Executive Summary

As we approach the end of 2021 and look toward next year, uncertainty surrounding a new COVID-19 variant, inflation, and expected monetary policy changes are top of mind. Despite these headwinds—and the likelihood that both economic growth and corporate earnings growth will slow in 2022—the U.S. economy is well-positioned for continued growth in 2022 and beyond.

What Piqued Our Interest

Just when it looked as though we cleared the hurdles from the Delta variant during the summer, the new Omicron variant surged into headlines toward the end of November. The concern at this stage in the global economic recovery is that the variant can impact the pace of future economic growth, impede any supply chain improvements, and continue to pressure inflation in the near-term. While there are still many unknowns, recent headlines about the severity of the new variant have been more upbeat, as the more transmissible virus has yet to fuel a surge in hospitalizations.

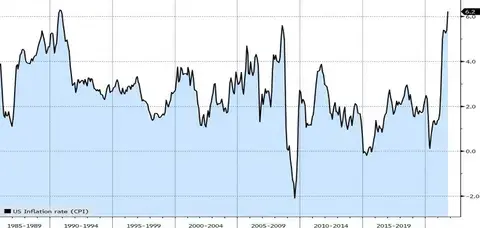

From an economic standpoint, the U.S. consumer has been resilient in 2021. Consumer spending drives 70% of overall U.S. GDP, and retail sales have been elevated all year, according to Bloomberg. Thanksgiving weekend was no exception, as Mastercard noted that U.S. retail sales (ex. Auto) increased 14% over the same four-day period last year. Visa also noted total payments volume for the month increased 25% over November of 2020. This consumer spending has been a significant contributor to the estimated 5.5% U.S. GDP growth for 2021. However, November also saw the Consumer Price Index (CPI) post a reading of 6.2%, the highest year-over-year growth rate since 1990. As a result of this elevated inflation, future consumption of goods may be dialed back or rotate toward more services as we go into 2022. Bloomberg’s estimate of U.S. GDP growth next year is still near 4%, a slight slowdown, but quite strong, nonetheless.

Source: Bloomberg

Contributing to the elevated inflation rate is the state of the labor market as wage growth has increased at an annual rate of more than 4%, according to the Atlanta Fed’s wage tracker. Total nonfarm payrolls have made a significant recovery, but the economy is still short 4.2 million workers. Labor participation remains lower than pre-pandemic levels due to those hesitant to re-enter the workforce, early retirements, and new opportunities created by technology that give workers more flexibility.

During the month, the Biden administration successfully passed a $1 trillion infrastructure bill aiming to improve transportation options by modernizing and expanding transit and rail networks, repair and rebuild roads and bridges, and expand broadband access and power infrastructure.

Against this backdrop, the Federal Reserve announced in November that it will be reducing the pace of its monthly bond purchases. This is another step toward pulling back on the accommodative stance it took during the initial stages of the pandemic. Currently, the Fed has been purchasing $120 billion of bonds per month, but this will be reduced by $15 billion each month ($10 billion in Treasuries and $5 billion in mortgage-backed securities). Going forward, with inflation becoming a more pressing issue, the Federal Reserve may adjust the pace of tapering in upcoming meetings. Testimony to Congress that began on the last day of November attests to this as chairman Powell commented that it was time to “retire the word transitory” when characterizing inflation.

Market Recap

U.S. equities were on a solid trajectory in November, as the S&P 500, Nasdaq 100 and Dow Jones Industrial Average all reached new highs during the month. However, news of the Omicron variant rippled through markets during the last week of November, pulling the S&P 500 and the Dow Jones into negative territory for the month. The Tech-oriented Nasdaq 100 and Large Cap Growth (as measured by the Russell 1000 Growth Index) continued their relative strength that began in October, finishing the month up slightly. International indices did not reach new highs in November and were down for the month.

On the fixed income side, the selloff along the short end seen in October continued into November. The U.S. two-year Treasury yield reached 0.64% in the month before retreating on the news of the Omicron variant during the last week of November. On the long end, the 10-year yield stayed within a similar range as during the month of October, resulting in a further flattening of the yield curve. The spread between the two-year and the 10-year returned to levels seen at the beginning of the year.

Commodities retreated the most during the month of November with the Bloomberg Commodity Index down -7.3% for the month. W.T.I. crude oil pulled back 20%, while other commodities such as corn and copper were down -2%. The fixed income and commodity markets may be reflecting a more subdued economic outlook, but it may also reflect the expectation for normalization in inflation and growth over the coming years, leaving the door open for central banks to keep rates lower for longer.

Final Thoughts

Whether Omicron turns out to be a quickly fading news story or something more serious will not likely be known for weeks or months. In the meantime, the combination of immunity and improved treatments through antiviral pills should further the prospect for a gradual return to normalcy. Travel data has continued to show a gradual recovery, supply chain congestions have started to ease, and the labor market remains healthy. Fiscal policy remains supportive, as the infrastructure bill was passed and further stimulus from the Build Back Better plan may be forthcoming.

Looking forward into 2022, we expect continued economic growth against the backdrop of gradually less accommodative monetary policy. This may increase volatility at times, but the market should be able to absorb modestly higher interest rates as a means to control runaway inflation. Given this outlook, we remain constructive on equities and credit but are mindful of the evolving risks as we proceed further along the recovery cycle.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.