What if you could sell off a highly appreciated asset, avoid capital gains taxes and create a steady stream of retirement income for yourself or your loved ones? It may sound too good to be true, but those are just a few of the benefits of establishing a charitable remainder trust (CRT).

Traditionally, trusts are created for estate planning purposes, but the truth is, many trusts can provide benefits that you actually get to experience during your lifetime. One such trust is a CRT–a tax exempt, irrevocable trust that’s meant to reduce your taxable income. CRTs are becoming more and more popular because they can potentially reduce your liability for certain taxes, allow you to support your favorite charities and/or causes and even create a steady stream of retirement income.

How Do Charitable Remainder Trusts Work?

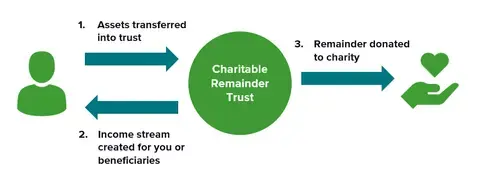

A charitable remainder trust is a type of “split-interest” giving vehicle, which means the assets in the trust are split between two beneficiaries: the initial beneficiary (you or someone else you name) and a charitable organization. While there are actually a couple different kinds of CRTs (more on that below), they both generally function the same way.

First, the grantor (person establishing the trust) contributes assets into the trust. This can be anything from cash, to shares of stock, to property, and even artwork. Typically, you’ll want to contribute something that can appreciate in value, and even then, it’s more beneficial for the asset to have already greatly appreciated.

From there, the terms of the trust are set. This is where you decide how much annual income you want yourself or your beneficiaries to receive from the trust (at least 5% of the fair market value of the assets in the trust, but no more than 50%), how long you want to have the trust (any set number of years up to 20, or the remainder of your life), and how much you anticipate donating to the charity/charities of your choice when the trust expires (at least 10% of the fair market value; though, since whatever’s left in the trust at the time of expiration is donated to charity, this final dollar amount could end up being more or less than what you anticipated).

Then, once those assets have been contributed and the terms have been set, the trustee (entity administering the trust) determines the fair market value (FMV) of the assets and essentially takes over ownership of them. The trustee sells off a portion of the assets to cover your income stream, and the cash from that sale is paid out to you. Also, if the trust allows it, instead of selling a portion of the assets, the trustee could make the payment in-kind (i.e. distributing the asset instead of cash).

Finally, when the trust expires, any remaining funds are transferred to the charity or charities you name as beneficiaries.

Charitable Remainder Unitrust (CRUT)

Charitable remainder unitrusts are one of the two types of CRTs. The basic structure and function remain the same, but CRUTs work just a little differently.

With CRUTs, the income stream that you or your beneficiaries receive from the trust is a set percentage of the FMV of the remaining trust funds, and the FMV gets revalued every year. This is a huge benefit if you plan on placing assets like stocks or properties into the trust, because those assets could appreciate over time. If that happens, you could end up making more money from the trust every year.

For example, let’s say you contribute shares of stock worth $300,000 into a CRUT, you name yourself as the beneficiary, and you wish to receive an annual income of 15% of the remaining assets in the CRUT. You’ll receive $45,000 of income from the trust in that first year. At the end of the year, the FMV of those shares is revalued, and maybe the markets are on fire, and the value of your shares actually jumps up to $350,000. If that happens, over the course of that second year, you’ll receive $52,500 in income from the trust.

Also, CRUTs allow you to make additional contributions into the trust even after it has been established. This is a great benefit if you find yourself with additional highly appreciated assets. You could make continuous contributions to your CRUT and generate a greater stream of income in retirement–and leave more to your favorite charities.

Charitable Remainder Annuity Trust (CRAT)

Unlike CRUTs, charitable remainder annuity trusts pay out a set dollar amount every year–not simply a percentage. So, if we go back to our previous example and you’re contributing shares of stock worth $300,000 into a CRAT, instead of choosing to receive 15% annually, you would simply choose to receive $45,000 annually–regardless of how well or poorly that stock is performing.

CRATs make a lot of sense when you want that income to remain consistent–for example, if you’re relying on the income from your CRAT as a steady source of money in retirement. Because you do have to pay taxes on the income from your CRAT, maintaining a consistent amount can also give you more control over which tax bracket you’re in. The same can’t be said for CRUTs, where if your annual income goes up due to the value of your trust assets increasing, then you could be catapulted into a higher tax bracket.

Pros and Cons of Charitable Remainder Trusts

Establishing a CRT can offer up some great benefits for you, your loved ones and the charities of your choosing.

Pros

Charitable remainder trusts can be a great way for you to spread realization of the capital gain on highly appreciated assets over a number of years while still retaining access to the funds from the sale of those assets. These types of trusts also provide a steady source of annual income, which may be something you end up relying on in retirement. If you don’t name yourself as the initial beneficiary, that income stream could be used to benefit a spouse or even your children.

Finally, if you’re philanthropically inclined, CRTs offer a great way to give back a portion of your estate to the organizations you support. You can take a partial income tax charitable deduction when you fund the trust, and this calculation is based on the remaining amount you plan to distribute to the charity of your choice when the trust expires. For example, when the terms of the trust are established, if it appears that you will leave 20% of the trust to charity, you can immediately take a partial income tax charitable deduction on the amount you are expected to donate (in this case, 20% of the FMV of the trust assets). And because those assets have been removed from your estate, you’ll even lower the estate tax liability they would typically incur.

Cons

There are, however, some potential drawbacks to establishing a CRT. By placing assets into the trust, you give up a lot of the control you would typically have if you had divvied up the assets via a will or some other method. And since the trust is irrevocable, the terms cannot be altered–once they’re set, they’re set.

Also, while these types of trust are technically tax-exempt, they do still incur a tax liability. You must still pay taxes on the annual income you receive from the trust, and, if that income pushes you into a higher tax bracket, you may have to pay even more in income taxes. Additionally, if the trust sells the asset, you don’t have to realize the capital gain upfront, but whenever a distribution is paid to you, the “carry-over gain” (for lack of a better term) gets paid out to you as well. For example, if the trust realizes a capital gain of $100,000 from the sale of a stock and distributes $10,000 to you each year. The first ten payments to you will be taxed as capital gains until the full $100,000 gain has been distributed. The exception is if the trust generates “worse” income (such as interest taxable as ordinary income). That then gets distributed to you first, and the remainder of the distribution is taxed as a gain. It’s a “worst first” distribution method, tax-wise.

Finally, if you fund the trust with something that has fluctuating value like stocks or property, it’s possible that over the lifetime of the trust, the value of those assets drops. This could affect how much income you receive from the trust, and it’s even possible that there’s nothing left over to donate to charitable organizations once the trust expires.

Should I Establish a Charitable Remainder Trust?

While there are great benefits to setting up a CRT, it’s ultimately a decision that will be up to your specific situation. Do you have highly appreciated assets? Do you want to delay having to pay capital gains tax on the sale of those assets? Are you charitably inclined? If you can answer “yes” to those questions, a CRT may be something to think about.

Luckily, you don’t have to make that decision alone. By discussing your financial situation with the advisors at Wealth Enhancement Group, you can better understand the options available to you and make strides to ensure your goals are met.

This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.