Executive Summary

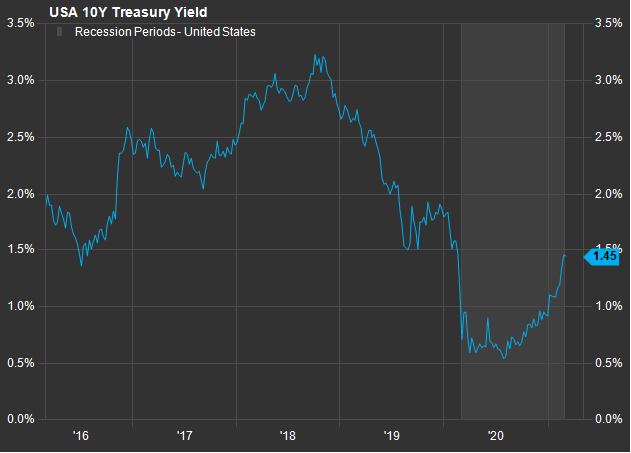

- Stimulus spending and expectations for a faster recovery have helped drive yields to a remarkable run, as the 10-year Treasury surpassed 1.5% in February.

- Higher rates are tied to rising inflation concerns, which are affecting risk asset classes and casting doubt on the resiliency of the equity bull market.

- The rotation from Growth to Value picked up steam in February, as long-struggling sectors such as Energy and Financials vastly outperformed the market.

- The Bloomberg Commodities Index reached its highest level in eight years due to a pickup in demand and the inflation outlook.

What Piqued Our Interest

The next round of COVID-19-related fiscal stimulus is working its way through Congress, and with it a wave of debate has emerged over the size and necessity of the package, as well as its long-term impacts. Proponents of President Biden’s American Rescue Plan laud the claim to “go big” in order to aid the unemployed, small businesses and local governments, as well as increase funding for vaccine distribution and testing. Critics point out that the economy may not need additional support after spending $900 billion in December and that more stimulus could be highly inflationary. Regardless, it appears that the bill will pass without Republican support by mid-March, even if it is slightly lower than the originally proposed $1.9 trillion price tag. (Editor's note: the full $1.9 trillion dollar bill did pass through Congress on March 10). The market is now discounting this new round of spending, along with another package tied to infrastructure in the coming months, which could amount to an additional $3 trillion by some estimates.

It’s difficult to wrap your head around the sum of money that has already been spent during this pandemic. According to the non-partisan Committee for Responsible Federal Budget, legislative actions have totaled $3.1 trillion thus far, with the Fed accounting for $2.8 trillion and administrative actions contributing an additional $500 billion. Add this up and you’re at almost 30% of the most recent GDP figures. When you include the proposed stimulus packages, which could be in the $4-5 trillion range, it’s easy to see why inflation concerns are beginning to percolate. On top of the fiscal spending, at his most recent congressional testimony, Federal Reserve Chief Jerome Powell made it abundantly clear that the central bank will maintain its accommodative policies for a long time to come, noting that the economy is still way off from employment and inflation goals, and it will likely take substantial time for progress to be achieved.

Given the enormous slack still in the economy, the recent inflation concerns still feel premature. However, the market has responded dramatically in recent weeks. Take the 10-year U.S. Treasury yield as an example, which bottomed out at 0.56% back in August and last month surpassed 1.5% before ending the month at 1.45%. According to research by Bank of America, the current bear market in bonds is one of the greatest of all time, with annualized return on 10-year Treasuries close to -30% since early August.

The big question is: What level of interest rates could be problematic for the stock market? Even with the recent surge, overall rates are still very low by historical standards. Independent research provider Cornerstone Macro suggest that the neutral federal funds rate–that is, the rate that neither inhibits nor stimulates growth–is still well above today’s levels. Roughly speaking, the firm estimates that rates could rise another half percent or more to about 2-2.25% before earnings expectations were adversely impacted and stocks sold off. Of course, higher rates imply lower future discounted cash flows, as well as higher costs of borrowing.

Another important consideration is that rising rates can have both positive and negative implications. The negative component is higher inflation, which could be very problematic for investors with income needs. Given the massive growth in money supply and federal debt, we cannot take this concern too lightly. On the positive side, when real rates are improving, it is indicative of higher economic growth forecasts. With the recent approval of the Johnson &; Johnson vaccine and a projected rapid increase in vaccine distribution in the coming months, the country now has a plausible path to herd immunity by the summer. The fall in new cases, hospitalizations, and deaths (and the gradual but steady reopening of the economy) are all in motion, all of which support the notion for real rates higher than today’s level.

The improving COVID-19 statistics and prospects for a reopening of the economy have had a substantial impact on forward-looking earnings estimates, which further warrant a rise in the term premium. Analysts are now projecting S&;P 500 earnings growth of 23.9% in 2021, albeit from depressed 2020 levels, according to FactSet. Broken down for the next two quarters, Q1 projected EPS growth is currently estimated at 14.5%, while Q2 is a whopping 44%. While these forecasts are likely to flatten in later months, the rebound in corporate earnings has far exceeded the earliest projections. All these factors support the rationale for the recent move in rates; however, the market should be able to live with today’s levels, which are still accommodative by most standards.

Source: FactSet

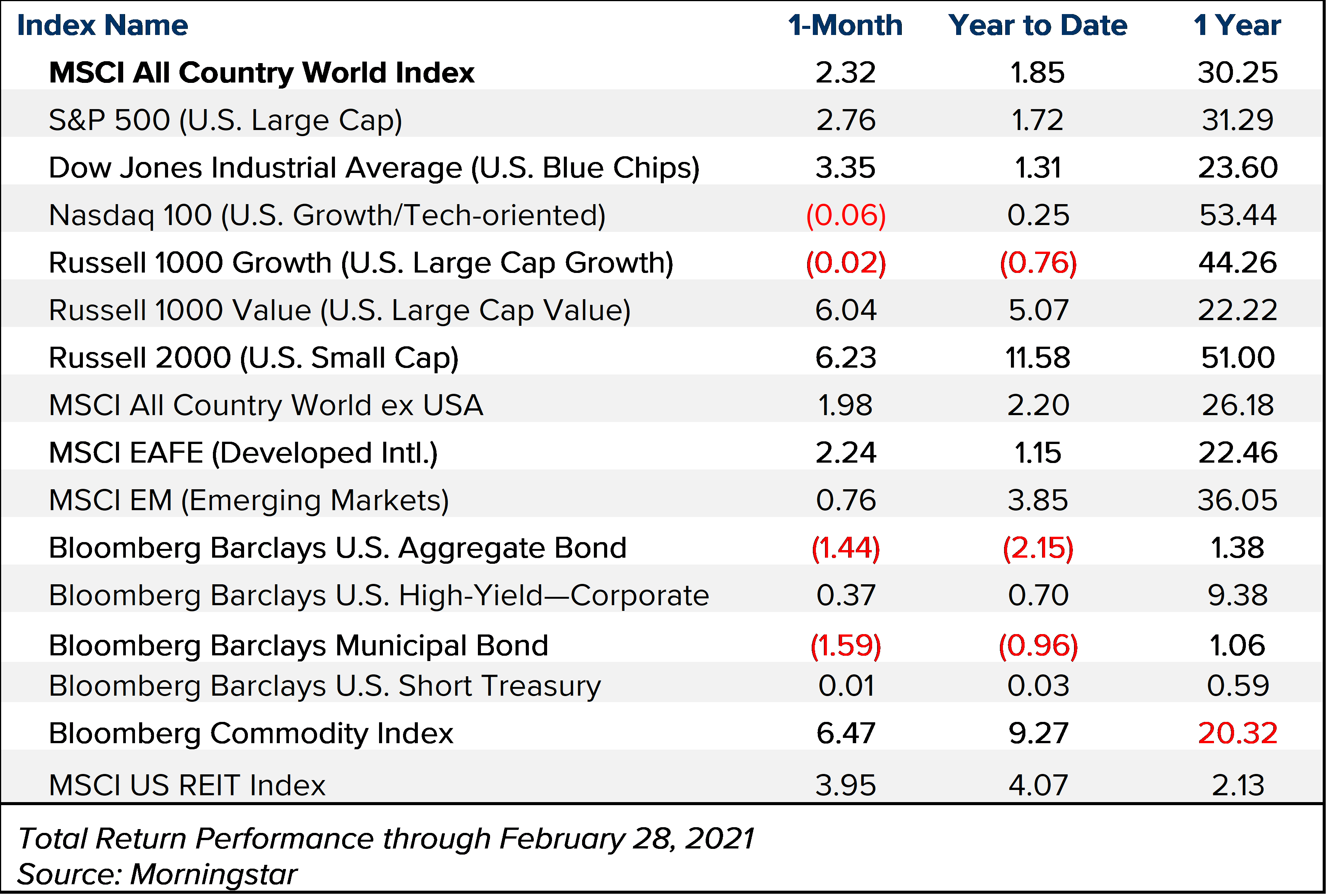

Market Recap

Overall, equities finished higher in February, but a notable trend that began in Q4 of 2020 has further established itself. The rotation of leadership from Growth stocks to Value stocks, which began in early November when the Pfizer vaccine was announced, further escalated in February, as the Russell 1000 Value index outperformed its Growth counterpart by 6%. Since November 6, the Value index has outperformed by roughly 12%. Perhaps more notable was the sizeable dispersion amongst sectors in February, with a clear distinction of winners amongst cyclical sectors. The big winner by far was the Energy sector, which shot up 22.7% and is now up 32.9% in the early goings of 2021. Also impressing, Financials leapt 11.5% in February and are now +16.5% this year. Another key cyclical sector, Industrials, was a distant third at +6.9% in February. Laggards in February included the historically defensive sectors, particularly Utilities (-6.1%), which usually are punished when interest rates rise. Consumer Staples (-1.4%) and Health Care (-2.1%) also resulted in down months, as investors rotated towards more attractively valued sectors.

The reasons for the rotation into cyclical stocks are abundant. A key component is the renewed focus on cyclical stocks, which benefit from a broader economic recovery–also benefiting Small Cap stocks over Large. The recent move in rates has also disproportionately impacted longer-duration Growth stocks, which are priced based upon future discounted cash flows. Meanwhile, banks and financials benefit from a steeper yield curve that allows them to borrow cheaper and lend at higher rates. Severe weather and a pickup in demand have been a boom for the Energy sector. Also, Industrials and Materials have benefitted from a strong recovery in manufacturing.

Switching gears to fixed income, the Bloomberg Barclays U.S. Aggregate Bond Index fell again in February and is now -2.15% this year. The key detractor, as we already discussed, was the selloff in Treasuries, which caused yields to spike, as the 10-year Treasury yield jumped 37 bps higher. Longer-duration bonds therefore underperformed short duration, while credit spreads continued to tighten, which favored lower-quality bonds over high quality. The spread between the Bloomberg/Barclays Corporate High-Yield Index and Treasuries is now just 3.47%, which is its lowest level since October 2018. Due to spread tightening, the High-Yield Index edged higher by 0.37%, which was the only bond sector to appreciate in February outside of Leveraged Loans.

The top-performing asset class, however, was Commodities, which historically have performed well when inflation expectations escalate. WTI Crude went on an 18% tear from $52.16 per barrel to as high as $63.43 before settling at $61.55 at the end of the month. Oil’s futures curve is in steep backwardation, meaning that future price of oil is considerably lower than the spot price, a phenomenon that is bullish for investors of longer-term contracts. Given the pent-up demand and reaccelerating economy, this backdrop could be supportive for oil in the months to come. Also, the S&;P GSCI Agricultural Spot Index was higher by 2.6%, while industrial metals gained 8.7%. In fact, all commodity subsectors saw gains except for precious metals, which dipped 5.7%. Gold fell another 6.8% and is now roughly 17% below its recent high set last August.

Looking forward, one has to be concerned with the size and scale of the COVID-19-related fiscal and monetary policies, but for now, most agree that more help is still needed to assist the most impaired citizens get through this perilous time. We remain optimistic that better days are ahead for the economy, yet we are cautious that the market may have already priced in the majority of this optimism. We could still be in the early stages of this rotation away from Growth to Value, Large Cap to Small Cap, and U.S. to International, but only in time will we know for sure.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The economic forecasts set forth in this material may not develop as predicted.