The burning question on so many investors' minds: can we see the light at the end of the tunnel, or will the bear market continue to roar? To provide us with some perspective, we assigned members of our Investment Management team a position and asked them to make the case.

To start us off, Randy Godsell, Wealth Enhancement Group Chief Investment Strategist, argues the case for a bear market. After elaborating his four main points, we'll hear from Ayako Yoshioka, Wealth Enhancement Senior Portfolio Manager, as she makes the case we're entering a bull market.

Although their justifications are comprehensive, it should be clear that this is a discussion specifically organized to illuminate both arguments. The views these financial experts present do not necessarily reflect their personal opinions or the position of Wealth Enhancement.

Before we start, let's get our terminology straight.

What Is the Difference Between a Bull and Bear Market?

In his article on understanding market cycles, Wealth Enhancement SVP and financial advisor Andrew Serafini explains the differences between bull and bear markets:

- A Bull market refers to a market in which prices are expected to rise over an extended period. In a bull market, the economy thrives.

- A Bear market, on the other hand, refers to an environment in which prices are expected to drop over an extended period. The economy is crashing, people are pessimistic, and individuals sometimes take drastic actions to try and reduce their losses.

Now that we've defined our terms, let's kick things off with Randy's argument: the bear market is here to stay.

The Case for a Bear Market

In his discussion, Randy makes four points to convince us that we will remain in a bear market for the foreseeable future:

- Markets are cyclical, and we're only halfway through this bear cycle.

- Valuations may have declined, but earnings might follow next.

- The recent downward trend is characteristic of a bear.

- The Fed raised rates quickly, and we haven't yet felt the full fallout.

Bear Point #1: This Bear Is Part of a Traditional Market Cycle

You don't need to be Isaac Newton to know what goes up must come down. However, with financial markets and the economy, this "law of gravity" isn't as final as an apple falling to the ground. Historically, financial markets have always behaved in cycles: what goes up must come down, but what goes down must also come back up.

Nevertheless, in the past two decades, we haven't seen a "normal" market cycle uninterrupted by some world-changing event. For instance, the financial crisis of 2007-2008 and its ensuing recession were not due to regular market cycles but a glut of easy credit and lax regulation. 2020 brought the COVID-19 crisis, another massive disruption that transformed our daily lives and brought the global financial market to its knees. This event may have knocked the economy off kilter, but it wasn't due to typical cyclic behavior.

Today, while we can still feel the ramifications of the COVID-19 crisis, the traditional market cycle may now be kicking in. Randy explains that the acronym HOPE can model the economy's typical behavior during a downturn:

- H - Housing: First, housing prices drop, and new construction slows down. This economic pattern has already begun following the piping hot housing market of 2021 and the first half of 2022.

- O - New Orders: New orders, as measured by a manufacturing index, then cool off. According to the U.S. ISM Manufacturing New Orders Index, new orders in August 2022 were down 22% from new orders in August 2021.

- P - Profits: The current economic downturn has just started trickling into profits, illustrated by a slight drop in the S&P 500 earnings per share.

- E - Employment: As the lagging indicator, employment reacts last to changes in the market cycle. Thus, record low unemployment does not necessarily signal a strong economy, especially considering the previous three indicators have already begun to show.

According to the HOPE acronym, we are only halfway through the downturn, with earnings and employment left to be impacted. If history repeats itself, we could see a year or more of this bear market ahead of us before we finally see the bottom.

Bear Point #2: Valuations Got Hit; Earnings Are Next

According to earnings data, there is an inverse correlation between Treasury interest rates and S&P 500 earnings revisions. In other words, the higher interest rates climb, the lower earnings expectations fall.

However, this relationship experiences a bit of a lag, and earnings revisions have just begun to be impacted by the sudden rise in interest rates. If the relationship between these two variables remains, earnings may have a long way to go.

Randy explains that the first part of the market downturn we've experienced so far (which he describes as a "mini bear market") was mainly driven by the drop in valuations. Reduced earnings have contributed little to the current bear cycle. But now that we are approaching the second half of the bear market, low earnings will start to have a greater impact.

Randy says, "If this pattern repeats, you see earnings revisions have a long way to go."

Bear Point #3: Bear Market Rallies Are Common

In the bear markets of both 2000 and 2008, small rallies happened far before the bottom of the market was reached. It's common to experience these rallies before another downturn brings prices even lower.

It can be dangerous to invest in this territory. Reading into a rally as a signal of future growth can get investors caught in what is referred to as a "bear-market trap." Bank of America performed a study that examined bear market rallies as far back as the Great Depression. They found that the average bear market rally was 17.2% and lasted 39 market days, close to the bear market rally experienced during the summer of 2022. "This just looks like a run-of-the-mill bear market rally to me," remarked Randy.

Bear Point #4: The Market Hasn't Caught Up with the Fed Raising Interest Rates

Finally, we turn to Federal Reserve activity, a hot topic in recent news coverage. According to Randy, things start to break when the Fed raises interest rates. However, during this economic downturn, the Fed has raised interest rates faster than at any time in recent memory.

The bear market argument says that this unprecedented rate of change has yet to precipitate throughout the economy. Once those rate increases get filtered through the market, the downturn will increase in intensity. In other words, things will get worse before they get better.

The Case for a Bull Market

Following the sobering discussion of bear market dynamics by Randy Godsell, Ayako Yoshioka provides a more optimistic perspective. She covers three main points in her case for a bull market:

- Historically speaking, now is a good time to buy.

- Stock valuations have come down to reasonable levels.

- The U.S. is in the midst of a productivity boom.

Bull Point #1: The Numbers Show It's a Good Time to Buy

According to market data from Goldman Sachs, after a 50% retracement during bear markets since 1956, the average 12-month return on buying stocks has been 19%. This upside risk compares to a 5% downside risk over the same period. Because the S&P 500 regained 50% of its losses during this bear market cycle, it could be a good time to invest.

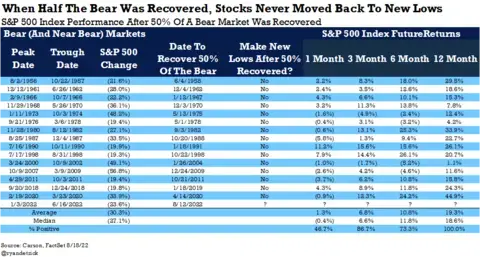

Figure 1: Performance After 50% Bear Market Recovery

The table in Figure 1, created by Ryan Detrick from Carson Group, tells a similar story. Through an analysis of previous bear (and near-bear) markets, Detrick found that after a market recovered 50% of the bear, it never made a new low.

In her discussion of this data, Aya points out that the current inflationary market environment is similar to what occurred in the 1970s. If you look at the S&P 500 Returns chart from the 1970s, you'll see that they were negative for up to a year after the 50% recovery, even though a new bottom was never reached. Put another way, buying now isn't necessarily foolproof.

Bull Point #2: Stock Valuations Are No Longer Sky-High

Aya's second point centers around stock valuations and the price-to-earnings ratio (P/E ratio). The P/E ratio measures a company's stock price against its earnings; it's a helpful metric for both valuing a stock and gauging market health.

Typically, the P/E ratio for the S&P 500 has been between 13 and 15. In other words, for every dollar a company earns, investors have historically paid between $13 and $15 for a share of that company's stock.

A year ago, the P/E ratio of S&P 500 companies vaulted to heights we haven't seen since before the housing crisis. At its most recent peak, the S&P 500 P/E ratio climbed to nearly 40, indicating that the market was far overpriced. This type of movement is characteristic of a bubble waiting to pop. Now that the market has corrected itself, we may be approaching more accurate prices, although Aya concedes that there could be more room to drop.

Bull Point #3: We're in a Secular Productivity Boom

For her third and final point, Aya explains the benefits of the technology-fueled productivity boom that the United States has ridden:

- Workweeks now versus a century ago: In the 1930s and 1940s, the average workweek was 5½ to six days. After World War II, the standard became a five-day workweek. Some companies are beginning to shorten this further, introducing half days on Fridays or giving employees Fridays off during the summer.

- Technology's impact: Technology's main driver of this productivity gain. Humanity has benefitted from countless technological advancements since the 1940s. Especially in the United States, the growth of the digital economy has increasingly impacted GDP since the mid-2000s. According to The World Bank, the digital economy generates over 15% of the global GDP and has grown 2½ times faster than GDP.

- Productivity benefits during a recession: The National Bureau of Economic Research conducted a study after the Great Recession to determine how productivity at a large firm fared during a time of economic hardship. They found that productivity climbed 5.4% during the recession. Additionally, as the recession worsened in specific localities, productivity rose in those places.

Whether or not the United States can ride this productivity boom to a bull market remains to be seen. In Aya's words, productivity helps, allowing us to complete more work within a shorter workweek. It may also motivate employees to work harder so they don't get laid off, a harsh prospect that could drive the market towards recovery.

Are We in a Bull or Bear Market?

Ultimately, it's up to you to make your own conclusions. Randy and Aya want to remind readers that they can find countless opinions on whether or not we are in a bull market. These claims aren't helpful, nor do they need to impact your investment strategy. The best action you can take is to prepare for any future. Understand your risk tolerance, establish an investment strategy that you are confident in, and carry a portfolio that reflects your future needs.

No matter what comes to pass, working with a financial advisor to establish your strategy is a worthwhile activity. Wealth Enhancement provides free, no-obligation consultations to ensure that your financial health is covered from every point of view; schedule yours today!