Whether you're new to employee stock options or trying to understand the nuance between the various types, we hope this glossary and basic explainer help you better understand your options (pun intended).

Exercise

The process of acquiring shares via stock options.

Expiration Date

The date your stock options expire. You must exercise your options by acquiring shares before this date.

Grant Date

The date the company makes the stock options available to you.

Exercise Price (a.k.a. Grant Price)

The discounted price at which the employee is eligible to purchase stock.

Capital Gains

Profits from the sale of stock in excess of its original purchase price. Gains from stocks held for less than one year will be taxed as ordinary income. Gains from stock held for at least one year are taxed at more favorable Capital Gains rates.

Vesting Period

The period of time after the grant date when the employee is allowed to exercise a specific number of shares.

Fully Vested

Marks the point in time when the employee is able to exercise 100% of the stock options they were granted.

How Non-Qualified Stock Options Work

Typically, a company will grant you stock options, which simply means they are giving you the opportunity to purchase shares of the company at a specific price during a specific window of time. These options may also come with a vesting period, or waiting period, before you can purchase the full amount of optioned shares.

As your shares vest, or once the vesting period is over, you have the opportunity to purchase the shares at the exercise price. Ideally, you will wait to exercise your option at a point where the market price of the stock exceeds the exercise price. You don't want to wait too long, however, as stock options have an expiration date, after which they can no longer be exercised.

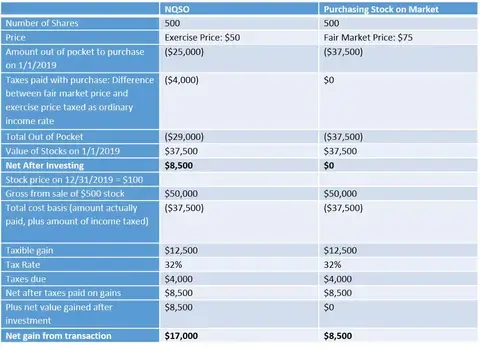

Benefits of NSOs—By the Numbers:

Individual earns $250,000 and is in the 32% income tax bracket and 15% Capital Gains bracket.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

This information is not intended to be a substitute for specific individualized tax advice.

Stock investing involves risk including loss of principal.

This is a hypothetical example and is not representative of any specific investment. Your results may vary.