Executive Summary

- U.S. credit’s outlook was downgraded from stable to negative by a major ratings analyst. Is it time to worry about our burgeoning debt crisis?

- Is the economic recovery reversing course? Real-time data and weekly jobless claims are showing signs of stalling.

- Equities continue to climb the wall of worries, but most of the returns are linked to Big Tech while the rest of the market lags.

- Longer-term bond yields are falling, once again suggesting that the market is pricing in slower growth in years ahead.

What Piqued Our Interest

In a proverbial shot across the bow for the financial markets, Fitch Ratings, one of the world’s major credit rating companies, has downgraded its outlook on U.S. credit from “Stable” to “Negative.” While they did maintain the rating at AAA, the highest rating overall, the message was unequivocally clear: In order to combat the economic impact of COVID-19, developed economies such as the U.S. have supported markets with 15-25% of their GDP in the form of monetary stimulus. In their own words, Fitch downgraded the outlook “to reflect the ongoing deterioration in the U.S. public finances and the absence of a credible fiscal consolidation plan.” The last time the U.S. was downgraded was in 2011, when S&;P lowered the rating on U.S. bonds one notch to AA+, causing significant market turbulence. So far, the bond market has not responded in the same manner. However, we are keeping a close eye on this situation, as there could be major ramifications down the road.

This all comes as the Bureau of Economic Analysis recently revealed that real GDP, the sum of all economic activity in the U.S., shrank by 9.5% in the second quarter. This marks the largest quarterly decline in modern history, dwarfing the previous low-water mark of -2.6%, which occurred during the Asian flu pandemic in 1958. After adjusting for seasonality, the annualized quarterly decline works out to -32.9%, almost four times greater than the worst quarter of the Great Recession last decade. The epic decline narrowly bested economists’ predictions, but it had long been baked into investors’ expectations, so the impact to the market was minimal.

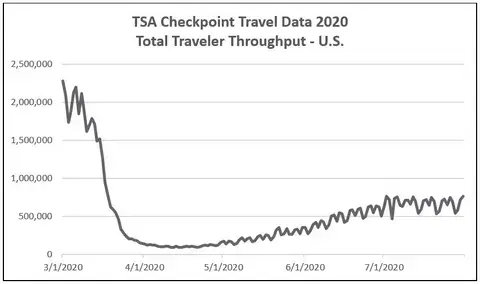

In our opinion, a more concerning issue is that numerous real-time data points are suggesting that the economic recovery may be hitting some speed bumps as COVID-19 cases continue to surge across the country. For example, following Mastercard's second quarter earnings release, remarks on consumer spending suggested that the U.S. economic recovery may be slowing. The company noted that July payment volumes have seen only modest week-to-week gains in July. These comments paralleled Visa’s earlier report, which observed little improvement since late June. In a separate observation, TSA data recently showed the first weekly downturn in travelers passing through checkpoints since April. Looking back at TSA data to the beginning of the pandemic, we observe that passengers going through checkpoints began rising in early May but have essentially stalled since the beginning of July.

Source: TSA

Turning toward the “soft” data, several prominent consumer surveys have turned weaker in recent weeks as well. Following a substantial increase in June, the Conference Board’s Consumer Confidence Index notably decreased in July. The decline was driven by pessimistic short-term outlooks for business and labor market conditions, with large declines occurring in Michigan, Florida, Texas and California, undoubtedly coinciding with the resurgence of COVID-19. This mirrors the results of the most recent University of Michigan Consumer Sentiment survey, in which the expectations component declined to its lowest level in six years, indicating that respondents are not expecting the recession to end anytime soon. The consumer surveys are largely a reflection of the ongoing gloom in the labor market, as weekly unemployment claims have totaled at least 1 million for 19 straight weeks. After declining for 15 weeks in a row, weekly claims increased during the last two weeks in July, as the pandemic continues to ravage the economy.

However, there has been one bright spot in the economy lately: Data for the housing market has been particularly strong. Driven by ultra-low interest rates, along with second home purchases and migration away from urban areas, home builders have reported strong results through the second quarter. Bloomberg recently reported that the U.S. home ownership rate has surged to almost 68%, its highest level since 2008, largely driven by young buyers, which usually spurs further business activity.

Market Recap

| Index Name | 1 Month | YTD | 1 Year |

| MSCI All Country World Index | 5.29 | (1.29) | 7.20 |

| S&;P 500 (U.S. Large Cap) | 5.64 | 2.38 | 11.96 |

| Russell 2000 (U.S. Small Cap) | 2.77 | (10.57) | (4.59) |

| Russell 3000 (U.S. All Cap) | 5.68 | 2.01 | 10.93 |

| MSCI All Country World ex. USA | 4.46 | (7.03) | 0.66 |

| MSCI EAFE (Developed Intl.) | 2.33 | (9.28) | (1.67) |

| MSCI EM (Emerging Markets) | 8.94 | (1.72) | 6.55 |

| Bloomberg Barclays U.S. Aggregate Bond | 1.49 | 7.72 | 10.12 |

| Bloomberg Barclays U.S. High Yield - Corporate | 4.69 | 0.71 | 4.14 |

| Bloomberg Barclays Municipal Bond | 1.68 | 3.80 | 5.36 |

| Bloomberg Barclays U.S. Short Treasury | 0.02 | 0.90 | 1.82 |

| Bloomberg Commodity Index | 5.71 | (14.80) | (12.07) |

| MSCI U.S. REIT Index | 4.04 | (15.67) | (11.51) |

| Total Return Performance through July 31, 2020. ; ; Source: Morningstar | |||

We are in the thick of corporate earnings season, as through the end of July, roughly 63% of companies in the S&;P 500 had reported their second quarter earnings, with another 129 reporting in the first week of August. Approximately 84% of reporting companies had beaten consensus EPS estimates, which is considerably higher than the 72% five-year average, according to FactSet research. On the heels of the better-than-expected results (albeit from a very low bar), the S&;P 500 gained another 5.64% in July, pushing itself back into positive territory for the year, up 2.38%. However, the returns have been widely dispersed, as market breadth (the total number of stocks advancing) has actually been quite low. In fact, through July 31, roughly 1.5 stocks in the S&;P 500 had declined for every one that advanced, with roughly 300 stocks still in negative territory for the year.

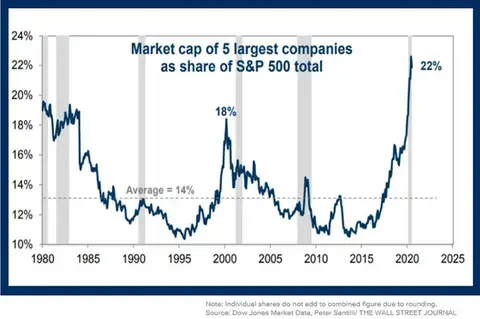

Many of the dynamics that have existed for years continue to be in force as the equity market rally continues on. Overall, Growth stocks continue to gain favor over Value stocks, a trend that is largely driven by the outsized performance of the largest FAANG (Facebook, Amazon, Apple, Netflix and Google [aka Alphabet, Google’s parent company]) stocks. It’s particularly notable that the market cap of the five largest companies in the S&;P 500 now make up more than 22% of the index, while just six companies make up roughly half of Nasdaq 100. The average return (not cap-weighted) for the six FAANG stocks was positive 38.8% through July, while the average return for all others was -6.75%, highlighting the stark difference in performance between Big Tech and the rest of the market.

In July, the top-performing sector was Consumer Discretionary (+9.0%), followed by Utilities (+7.8%) and Materials (+7.07%). The only negative sector was Energy (-5.13%) which fell despite the spot price of crude oil edging higher by 2.55%. While overall U.S. stocks have continued to outperform international, its worth noting that emerging markets have performed admirably as of late, as the index surged 8.94% in July. Some of the outperformance may be related to the recent weakness in the U.S. dollar, which had its worst month in a decade, falling 4.6% versus a basket of foreign currencies. E.M. stocks tend to benefit from a weaker dollar, as many companies have significant debt denominated in our currency.

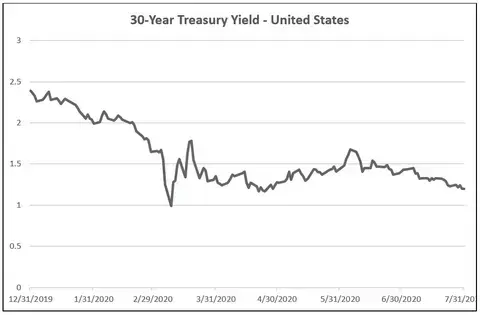

Despite the warning on U.S. debt from Fitch, bond yields on the short end of the curve have remained relatively stable, as the 10-year yield now trades around 0.56%. The same cannot be said about longer dated bonds, as the 30-year treasury now yields around 1.24%, down from 1.68% in early-June when COVID-19 cases began to resurge. Falling long-term bond yields can be indicative of weakness in growth expectations. Note that bond yields steadily drifted lower in January and February ahead of the downturn in equities, as the pandemic took hold in Asia and Europe. For the month, the Aggregate Bond Index gained another 1.49% in July and is now up a respectable 7.72% in 2020. High-yield corporate bonds enjoyed another strong month and are now positive on the year after falling almost 21% during the peak of the crisis back in March.

Source: FactSet

It can be difficult to make sense of all that’s happening in the world today considering the dislocation between Main Street and Wall Street. Equity valuations remain stretched by historical comparison, while interest rates continue their plummet towards zero, which the Fed has made clear will be the norm for years to come. The economic recovery appears to be stalling due to the resurgence of COVID-19, while Congress squabbles over the fifth fiscal relief package, which is so desperately needed by many. As if this weren’t enough, we haven’t even mentioned the plethora of uncertainties surrounding the upcoming elections, which are unbelievably just three months away.

Despite all this, the massive monetary stimulus unleashed by the Fed has continued to support risky assets and may do so for the immediate future. Without the clairvoyance of a crystal ball, as investors, we can only hope for the best but must prepare for the worst. While staying the course is paramount for long-term investment success, history suggests that volatility will soon reemerge, and it’s always best to have a strategy in place before that occurs.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.