For the period January 1 – January 31, 2023.

Executive Summary

The start of 2023 brought a welcome change of scenery, with most asset classes performing strong out of the gate. Indeed, the beleaguered “60/40” portfolio was up 4.5% in January, its fourth-best start to a year since 1976. However, forecasts for the first quarter of 2023 are still tepid at best, as the economic tea leaves continue to point toward a slowdown in the U.S. and globally.

What Piqued Our Interest

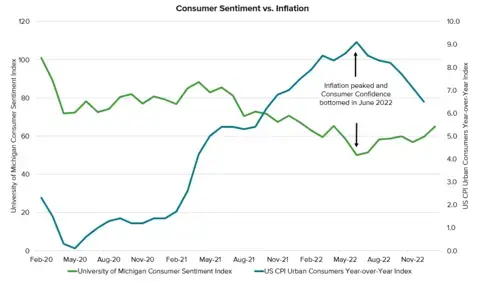

The University of Michigan Consumer Sentiment Index, a consumer confidence index published monthly by the University of Michigan, is a key indicator designed to illustrate the average U.S. consumer's confidence level. This indicator is important to retailers, economists and investors, as its rise and fall has historically helped predict economic expansions and contractions. The lower the index, the less confident consumers are feeling about the economy, while the higher the index, the more confident consumers feel about where things are or where they’re heading. Notably, the index hit a low in June 2022, the same month inflation hit a high of 9.1%.

Figure 1. Consumer Sentiment vs. Inflation

Source: Bloomberg LP

This is likely not a coincidence, as inflation has been a major drag on consumers, given the higher costs for gasoline, utilities, groceries and most living expenses in general. As inflation has declined, consumers seem to be feeling better.

Further, as shown in the table below, bottoms in the Consumer Confidence Index have historically proven bullish for markets. Meanwhile, peaks in the index have historically signaled the opposite trend.

Figure 2. S&P 500 12-Month Forward Returns Following Consumer Confidence Index Bottoms and Peaks

Source: Bloomberg LP

Since the index low in June 2022, the S&P 500 Index has returned 7.7% in seven months through January 2023. Given the historical precedent, this positive trend should not be a surprise. Of course, past patterns do not guarantee we will see the same result. Consumers remain sensitive to changes in inflation and the overall economy. Consequently, moods could sour, and we could see negative sentiment pick up again.

Market Recap

Overall, market performance was especially strong across the board in January, rebounding from a poor December. Market participants seem to believe the declining trend in inflation, robust employment, and a steady economy will provide enough leeway for the Federal Reserve to slow the pace and level of interest rate hikes. This, in turn, could lead to the sought-after soft landing, even if economic growth slows.

The U.S. Growth/Tech-oriented Nasdaq 100 led the way in January, up 10.7%, perhaps highlighting oversold conditions, as the index declined -32% in 2022. Bonds also rebounded nicely, as interest rates declined and expectations for less-aggressive interest rate hikes took hold. International and Emerging Markets outperformed the U.S. market as fears of deeper recession in Europe subsided and a weakening dollar buoyed Emerging Markets. Finally, commodities were the only asset class in the red, down -0.89% for the month. This continues a trend in commodities, with the index having peaked in June 2022. It has declined 20% since then, which has been a factor in the declining rate of inflation since that, too, peaked in June of last year.

Closing Thoughts

Although one month does not make a year, strong market performance across asset classes was a welcomed beginning to 2023. Still, we expect there could be bouts of elevated market volatility as the Fed nears the end of its cycle of raising rates. Certainly, many economic indicators are showing we are not out of the woods yet, with the Treasury yield curve still significantly inverted and the Leading Economic Indicators Index in negative territory. No matter the environment, having a balanced and diversified allocation can help dampen the natural ebbs and flows of investing, rewarding those investors who stick with it.