Executive Summary

While interest rates have stabilized for now, inflation remains elevated, and uncertainty remains. The global economy continues to slow, while central banks worldwide attempt to rein in inflation. As near-term risks remain elevated, we believe recession risk remains moderate, and investors should refrain from making rash investment timing decisions.

What Piqued Our Interest

It’s been an eventful year so far, and the last month has been no exception. Here’s what we’re keeping an eye on:

Rate hike(s)

The Federal Reserve raised their federal funds target rate by 0.50% on May 4 and signaled June and July hikes of 50 bps were possible. Subsequent activity is likely dependent upon near-term stock market performance and economic activity.

Inflation

Despite a 0.3% rise in April, the annual rate is expected to remain above 8% through May. Congressional Budget Office (CBO) projects high inflation through year-end, then slowing through 2023 to the Federal Reserve’s long-term 2% goal by year-end 2024. With no resolution in sight for oil and gas prices, coupled with ongoing supply-chain issues, those projections may be extended out in time.

Bear market warning

The S&P 500 breached bear market territory for a brief time on May 20. Declines greater than 20% define a bear market, which historically has preceded a recession 15 times out of 26 bear markets (since 1929). While it's mainly a symbolic event at this point, it is a stark reminder of the downside risk in the market and the fragility of the U.S. economy.

Retail earnings

As the inflation shock has worked its way through stock and bond markets—and made its presence known at the cash register and gas pumps—its effect on earnings has been rather muted until May. Major retailers such as Walmart and Target recently posted poor earnings reports and highlighted inflation as being influential. While decreased consumer spending can help tame the core components of CPI, it does not bode well for overall economic activity.

Consumer health

Despite becoming a more service-based economy, U.S. economic growth is heavily consumer-driven. One major area of concern at this point of the cycle is the health of the consumer. Recent data suggests that consumers are navigating the inflation pinch by financing purchases through credit cards or revolving lines of credit. Figure 1 below shows the growth in revolving consumer credit outstanding. The trend post-2021 is in stark contrast to previous cycles and is something to monitor.

Figure 1. Percent Change of Total Revolving Consumer Credit

Source: Federal Reserve Bank of St. Louis

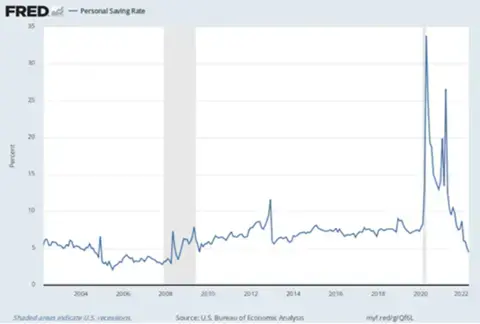

Additionally, personal savings rates are on the decline again, reverting to historic lows. While this is symptomatic of a consumer-based economy, it raises concerns about the ability of consumers to weather adverse economic conditions—particularly coupled with increasing levels of debt.

Figure 2. Personal Savings Rates

Source: Federal Reserve Bank of St. Louis

Market Recap

Despite ending the month on a positive note, May was a tumultuous period for stocks. After seven consecutive weeks of negative returns, the S&P 500 Index rallied 6.8% in the fourth week and held on through the final trading day to eke out a positive return of 0.18% for the month. The Small Cap Russell 2000 Index followed a similar path, rallying at the end of the month to yield a small, but positive 0.15%. As Technology stocks experienced continued selling pressure, the tech-heavy Nasdaq 100 continued its decline, falling over 1.5% in May.

Value stocks continued to outperform Growth through May, driven by a strong performance from Energy and Financial sectors. International stocks performed marginally better than the U.S. for the month, as the developed MSCI EAFE Index and MSCI Emerging Market Indexes gained 0.75% and 0.44%, respectively.

After four straight months of negative returns, bond investors were finally granted some relief in May, as the Bloomberg Aggregate Index returned 0.64%. Despite the 50-bp rate hike early in the month, Treasury rates across the maturity spectrum were relatively unchanged. Both high-yield and short-duration bonds posted modest returns, as investors were rewarded across maturities and credit quality. Inflation-protected TIPS were the only negative performer in the bond universe for the month, dropping 0.99% as inflation moderated slightly.

Commodities continued their strong performance through the month, as the Bloomberg index gained 1.52% and is now 32.74% higher for the year-to-date. Energy sectors drove performance, with strong returns from crude oil and natural gas, while agriculture and industrial and precious metals posted negative returns.

Final Thoughts

Prospects for the economy and the market remain questionable, as the situation in Ukraine continues, supply-chain issues linger, and energy prices and inflation remain elevated. Until matters are resolved through policy and/or market forces, the future path of both equities and fixed income will remain highly reliant upon interest rate policy via the Federal Reserve. Whether the Fed can navigate a soft landing or avoid stagflation remains to be seen. What is certain is that much of what is plaguing markets is essentially out of their control.

As yields have returned to more respectable levels, we can hopefully expect more normalcy in bond returns. A return to regular “coupon clipping” and protection from adverse stock market movements is more likely now, as the surprise inflation effects have passed through the bond market. Despite negative sentiment and potential headwinds for the stock market, staying the course is generally recommended, particularly with the proper asset class and strategy diversification. Even with superior tools and world-class research and expertise, markets are elusive and extremely difficult to time.

The opinions voiced in this material are for general information only, are subject to change at any time without notice, and are not intended to provide or be construed as providing specific investment advice or recommendations. Any economic forecasts presented herein may not develop as predicted and there can be no guarantee that any strategies promoted will be successful. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy.

Index returns reflect reinvestment of dividends and other income but do not reflect fees or other expenses of investing. Indices are unmanaged and are not available for direct investment. Past performance is not a guarantee of future results. Investing involves risk, including the possible loss of principal.