Social Security is a big asset–one that could potentially exceed a million dollars in accumulated benefits over your lifetime–and it poses a number of complex decisions requiring financial projections as well as knowledge of Social Security rules and regulations. It’s important that you ensure your entire financial plan is ready to withstand potential changes.

While some of the considerations below may seem complex, you don’t have to figure them out on your own. Your financial advisor can help you go through each of these steps to find a claiming strategy that provides the maximum benefits for your unique situation.

Step #1: Decide When to Claim Social Security Benefits

When to start claiming benefits is perhaps the most complicated decision of all. You need to consider Social Security in the context of your entire financial situation. Keep in mind this simple principle: The later you begin receiving benefits (up to age 70), the larger those benefits will be.

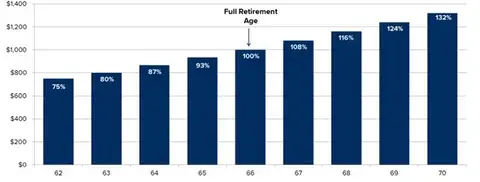

The full monthly retirement benefit is based on applying for benefits at Full Retirement Age (FRA), which is currently age 66 for those born 1943-1954, age 66 plus 2 months per year for those born 1955-1959, and age 67 for those born after 1960. For every year you wait after you reach FRA to apply for benefits, your benefits amount increases 8% per year up to age 70.

You can also apply before FRA, as early as age 62, and receive reduced benefits. For those born 1943-1954, that is a reduction of 25%; that is, you would receive only 75% of your full retirement benefits. If you were born in 1955 or later, the percent of your full benefits amount received at age 62 goes down even further. The graph below demonstrates what the increase or decrease would look like based on a monthly benefit amount of $1000 at the full retirement age of 66.

Source: Social Security Administration. Percentages based on an individual born in 1954 or earlier.

Step #2: Consider the Impact of Working in Retirement

Many retirees plan to continue working, most often part-time. While this can be a great way to stay active and maintain a steady income, working in retirement can actually reduce your Social Security benefits.

If you claim Social Security prior to reaching FRA, you can earn up to $18,240 without reducing your benefits. However, for every $2 you earn over $18,240, your benefits will be reduced by $1. It’s important to note, however, that the reduction becomes less severe the calendar year you reach FRA. The earnings limit increases to $48,600 and only applies during the months prior to reaching FRA, reducing benefits by $1 for every $3 you earn over $48,600. The month you reach FRA and every month thereafter, none of your benefits will be reduced, regardless of how much you earn.

Step #3: Employ Effective Tax Planning

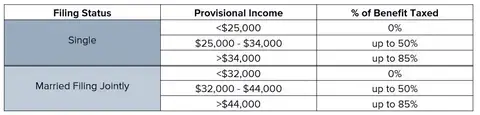

Whether or not you continue to work, you will continue to pay taxes. It’s important to know that Social Security benefits are taxable for all except the lowest income retirees. Only individuals with provisional income under $25,000 ($32,000 married filing jointly) have tax-free benefits. Otherwise, up to 85% of your Social Security benefits will be included in taxable income.

Understanding these thresholds is important, as is building tax diversification because withdrawals from a tax-advantaged Roth IRA don’t get included in your provisional income. For example, imagine you retire with no mortgage at age 65 and living expenses for you and your spouse are $50,000 per year. If you can take at least $6,000 of living expenses from a Roth IRA, you can avoid income tax on half of your Social Security benefits. You increase tax savings even more if you use an HSA to cover qualified medical expenses.

In order to avoid losing a large portion of your monthly benefit in taxes, it’s important to take into consideration how claiming your benefits will fit into your overall financial plan.

Step #4: Don’t be Shortchanged on Marital Status

After deciding when to file, the Social Security options based on marital status can be the most complex decisions you will make. File the wrong way, and you could lose thousands.

Married couples face a variety of complexities including whether or not to claim spousal Social Security benefits, which is 50% of the other partner’s retirement benefits. In general, couples with similar earning histories usually are best off both applying for their own benefits. Both are also usually best off waiting until FRA or beyond to claim benefits, but there are some exceptions.

Single, never married people have a simple claiming strategy. There are no benefits to claim other than your own.

Divorced individuals may qualify to claim on their ex-spouse’s earnings history, if they were married for 10+ years and are not currently married. Your ex-spouse does not need to approve of your benefits claim, nor will it affect his or her own benefits. In addition, if your ex-spouse dies, you may claim 100% of that late ex-spouse’s retirement benefits, even if another spouse or ex-spouse is claiming that same benefit.

Widow(er)s may receive 100% of your late spouse’s retirement benefits, which may be higher than your own benefits or spousal benefits. If you are receiving Social Security when your spouse dies, you are eligible to have your benefits increased to those of your late spouse.

These considerations are just the beginning. There are countless other life factors to take into account when creating your Social Security claiming strategy. It can be confusing to sort through all of the information to determine the best time to file for your unique situation. That’s where financial advisors come in–we can walk you through each consideration as it relates to your overall goals to develop a plan that works for you. Request a no-obligation meeting with a Wealth Enhancement Group advisor to get the answers you need to file for Social Security with confidence.

The information presented in this material is for general information only and are not intended to provide specific advice or recommendations for any individual. We suggest that you discuss your specific tax issues with a qualified tax advisor.