For the period May 1 – May 31, 2023

Executive Summary

A debt ceiling deal has been reached, and we can breathe a sigh of relief as it appears another negative market catalyst has been averted. Despite slowing economic activity and turmoil in the regional banking sector, most investment markets have seen positive returns thus far in 2023.

What Piqued Our Interest

Markets dodged several risks during May, including risks associated with the debt ceiling, continued credit tightening in the banking sector, softer economic data, and further debate on the forward path of interest rates.

The month began with heightened attention towards the need for Congress to raise the debt ceiling, as Treasury Secretary Janet Yellen warned that the ceiling could be breached by June 1. After negotiating over the Memorial Day weekend, a deal was reached and subsequently passed by Congress just as the Treasury revised the date of breach to June 5. The agreement suspends the debt ceiling for the next two years (importantly, through the next presidential election) and freezes non-defense discretionary spending for fiscal year 2024 and caps the increase for fiscal year 2025 to 1%. The deal also removed a key overhang in markets and allowed the S&P 500 Index to finish the month with positive returns.

Economic data has been mixed, with inflation and employment remaining stubbornly strong despite slowing growth in economic activity. Labor constraints persist, as the unemployment rate is still near historic lows. However, there are some signs that the labor market is cooling, with temporary job employment turning down and initial unemployment claims above levels seen throughout most of 2022.

At the end of May, the Bureau of Economic Analysis released the Fed’s preferred measure of inflation, the Core Personal Consumption Expenditures (Core PCE) Index. This index never reached the 9% level seen in the Consumer Price Index (CPI), but Core PCE reported a high of 5.4% in 2022 and has only retreated to 4.7% at its most recent reading. Although the current Fed Funds Rate at 5.00 – 5.25% is above the Core PCE measure of 4.7% and may be considered restrictive for economic activity, this elevated level of inflation continues to keep markets guessing on the future path of interest rate moves.

Many market strategists expect the Fed to take a pause at their upcoming meeting in June, as they want to monitor the lagged impact of their prior interest rate increases on the overall economy. The Fed had already started slowing the rate of interest rate increases in 2023, and a pause could allow them to contemplate the tradeoff of living with some higher levels of inflation to avoid a deeper recession.

Corporate earnings for the first quarter of 2023 finished reporting season in May, with overall S&P 500 Index earnings falling -2% compared to the first quarter of 2022. Despite the decline, this was better than the initial street estimate for a decline of -7% at the start of earnings season. Additionally, this was an improvement from the -5% year-over-year earnings decline that was reported for the fourth quarter of 2022. Despite the better-than-expected state of corporate earnings, commentary from corporate earnings calls indicated delays in capital spending plans, consumers trading down with depleted savings, and waning CEO confidence.

Market Recap

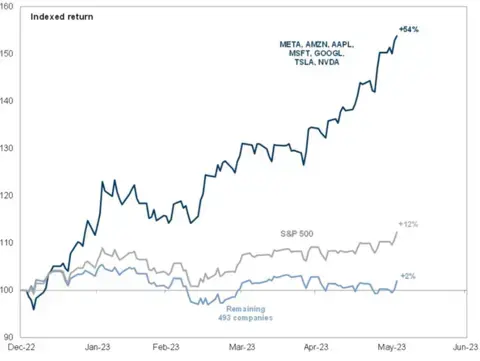

With all this negative sentiment in the backdrop, it is surprising to see that equity market returns have been generally positive in 2023. The S&P 500 Index is up 9.7% year-to-date. However, under the surface, there has been a divergence between some of the largest Technology stocks within the index and all other stocks, shown in the graph below. This divergence began in March when the regional banking troubles began, but the divergence expanded further in May as many Technology stocks hit new highs on the accelerating buzz surrounding artificial intelligence and generative natural language models. To further illustrate the point, only three sectors have positive returns on a year-to-date basis: Consumer Discretionary, Communication Services and Information Technology. All other sectors were down in May and for the full year of 2023.

Figure 1. Market Cap-Weighted S&P 500 Index vs. the Equal-Weighted S&P 500 Index

Source: Goldman Sachs

Within Fixed Income, the debt ceiling drama and the stronger-than-expected inflation data generally pushed Treasury yields higher during the month, and the Bloomberg Barclays U.S. Aggregate Bond Index declined -1.1% for the month. After the initial scare from the banking sector pushed yields down, markets were certain that the last 25-basis-point increase at the meeting in early May was the last increase for this hiking cycle. Futures markets priced in a few months of a pause and interest rate cuts by the end of the year. However, with inflation data coming in stronger than anticipated, yields rose to price out the prospect of interest rate cuts coming so soon. Municipals also declined in May, with the Bloomberg Barclays Municipal Bond Index down -0.9%.

Closing Thoughts

The list of concerns continues to grow with credit conditions tightening, liquidity being withdrawn, yield curves remaining steeply inverted, and inflation continuing to stay more elevated than we would all desire. Despite these risks and concerns, the economy remains resilient, but the more resilient it is to higher interest rates, the more likely they are to stay high.

Additionally, amidst this economic backdrop, markets have been surprisingly calm this year—at least, it appears so on the surface. When we dig deeper, volatility within the equity market is elevated but masked by the dominance of the mega-cap Tech stocks that may be trading like safe-haven assets that can grow through any economic turmoil (such as they did during the pandemic). However, as we learned in 2022 when Treasuries began the year with yields at zero, even safe-haven assets can post negative returns. Though many strategists and economists were right about the macroeconomic environment, markets don’t always behave as expected in the short run. During times of uncertainty, we continue to advocate for a well-diversified portfolio and view these investments with a long-term time horizon.