For the period November 1 – November 30, 2024.

Executive Summary

With the US presidential election in the rearview mirror, US equities climbed higher in November and bond yields declined. Risk assets continue to be supported by a positive macroeconomic backdrop, solid earnings growth, and an accommodative Fed.

What Piqued Our Interest

In 2024, markets climbed the wall of worry, which consisted of inflation, elections, central bank action, and market concentration. The decisive US presidential election outcome removed an overhang in markets which has now coincided with favorable seasonality for US equities and other risk assets through year-end.

Investors embraced these “animal spirits,” leaning into the potential for further economic growth despite inflation remaining above the Federal Reserve’s target of 2%. As we approach year-end and look towards 2025, we anticipate changes to fiscal policy which are likely to impact certain areas of the market. On one hand, the new fiscal backdrop could be supportive, as tax cuts and deregulation lead to additional economic activity and above-trend GDP growth. On the other hand, changes to trade policy could keep inflation elevated for longer and increase market volatility as new tariffs are announced. Additionally, the new administration’s focus on government efficiencies and reducing the deficit could lead to tighter fiscal policy, turning fiscal policy into more of a headwind.

The US has experienced exceptionally strong economic growth since the pandemic, and economists expect economic growth to broaden more globally in 2025—supporting global GDP growth near 3%. The US is likely to remain a prominent contributor to this global growth with the help of a healthy labor market, strong credit backdrop, and increased AI-related spending and productivity enhancements. However, for the US economy, increased trade tensions could dent GDP growth as prices increase at a time when inflation remains a significant concern.

From a monetary policy perspective, the Fed will likely continue to err towards recalibrating interest rates lower in 2025. The pace and magnitude of cuts are still up for debate as we look for the Fed to navigate interest rates toward a neutral stance—where the level is high enough to keep inflation at bay but low enough for the economy to continue to grow. As rates come down, mergers and acquisitions activity is also likely to increase and further support earnings growth across the corporate landscape. However, with that economic strength, inflation may reappear as the economy reaccelerates.

Market Recap

In November, the S&P 500 saw its biggest monthly gain of 2024, posting a 5.9% increase for the month, and bringing year-to-date returns close to 30%. Consumer Discretionary stocks posted the best sector returns, up 13.2% for the month. Other pro-cyclical sectors also saw strong performance with the Financial sector boasting the second-best performance (up 10.2%), followed by Industrials, up 7.3%. Real Estate also saw a nice rebound as the MSCI US REIT index increased 4.3% for the month. US Small Caps surged nearly 11% in November, as the election was a larger overhang for smaller businesses. With the removal of this uncertainty investors celebrated, as the potential for lower corporate taxes, deregulation, and increased M&A activity benefits smaller companies the most. Outside the US, stocks declined in November, coinciding with a strengthening US dollar. Emerging Market stocks were hit especially hard, down 3.6% for the month.

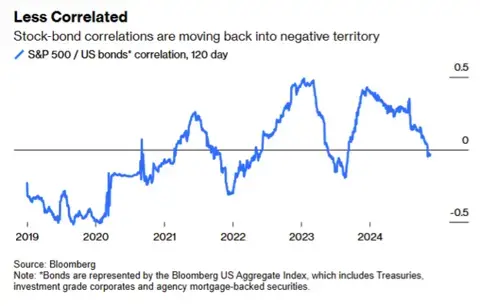

Fixed Income markets witnessed a rebound in November as yields declined. The Bloomberg US Aggregate Bond index was up 1% while municipal bonds were up almost 2%. Deficit and inflation concerns drove yields up recently, providing attractive entry points for fixed income investors. Bonds have been on a bit of a roller coaster ride in 2024, as the market navigated expectations for rate cuts alongside stickier inflation. However, bonds are back to being negatively correlated to equity markets (as seen in the chart), which can be beneficial for those who are concerned about high valuations and market concentration within equity markets.

Closing Thoughts

With the economy on solid ground, the overall narrative for markets remains constructive, even as elevated valuations suggest growing investor complacency. Although these good times may continue, outsized risks can appear and create bouts of volatility. Policy changes from the incoming Trump administration may be the market’s current area of focus as potential risks, but geopolitical, inflation, and growth risks have not disappeared. The disparity in stock-bond returns may not be as stark as it has been over the last few years, which may dampen volatility in balanced portfolios as investors navigate markets in 2025. Our focus remains on evaluating the fundamental strength of the economy and markets, monitoring for potential risks, and looking for opportunities that will align with our clients’ long-term financial plans.

This information is not intended as a recommendation. The opinions are subject to change at any time and no forecasts can be guaranteed. Investment decisions should always be made based on an investor's specific circumstances.

2024-6043