Perhaps the most challenging question for financial advisors to answer for their clients is, “Have I saved enough to retire?” The problem is, it’s also probably the most common one they hear. And for good reason.

With today's lifespans, retirement can last up to 30 years or more. You need to make sure you’re financially prepared. And since there’s no one-size-fits-all retirement, there’s no “magic number” that everyone needs to reach before they’re ready to retire.

Your retirement is more than just "not working anymore." This means whether you're ready to retire or not comes down to more than just a number. You and your unique goals determine it.

The good news is those are things you can figure out. But to get started, you need to answer a few questions about your retirement plans.

Taking Inventory of Your Retirement Plan

There are six things you need to determine if you’ve saved enough or are on track to meet your retirement goals:

1. Estimate how much your retirement will cost

Several factors determine this:

- Do you hope to maintain your current lifestyle?

- Do you plan to stay in your current home, downsize, relocate, or maybe even buy/rent a second property?

- How often—and how lavishly—do you plan to travel?

- Will you need to provide support to other family members?

That's a lot to figure out, but the more accurately you can answer these types of questions, the easier it'll be to budget what you'll need for retirement income.

2. Predict likely spending changes during retirement

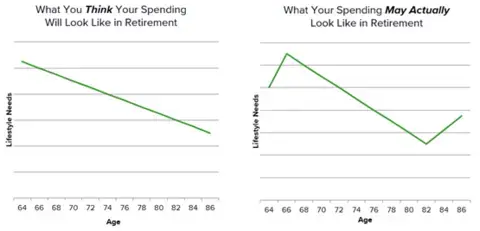

Before retirement, you might assume that your spending will slowly decrease as you progress through retirement. But in reality, we see a different spending pattern. Your spending might increase shortly after retirement. These are called the “go-go years,” where retirees spend their time going on adventures and knocking things off their bucket lists. After the go-go years, things will likely start to taper off, but spending climbs again as health care costs become more of a factor.

Figure 1. Perceived Retirement Spending vs. Actual Retirement Spending

3. Forecast the investment growth of your retirement assets

This is certainly easier said than done, as no one can predict how the markets will perform. In 2019, no one predicted a global pandemic would rock the worldwide economy. In 2020, no one predicted the markets would recover the way they did. And in 2021, no one predicted inflation would reach a 40-year high just weeks before Russia shocked the world by invading Ukraine.

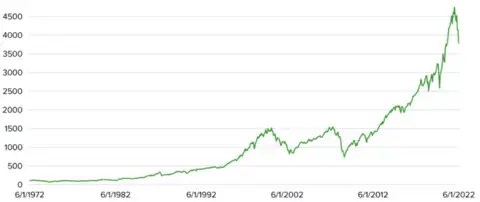

However, based on long-term market trends, it’s possible to make some guesses as to where your investments may end up by your targeted retirement date. As Figure 2 shows, markets go up and down all the time, but if you look at a large enough sample size, patterns start to emerge. While past performance is in no way indicative of future results, you can at least use these trends to make some assumptions and implement a plan.

Figure 2. S&P 500 Index Performance Over Last 50 Years

4. Predict the income your assets will generate

During your retirement years, you’ll also need to adjust your investment strategy to account for the income you’ll need those assets to generate. When you were working and contributing to retirement accounts, you were focused on growing assets and accumulating wealth. You were likely willing to be more aggressive and riskier with your investments in the hopes of yielding greater returns.

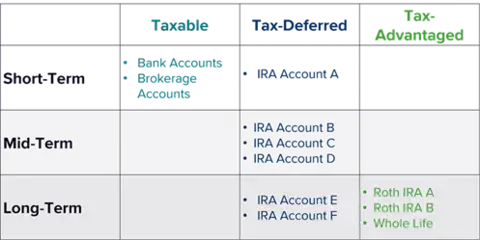

But in retirement, you need to adjust that strategy. You’ve already built up enough to retire, so your investment focus should be on sustaining that wealth and using it as income in the short term (the next five years), the midterm (6-10 years), and the long term (10 years and beyond).

The Your Money Matrix™ is a proprietary tool we developed to help you plan your asset allocation strategy. Using both time horizon and tax treatment, the Your Money Matrix can help you determine where you should allocate certain funds based on when you’ll need them and how they’ll be taxed—making it easier to plan for the income you’ll get from those accounts.

Figure 3. Your Money Matrix

5. Assess your other income sources

Some retirees still have pensions they can count on, but as for most people, Social Security will be your only source of additional income in retirement. And it usually requires a little more planning than people expect. Most notably, you need to decide at what age to file for benefits, and this decision can have a dramatic and irreversible impact on your total lifetime income.

Beyond Social Security, you might have additional income sources in retirement, from rental property, consulting or other part-time work. These need to be included in your plans, of course.

6. Plan an asset withdrawal rate in line with your probable lifespan

Your withdrawal rate is the percent of total assets you take out of investment accounts—including dividends, interest and principal. Few are fortunate enough to accumulate enough in assets to live on the dividends and interest alone; most will have to take out some principal each year, as well. That’s fine if you plan carefully to be confident your money lasts a lifetime, but otherwise, it could be a retiree’s worst fear: running out of money.

It Might Be Time for a RealityCheck™

As you can see, a lot goes into determining if you’ve saved enough to retire. However, you can take the guesswork out of retirement income planning with a RealityCheck.

At Wealth Enhancement Group, we built a proprietary tool called RealityCheck. It translates abstract investment statistics into a real-world projection: how much retirement income you’ll have to live on. In short, RealityCheck looks at multiple aspects of your specific financial situation and projects how much income you might be able to draw while seeking to ensure the income is sustainable for life.

Four elements go into each RealityCheck:

- Analysis of current assets

- Forecast of potential growth

- Estimated Social Security benefits

- Projection of future taxes

We then take these raw statistics and transform them into something you can easily relate to—just as a paycheck shows where you stand during your working years.

Remember, however, that RealityCheck is just a ballpark estimate of what you might have to work with several years into the future. It’s no guarantee that you’ll achieve any specific income level or financial goal.

Your nest egg was likely built from decades of hard work. It's the result of many small but meaningful decisions over your career. Using that nest egg to create a retirement income will also come from many small decisions you must make along the way. That's where an experienced financial advisor can help: Keeping you organized, planning for the potential risks, and preparing for those unexpected changes that inevitably come.