Executive Summary

Like gasoline near an open flame, the Russian invasion of Ukraine has unnerved markets and stoked fears of even higher inflation and commodity prices. Our longer-term prospects on the U.S. economy are still constructive, however, the conflict is likely to deteriorate before it gets better, and it remains to be seen how markets will react. The conflict shouldn’t impact the Fed’s March rate liftoff; however, it may lessen the magnitude of hikes this year, which would be a welcome sign for rate-sensitive sectors.

What Piqued Our Interest

It has been a tumultuous start to 2022 across the globe, as the Russian assault on Ukraine set off the largest conventional military invasion since World War II. As this tragic event unfolds, our initial thoughts and prayers go out to the people of Ukraine and all those impacted by this war. In the wake of this unnecessary conflict, equity markets have experienced increased volatility as expectations for global economic growth have taken a substantial hit.

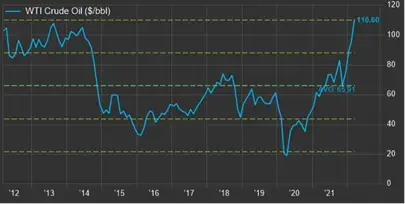

Fortunately, direct exposure to Russia via trade and foreign banks have meaningfully declined since 2014 when Russia annexed Crimea from Ukraine. While the U.S. has limited trade exposure to Russia—less than 0.5%, according to U.S. Census data—both Russia and Ukraine combined are substantial exporters of a range of commodities, most notably industrial metals such as palladium and titanium, as well as agricultural commodities such as corn and wheat. Both oil and natural gas are major exports for Russia, as Europe relies upon Moscow for 25% and 40% of their supply, respectively. The supply chain disruptions and elevated uncertainty have sent shockwaves across commodity markets, many of which were already trading at multiyear highs. Both Brent and WTI oil recently surpassed $100 per barrel, a level not seen since 2014, and roughly two standard deviations above their 10-year average price.

Figure 1. WTI Crude Oil—Price per Barrel

Source: FactSet

What remains to be seen is how long this surge in energy and other commodity prices will continue, along with what impact it will have on the broader economy. While somewhat of a contradictory implication, higher oil can actually have a deflationary impact over the medium term. Considering that oil had already risen 125% before the Ukrainian invasion began, this was already taxing consumers and businesses, which will impact profitability and deter future purchasing decisions. In the short run, higher oil will lead to a spike in headline CPI, however, “Core CPI” which strips out food and energy components, could begin to flatten in the coming months.

The distinction between core and headline inflation is an important factor when it comes to Fed policy. The Fed understands its policy acts with a lag, so they put more emphasis on core inflation, since food and energy are more volatile and tend to revert to the mean. However, core inflation is more indicative of structural inflation that the Fed can manage. As the Fed has now fulfilled its employment mandate (currently at 3.8%), they are now focusing entirely on inflation, with risks skewed to the upside. If Core CPI does level off, this could suggest fewer rate hikes in 2022 than the six 25 bp hikes currently projected, according to CME Group. That being said, the Fed is preparing to increase the Federal Funds Rate by a quarter percent when they meet later this month, which will be the first increase since 2019.

The U.S. has been employing a “war-like” response both monetarily and fiscally to counter the impacts from the COVID-19 recession, however, both policies are now in the process of reversing, which means M2 (money supply) is set to slow considerably. Slower M2 growth, along with a shrinking Fed balance sheet and upcoming rate hikes, suggests a slowdown in nominal GDP growth, as well as a peaking of bond yields. According to Piper Sandler research, they now expect U.S. GDP growth of just 2.5% in 2022, down from 3.5% earlier this year. As both manufacturing and services PMI indices have declined in recent months, this suggests that the economy is still expanding, just at a declining rate. The Purchasing Managers Index (PMI) provides current insight into prevailing economic trends by surveying data points such as new orders and inventories. It is becoming clearer by the day that the surge in inflation and now the Ukraine conflict have pulled us forward in this business cycle—not that we are entering an economic contraction, however, all eyes will be on the Fed and how the market responds to several rate hikes in the coming months.

Market Recap

As referenced above, U.S. equities came under pressure in February after a January selloff that saw the S&P 500 suffer its biggest monthly pullback since the depths of the pandemic in March 2020. The S&P 500 fell -2.99% in February and is now down -8.01% year-to-date (YTD). The Nasdaq 100 was pummeled even more and is now -12.65% through the end of February. International Developed equities fared slightly better as the MSCI EAFE Index fell -1.77%, however, the Emerging Market Index fell in tandem with the U.S. (-2.99%). Interestingly, the Russell 2000 Small Cap Index ended the month positive after being hammered in January. Prevailing wisdom suggests that the notion of fewer rate hikes than originally projected last month should benefit Small Caps, which are generally hurt more than Large Caps when rates rise due to elevated financing costs. Another factor, Small Caps are now valued at much more attractive levels compared to Large Caps. While the forward Price-to-Earnings (PE) ratio on the S&P 500 has come down to around 19, it is still elevated by historical standards. The Forward PE on the S&P 600 Small Cap Index is just 13.8, which is well below its 10-year average of 16 (we use the S&P 600 Index because it excludes most unprofitable businesses).

Fixed income sectors continued to face dual headwinds of rising interest rates and widening credit spreads. The 10-year Treasury remained relatively flat around 1.8%, however, the two-year yield continued to climb from 1.16% to 1.43% and was as high as 1.60% in late February. Meanwhile, the spread on the high-yield index over Treasuries has risen 70 bps to 4% in the first two months of the year. The Bloomberg Barclays Aggregate Bond Index fell 1.12% in February, and all major sectors except for TIPS (inflation-protected bonds) saw negative returns. Municipal bonds were down as well, however, not as much as their taxable counterparts. From a valuation standpoint, both emerging market bonds (USD denominated) and Preferred securities are both now trading at more attractive spreads relative to their 15-year average, representing an attractive entry point for both asset classes.

Final Thoughts

Given the headline risk and heightened volatility, the path of least resistance appears lower in the immediate term. This doesn’t affect our long-term outlook, however. We still view the U.S. economy as healthy, with strong corporate earnings and a robust labor market that is back at full employment. However, from a global standpoint, the war in Ukraine is likely to get worse before it gets better as Vladimir Putin appears determined to continue on this devastating path of authoritarian expansion. History has shown us that geopolitical events generally do not move the markets in the long run, but rather economic fundamentals and the business cycle have a far greater impact. As of now, Russia and Europe will likely be the most impacted and have the greatest recession risk, but needless to say, the spillover effect will certainly be felt across the globe.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.