Executive Summary

This has been an incredibly challenging year for investors. Though uncertainty continues in the near term, 2023 should be more stable as inflation subsides and a terminal interest rate is established. Opportunities are arising for patient investors, especially across the fixed income spectrum.

What Piqued Our Interest

It’s fair to say that most investors and financial practitioners are ready to turn the page on 2022, having suffered through a bear market in equities, the highest inflation surge since the 1970s, and the worst year on record for investment-grade fixed income. Nearly every traditional asset class outside of commodities is in negative territory, and a plethora of economic data suggests that a recession may be imminent. However, the markets are notoriously forward looking, and given the current market rally, along with evidence of peak inflation and China softening it’s zero-Covid policies, hope could be on the horizon.

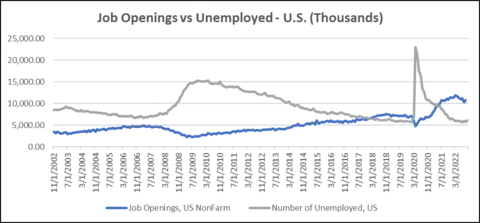

Comments by Fed Chief Jerome Powell on December 1 suggested that a “soft landing,” a tightening of monetary policy without pushing the economy into a recession, may still be possible. However, most of the data we observe suggests we’re heading toward a recession, with the major exception being the continued strength of the labor market. November payrolls again surpassed expectations, adding 263,000 jobs relative to expectations for 200,000, while October’s gains were also revised higher. On that note, there continues to be a wide gap between the number of job openings versus unemployed, currently near 4.6 million, its widest gap in the past two decades. This has driven wages higher, which is good for workers but bad for inflation, as data in November showed wages climbed another 0.6% and 5.1% year-over-year.

Figure 1. Job Openings vs. Unemployed in the U.S.

Source: FactSet, U.S. Department of Labor, Conference Board U.S.

The historically tight labor market has the Fed in a predicament as they attempt everything in their means to curb inflation. Though the Fed’s stated dual mandates are price stability and maximum employment, influencing financial markets through constant communication has become a more substantial element of their strategy over the years.

Dissecting Powell’s recent comments, the Fed is currently pushing two narratives simultaneously: The first is that the pace of interest rate hikes, which has been 75 basis point hikes at each of the last four meetings, is likely to decrease—news that has been well received by investors in risky assets such as stocks. The second is that the terminal rate may likely be higher than currently expected and that the Fed may need to remain at peak rates for longer than previously suggested. Hopes of interest rate cuts in 2023 are dissipating, while expectations for more 50- and 25-basis point hikes next year are rising. According to CME Group, Fed Fund Futures project a roughly 50% probability that rates will be above 5% by the March meeting (currently 3.75-4.0%).

Market Recap

Figure 2. Investment Market Data as of 11/30/2022

Source: Bloomberg

Global equities continued their fourth-quarter hot streak in November following a breakout month in October. The MSCI All Country World Index gained an additional 7.76% and is now up 14.26% this quarter. The S&P 500 climbed 5.59% but was once again outdone by the Dow Jones Industrial Average, which is now 20.96% higher this quarter and closing in on eliminating its losses this year. Oversold conditions, falling yields on the long end of the curve, and expectations for easing of monetary policy have all contributed to the market rally.

Seasonality may also be a factor, as the fourth quarter has traditionally been good for stocks, but also the post-election tailwind of a split Congress, as well as easing geopolitical risks in China and Ukraine, have helped the path of least resistance swing to the upside. Goldman Sachs recently noted that over the past 90 years, the median return 12 months after midterm elections has been +17%, and returns have tended to be higher when markets were down heading into the election.

Another notable takeaway has been the recent surge for International equities. The MSCI EAFE Index gained 11.26% in November and is quickly catching up to its U.S. counterparts. Both developed Europe and Asia-Pacific were strong, this coming on the heels of a decline in the U.S. dollar, which had been at its highest level since 2002. The U.S. Dollar Index (DXY) fell 5% in November and is now roughly 8% off its high in late September, much to the benefit of international equities. Chinese shares staged a huge comeback last month, as the MSCI China Index surged 29.7% fueled by signs of a Covid policy shift.

Turning our focus to bonds, the U.S. Aggregate Bond Index gained 3.68% last month and is now down -12.62% on the year. The yield on 10-year Treasuries fell from 4% to 3.5%, further inverting the yield curve to -0.70% versus the 3-month T-Bill. The bond market has certainly welcomed the news of softer inflation data after being hammered by higher rates for much of the year. All fixed income sectors finished positive in November, led by the Bloomberg/Barclays Long-Term Treasuries Index (+7.07%), credit (+4.97%) and municipals (+4.68%). Interestingly, the high-yield index lagged at just +2.17%, even as equities staged a rally. The spread on the high-yield index remained around 4.9%, which is right in line with its 20-year average versus the 10-year Treasury.

Closing Thoughts

It’s fair to wonder if we’re truly turning a corner or if we’re in a bad-news-is-good-news state for the markets, given the outsized focus on monetary policy these days. Weaker economic data continues to support our base case of a mild recession, which in turn could impact the trajectory of interest rates in 2023. Manufacturing is undoubtedly slowing, as is housing, as the November NAHB Builder Confidence Index fell for its 11th straight month to its lowest level since June 2012—excluding the pandemic. Inflation will likely remain above target well into next year, which is eating into corporate profits, as fourth-quarter earnings estimates have dropped 5.6% since the end of September, marking the steepest intra-quarter decline since Q2 2020, according to FactSet.

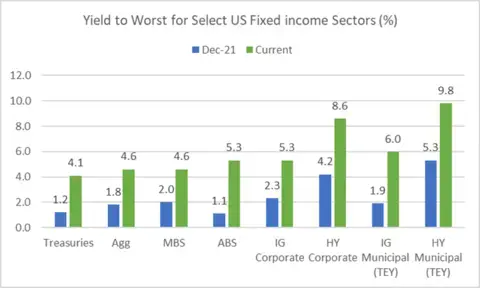

Whether we enter a recession in 2023 or not, we are beginning to see some silver linings in investment opportunities, particularly across the fixed income asset class. Investors can finally receive some “income” in their fixed income, as yields have rallied to their highest levels since before the Global Financial Crisis when we became all-too familiar with the concept of quantitative easing. The year-to-date increases have been remarkable, as investors can now earn high-single digits for paper that not too recently paid virtually nothing.

Looking overseas, the vast majority of negative yielding debt has now vanished, with the exception of Japanese issued debt. While more rate hikes are anticipated in the near term, which will lift the short end of the curve, slowing growth could put a ceiling on longer yields, so taking some duration risk next year looks more compelling. If nothing else, the current income will help offset any price volatility that could occur as inflation remains a concern.

Figure 3. Yield to Worst for Select U.S. Fixed Income Sectors

Source: Bloomberg, as of 11/30/22

Looking forward to next year, we expect more volatility for equities as the market grapples with the reality of an economic downturn, which could get worse if unemployment begins to rise. Despite the bear market we’re in, valuations for most equities are still relatively rich compared to long-term averages, particularly for categories such as Large Cap Growth, which have been overvalued in more recent years. As most of the price declines this year have been associated with a repricing of valuations, a decline in earnings-per-share could be the catalyst for the next market selloff. Small Cap stocks are looking more attractive comparatively and tend to do well coming out of a recession. The best approach, as always, is to own diversified, all-weather portfolios that can mitigate risk during downturns but participate when markets recover.

The opinions voiced in this material are for general information only, are subject to change at any time without notice, and are not intended to provide specific investment advice to any individual. Any economic forecasts presented herein may not develop as predicted. There is no guarantee that asset allocation or diversification will enhance overall returns, outperform a non-diversified portfolio, nor ensure a profit or protect against a loss.

Past performance is not a guarantee of future results. Index returns reflect reinvestment of dividends and other income but do not reflect fees or other expenses of investing. Indices are unmanaged and are not available for direct investment. Investing involves risk, including the possible loss of principal.