession.

After a tough month in June, Commodities bounced back in July, as well. Commodities are up +4.3% and remains the lone positive asset class on a year-to-date basis. Additionally, July continued to be a tough month for Emerging Markets, as the MSCI Emerging Markets Index declined another -0.25%.

Closing Thoughts

Despite the rise in markets in July, we may not have passed the maximum Fed policy impact, as inflation remains stubbornly high. Current market conditions have crosscurrents unlike those seen in recent history with geopolitical tensions, a slowing post-pandemic recovery, and high inflation that may be more structural in nature. With this backdrop, the projected path of inflation and interest rates will continue to dictate the direction of markets.

Although investor patience can wear thin during years such as 2022, we remain optimistic in the long term, as the end of the current cycle eventually leads to the beginning of the next one. During these times, we continue to stress the importance of having a financial plan that keeps the focus on long-term investment goals that are calibrated for each investor’s risk tolerance.