After the market plunge and recovery following the Recession of 2008/2009 and the COVID-19 crisis of 2020, it’s painfully obvious just how volatile and unpredictable investment markets can be. There’s always an inherent risk when it comes to investing, but there are some strategies that can be implemented and techniques you can follow to help mitigate that investment risk–and one of them is called dollar-cost averaging (DCA).

What Is Dollar-Cost Averaging?

The term was first popularized by Benjamin Graham in his seminal 1949 book, The Intelligent Investor. In it, Graham defines dollar-cost averaging as a strategy in which:

“The practitioner invests in common stocks the same number of dollars each month or each quarter. In this way, he buys more shares when the market is low than when it is high, and he is likely to end up with a satisfactory overall price for all his holdings.”

Dollar-cost averaging is an investment technique that can be used when you’re saving or investing a lump sum. Using DCA to save during your accumulation years is generally a good idea. It adds discipline to the process; for example, if you invest every month into a brokerage account. This is a great way to curb what behavioral economists call self-control bias, or the tendency that causes people to consume today at the expense of saving for tomorrow. Mathematically, it also makes sense to use the DCA strategy, as you get your money to start compounding earlier.

Additionally, taking advantage of your company’s 401(k) plan at work is a great example of using DCA to save. Depending on how often you are paid, you make contributions into an account on a weekly or biweekly basis, and these contributions are then compounded over time. Taking advantage of a company match increases these installments and helps you save more.

How Can DCA Help Reduce Investment Risk?

Using DCA to invest a lump sum is not quite as obvious as using it to save, but it’s still very beneficial for a lot of people. For example, you might have a large sum of cash to invest from a pension payout, inheritance, selling your business, or simply by transferring accounts. If you have a lump sum, should you invest it all immediately or make smaller investments over time using a DCA approach? That depends on your financial goals, but generally, a DCA approach better suits more risk-averse investors.

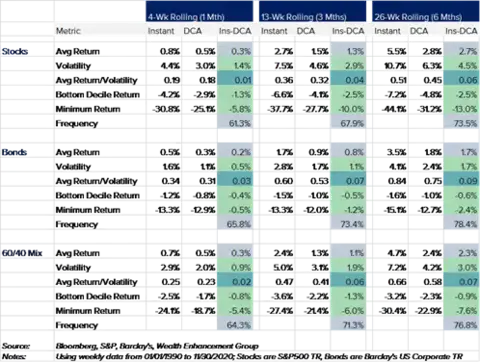

Looking at historical returns, you can see the differences between investing immediately versus a DCA approach by examining index portfolios for stocks, bonds, and 60/40 mixes. For the DCA period, assume someone invests the lump sum on a weekly basis over one-, three- and six-month periods. These are more realistic timeframes than most studies that look at monthly installments over a year, which many people find to be too long a period. Additionally, asset mix will stray further from target the longer the period, and people that need investment income in retirement will simply not want to wait a whole year.

Figure 1. Immediate Investing vs. DCA

Note: This is a hypothetical example and is not representative of any specific situation. Your results will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing.

The comparison of immediately investing versus using the DCA strategy across rolling time periods since 1990 is shown in Figure 1 above. Down the left-hand column are asset performance metrics, and across the top row are the rolling time periods. The colored columns show the difference between immediate investing and DCA, with grey denoting immediate is better, green meaning DCA is preferable, and blue indicating immediate is only slightly more favorable.

Consistent patterns can be seen across the three asset sections and across rolling time periods. You can see that investing immediately can generate higher average rolling returns than DCA, with the delta being more as the rolling periods increase. The higher returns stem from compounding earlier with no cash drag. The frequency that instant outperforms DCA can also increase with longer periods.

However, while investing that lump sum immediately has its advantages, using the DCA strategy is generally less risky. Volatility can decrease using DCA, and, unsurprisingly, the difference between the two becomes larger with time. Downside risk is also better with DCA when looking at the bottom tenth percentile of returns and the worst returns. In sum, immediate investing can generally yield higher returns than DCA, but with those potentially higher returns comes greater risk–especially on the downside.

Who Can Benefit from a DCA Strategy?

How much investment risk you’re willing to take on is an important consideration that will no doubt vary from person to person. If you’re a younger investor and have more time to recover from market downturns or periods of volatility, then you may decide it’s better for your situation to invest your money immediately.

However, if you’re approaching retirement or are already retired, you may decide you can’t afford to take as many chances. You need to make sure you keep the money you have, and you’re willing to trade a potentially higher payout for a safer bet.

So, if you’re someone who’s less interested in risk and more interested in the conservative play, the wisdom of dollar-cost averaging is time tested. As a combined saving and investing technique, it makes intuitive sense. For lump-sum investing, it reduces risk. And if you’re nearing or in retirement and need to have higher certainty in generating income, speak with your advisor about setting up a DCA strategy.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy though changes in the aggregate market value of 500 stocks representing all major industries.

Dollar-cost averaging involves continuous investment in securities regardless of fluctuation in price levels of such securities. An investor should consider their ability to continue purchasing through fluctuating price levels. Such a plan does not assure a profit and does not protect against loss in a declining market.