Executive Summary

Even though we’ve turned the calendar to 2023, the challenges from 2022 that included the lingering effects of the pandemic, inflation, higher interest rates, and market volatility are still with us. As we look forward to the new year, we acknowledge that there is always a level of uncertainty within markets, but the uncertainty can bring opportunity and reward investors over the long term.

What Piqued Our Interest

The focus in 2022 was centered on inflation, with central banks raising interest rates across the globe to tackle price increases we hadn’t seen in decades. The Federal Reserve raised the Fed Funds rate from 0.00-0.25% at the start of the year to 4.25-4.50% by year-end. This rapid increase in interest rates dampened demand as the Fed intended, as we have seen declines in car sales, house prices and even cryptocurrencies.

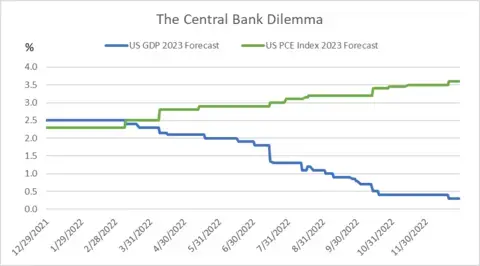

The dampened demand is showing up in forecasts for GDP growth in 2023. Economists expect tepid growth, while forecasts for inflation, using the Fed’s preferred measure of Personal Consumption Expenditures (PCE), have continued to rise. After so many interest rate increases in 2022, the Fed still faces the dilemma of slowing GDP growth and high inflation, which may lead the Fed to have to continue with tighter monetary policy for much longer than market participants anticipate. This is especially true given the strength of the job market, which is why the Fed has acknowledged that the unemployment rate will need to rise for them to be comfortable that the impact of higher rates has curtailed the potential for further inflationary impulses.

Figure 1. The Central Bank Dilemma

Source: Bloomberg, as of 12/30/2022

This battle on inflation is not just a domestic phenomenon. In 2022, Bloomberg noted that 60 of 68 central banks raised interest rates, with only China, Russia, Turkey, and Angola cutting rates. During the month of December, in a surprise to markets, the Bank of Japan adjusted their monetary policy to allow long-term yields to rise. This was significant, since Japan was the first country to institute Quantitative Easing, where bonds are purchased by a central bank. Japan first implemented Quantitative Easing in 2001 to combat deflation and lackluster economic growth. Since 2016, Japan has instituted yield curve control, where the Bank of Japan aimed to keep yields low across the yield curve. Thus, the decision to allow these long-term bonds to fluctuate higher in yield led many investors to believe that interest rates across the globe could stay higher for longer.

With the Fed having reduced the magnitude of rate increases to 50 bps from 75 bps at the most recent meeting in December, a less aggressive Fed in the coming months should be bullish for asset prices across rates, credit and equity markets. That said, the flipside is true: If inflation stays elevated and the labor market stays strong, the Fed may have to raise rates further or keep them at higher levels for longer than market participants would prefer. Thus, markets will likely remain vulnerable, and volatility will likely persist because capital remains scarce and expensive.

Market Recap

It should come as no surprise that 2022 was a rare year when looking through the lens of market history, as both stocks and bonds produced negative returns for the calendar year. Over the last 90 years, there have been only three times in which the S&P 500 Index and the 10-year Treasury bond both had negative returns in the same calendar year, so 2022 marked the fourth time. A typical 60/40 portfolio of U.S. stocks and bonds was down -15.5%-17.5% in 2022, its worst year since 1937. The good news is that one of these asset classes is likely to post a positive return in 2023. Additionally, it is also rare to have two consecutive down years in major equity markets. The S&P 500 Index fell for two straight years on just four occasions since 1928, which is why 71% of global investors in a Bloomberg News survey expected equities to rise in 2023.

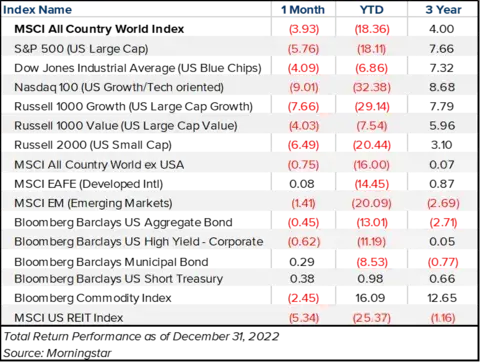

In December, global equities gave back some of the fourth quarter gains they had built from the lows in October. The MSCI All Country World Index declined -3.93% in the month, but was up 9.76% for the quarter. The S&P 500 Index was down -5.76% in December, and both indices were down slightly over -18% for the full year. The Dow Industrial Average and the Russell 1000 Value Index both gave up -4% during the month, but given their lower exposures to the embattled Technology sector, both indices posted double-digit returns for the fourth quarter and ended the year -6.86% and -7.54%, respectively.

Internationally, the MSCI EAFE posted a positive return in December, up +0.08% and finishing the quarter up +17.34%. The U.S. Dollar strength that we had noted all year took a breather and pulled back -10% from its September highs, benefiting international equities. Commodities pulled back in December as well, down -2.45% but remained the sole category to post strong, double-digit returns for the year.

Within fixed income, the U.S. Aggregate Bond Index declined -0.45% and ended the year -13.01%, its worst annual return in the 45-year existence of the index. The yield on the 10-year Treasury climbed back from 3.4% at the start of December to end the year at 3.9%. Municipals were also positive in December, with the Bloomberg Barclays Municipal Bond Index up 0.29%. Municipals can weather some of the economic uncertainty, as many provide essential services, such as water or infrastructure. The high-yield index declined in December, but similar to last month, the spread to 10-year Treasury yields remained at its 20-year average of 4.9%. We expect this to widen in 2023 as investors seek greater compensation for recession risks.

Closing Thoughts

Although the calendar year has turned to 2023, the markets are likely to ebb and flow with the expected direction of monetary policy. While inflation data was the key metric to follow in 2022, we assume that data on the labor market will be a primary focus in 2023, allowing markets to judge the potential magnitude of a recession that may or may not unfold. Volatility is likely to remain at the forefront as each economic data point is extrapolated to anticipate the next move in monetary policy.

Even as the market expects additional rate hikes in 2023, fixed income investors are being compensated now with higher yields, which can be a good estimation of expected returns. Additionally, we see opportunity in extending duration risk, as longer-dated yields will be influenced more by the slowing economy versus moves by the Fed. For equities, we expect negative earnings revisions to continue, but at some point, it will be discounted in the prices of the stocks and provide opportunities for patient long-term investors.