If part of your compensation package includes access to an Employee Stock Purchase Plan (ESPP), it could provide you with an easy way to purchase company stock at a discount. While this may give you an opportunity to build your wealth, the tax rules associated with ESPPs may introduce unintended consequences. To help you optimize the benefits and minimize the potential pitfalls, here we explore how ESPPs work, their tax implications, and some strategies you can use to manage them effectively.

What is an ESPP and How Does it Work?

Employee Stock Purchase Plans are company-sponsored benefit programs that allow employees to purchase company stock at a discounted price, to a maximum discount of 15%.

Typically, you contribute to the plan through after-tax payroll deductions, which are often calculated as a percentage of your salary. Automating those deductions allows you to save regularly to meet your financial goals. The maximum contribution you can make each year is $25,000.

ESPPs work by accumulating all employee contributions over a specific “offering period”, which typically lasts between six and 24 months. The offering period (or enrollment period) is when you decide to participate in the ESPP and determine the percentage of your paycheck to be deducted for purchasing stock. This is followed by the “purchase period”, during which the company uses the accumulated funds to buy shares at a predetermined price on behalf of the participating employees.

Some ESPPs come with added benefits, such as discounts on market price or lookback provisions that let you buy shares based on the stock price on the date your ESPP was granted. This feature may increase the potential upside for participants.

Connect with a Wealth Enhancement advisor today to discuss ESPPs.

Types of ESPPs: Qualified vs. Non-Qualified Plans

There are two primary types of ESPPs: qualified and non-qualified plans. The primary distinction lies in the tax implications for participants.

- Qualified ESPPs (also known as Section 423 plans) follow specific IRS guidelines that allow you to defer taxes as long as you hold onto your shares for a specific period. These so-called “holding periods” generally last at least two years from the offering date and one year from the purchase date.

- Non-qualified ESPPs do not meet the IRS criteria for favorable tax treatment. Instead, contributions to non-qualified ESPPs are generally taxed as ordinary income at the time of purchase, and any gains realized between purchase and sale are subject to capital gains tax.

Given this differential tax treatment, it’s important to understand the type of ESPP your employer offers if you hope to optimize the benefits and minimize potential taxes.

The Benefits of ESPPs

Despite the tax complexities, participating in an ESPPs comes with several benefits, including:

- Discounted stock purchases. The opportunity to buy company stock at a discount translates into immediate gains and could position you to fund a range of short-term goals, such as saving for a down payment to buy a home or taking a vacation.

- Potential for long-term growth. For those willing to hold their shares for a longer period, ESPPs can offer significant growth potential, especially if the company performs well. This may enhance the value of your shares, positioning you to build wealth over time.

- A culture of ownership. There is also an intangible benefit to participation, as ESPPs often help to create a sense of shared success by aligning the interests of employees with the company’s performance.

ESPP Tax Rules: Calculations and Best Practices

If you find the benefits enticing and plan to participate in your company’s ESPP, it’s important to understand some key ESPP tax rules. Determining the tax impact involves considering the discount at which the shares are purchased, the holding period, and whether the plan is qualified or non-qualified. To calculate taxes, you’ll need to know the price of your shares on several key dates, including the:

- Offering date (or grant date), which coincides with the start of the offering period in which you elect to participate in your company’s ESPP.

- Purchase date, which is the date when the stock is actually purchased at the end of the purchase period.

- Sale date, which is the date on which you sell your shares, which determines if it’s considered a qualifying disposition or a disqualifying disposition.

It’s possible to optimize ESPP tax outcomes by following certain best practices. This may include holding onto shares for the qualifying period to benefit from lower tax rates or timing the sale to minimize tax liabilities.

You may also benefit from working with a financial advisor who can help you assess how participation in an ESPP may impact your overall financial plan. This can help you make more informed decisions about when to enroll in the plan, how much to contribute, when to sell your shares, and how ESPP tax rules might affect your after-tax proceeds.

ESPP Tax Rules for Qualifying Dispositions

To realize the full after-tax value on the sale of your ESPP shares, it’s important to understand the criteria for qualifying dispositions. A qualifying disposition occurs when you sell your shares at least two years from the offering date and at least one year from the purchase date. This type of disposition is advantageous because it may allow part of your gain to be taxed as long-term capital gains.

While you may still owe ordinary income tax on qualifying dispositions, ESPP tax rules only require you to pay ordinary income tax on the lesser of:

- The discount offered based on the offering date price, or

- The gain calculated using the actual purchase price and the final sale price.

Example of a Qualifying Disposition

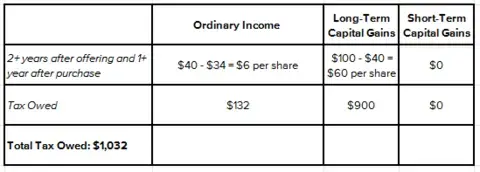

Consider an example with the following assumptions:

- Stock Price on Offering Date: $40.00

- Stock Price on Purchase Date: $50.00

- Discount (15%): $6.00

- Price Paid: $34.00

- Shares Purchased: 100

If you sell at $100 and are in the 22% marginal income tax bracket and the 15% long-term capital gains bracket, you would end up owing about $1,032 in taxes:

The advantage of qualifying for long-term capital gains is that these rates are usually lower than your ordinary income tax rate. Keep in mind, however, that this strategy requires you to hold your shares for at least one year after you purchase them. Keeping the shares for that long may expose you to concentration and single stock risk, which could leave you vulnerable to a level of price volatility in your shares that you may or may not be comfortable maintaining.

Talk to a financial advisor about ESPPs today.

ESPP Tax Rules for Disqualifying Dispositions

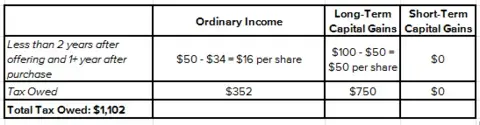

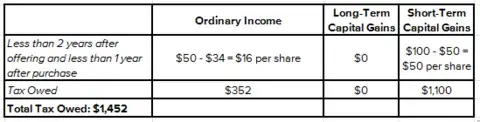

If you don’t meet the holding period requirements for a qualifying disposition, then you have a disqualifying disposition. Again, you may be subject to both ordinary income taxes and capital gains taxes.

This is where it gets a little complicated. You will pay ordinary income tax on the difference between the actual purchase price and the market price on the date of purchase. Additionally, you'll pay capital gains tax rates at the difference between the purchase date price and the final sales price (which is subject to short-term or long-term holding period requirements).

Example of a Disqualifying Disposition

Following the same example above, you could owe between $1,102 and $1,452 for a disqualifying disposition, depending on how long it has been since you purchased the shares:

On the surface, paying ordinary income tax on a disqualifying disposition may seem like the less attractive option. However, it may allow you to avoid single stock risk, reap the proceeds of the sale, and use the money to meet your short- or long-term savings goals.

What Do These Tax Rules Mean for You (and Your ESPP)?

Understanding employee stock purchase plan tax rules is essential to developing a strategy that aligns with your financial goals. If you can afford to hold onto the shares, qualifying dispositions can lead to significant tax savings. However, if you need immediate liquidity or the stock price is volatile, selling earlier might make more sense, even with the higher tax rates.

There is no one-size-fits-all strategy when it comes to getting the best outcome for you. Depending on your risk tolerance, financial needs, personal circumstances, and the potential for stock price changes, your ESPP selling strategy may shift.

Whether you’re aiming to enhance tax advantages through qualifying dispositions or mitigate the tax consequences of disqualifying dispositions, a tailored approach is important. By working with your financial advisor, you can get a clearer understanding of how your ESPP is taxed so you can make the most informed choice for your situation.

Frequently Asked Questions About ESPP Tax Rules

When should I sell my ESPP shares?

The optimal timing for selling ESPP shares depends on various factors, including your financial goals, market conditions, and tax implications. If you hold the shares for at least two years from the grant date and one year from the purchase date, you’ll benefit from long-term capital gains rates. Conversely, if you need the money sooner, you can sell right away, although you will likely pay higher taxes. For personalized guidance, speak with your financial advisor.

Can I participate in both qualified and non-qualified ESPPs simultaneously?

Yes, if both are offered by your employer. To make an informed decision, however, it’s important to review the plan documents and tax implications of participation.

How do ESPP tax rules impact the proceeds I receive from selling my shares?

ESPP tax rules affect how much of your proceeds are considered ordinary income versus capital gains, which will determine how much you’ll need to pay in taxes. The timing of the sale, whether it’s considered a qualifying or disqualifying disposition, and your personal tax rates directly influence the amount you will receive after selling ESPP shares. To potentially maximize proceeds, consider factors such as your current tax bracket, the potential for future appreciation in the stock’s value, and your overall financial situation. Strategically navigating these variables may enhance the financial benefits of participating in an ESPP.

Can I lose money in an ESPP?

Yes, if your company’s stock price falls below your purchase price, you could lose money. That said, the discount rate and potential tax benefits tend to make ESPPs a worthwhile investment for many employees.

What happens to my ESPP if I leave the company?

If you leave your employer, the status of your ESPP shares and accumulated contributions will depend on several factors, including the specific terms of your ESPP, the stage of the offering period, and your company’s policies. Typically, any contributions that have accumulated will be returned to you if they have yet not been used to buy shares. Any shares you already own remain yours, but the same tax rules regarding qualifying and disqualifying dispositions apply even after you leave the company.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.