For the period February 1 – February 28, 2023.

Executive Summary

The positive sentiment that lifted markets in January waned in the month of February, as progress slowed in bringing down inflation. This has led to expectations for additional interest rate hikes in the future, alongside a higher terminal interest rate.

What Piqued Our Interest

The bullish narrative that began the year, fueled by the notion that the Federal Reserve was nearing the end of its rate-hiking cycle, faded during the month of February. The decline in inflation we saw in January reversed when the Consumer Price Index was reported in February, registering a 0.5% month-over-month increase, its biggest monthly gain in three months. Validating these trends, the Producer Price Index was also stronger than expected, showing a month-over-month increase of +0.7% compared to a -0.2% decline in the previous month.

Economic data releases in February revealed an economy that was not as impacted by the rate hikes from 2022—at least not yet. We saw that retail sales were still strong; thus, the consumer is still spending as the labor market remains tight. This strength in the economy is puzzling to many, given the tighter monetary policy that is currently in place, but we have continued to highlight the relative strength and healthy balance sheets of both corporations and wealthy consumers. This is largely because many consumers and corporations took advantage of the low-interest rate environment that followed the ’08-‘09 Financial Crisis and locked in low long-term rates.

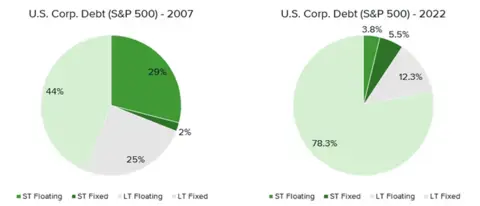

As you can see in Figure 1 below, in 2007, only 44% of U.S. corporate debt (of companies within the S&P 500 Index) had long-term (LT) fixed-rate debt. Fast forward to 2022, almost 80% of U.S. corporate debt is long-term fixed-rate debt. Similarly, a large majority of homeowners with an outstanding mortgage in 2022 had locked in rates near or under 3.5%. Thus, as the Federal Reserve increases interest rates, there is less outstanding debt that floats higher.

Figure 1. Breakdown of U.S. Corporate Debt – 2007 vs. 2022

Source: Bloomberg, Bank of America Global Research

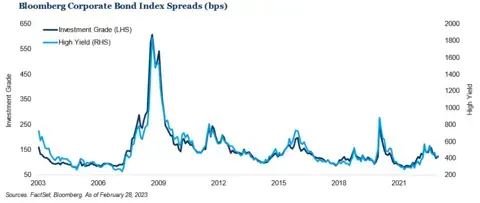

This may also explain why corporate and high-yield spreads haven’t widened as much as one would speculate as the economy slowed. This can be seen in Figure 2 below, with spreads elevated from the lows of 2021 but not indicative of distress.

Figure 2. Bloomberg Corporate Bond Index Spreads

As we ended the month of February, Treasury yields were back on the rise, with the 2-year Treasury ending the month at 4.8%, a 70-bps increase from where it began the month and surpassing the November 2022 high of 4.7%. Stocks took their cue from the bond market, and the higher interest rates weighed on stock prices, as the S&P 500 Index declined for the month. Corporate earnings that were reported from mid-January through mid-February were not very strong, but they weren’t as bad as many had expected, and the outlooks for the year were muted—not weak enough to cause alarms, but acknowledging an expected slowdown in demand.

Despite this February pullback in equity markets, valuations are still elevated, as sentiment carried stock prices higher from their October lows. Valuation is a poor timing tool, and there are times to look past rich valuations when economic fundamentals are near their troughs and expectations are low, but the current situation does not warrant this.

Market Recap

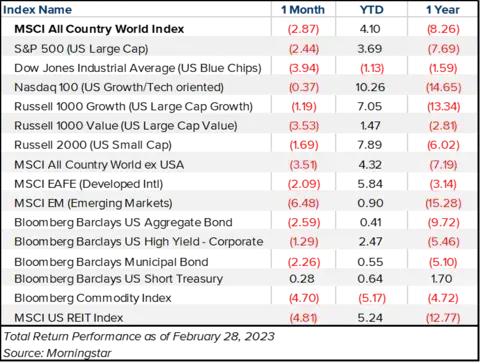

In February, global equities gave back some of the gains from January. The MSCI All Country World Index declined -2.87% in the month but was still up 4.1% year-to-date. The S&P 500 Index was down -2.44% in February, and it remains notable that Growth has outperformed Value to start 2023 and that the Technology sector was the only positive sector within the Index during the month. Similarly, the Tech-heavy Nasdaq 100 was only down -0.37% for the month and is still up 10.26% for the year. The Dow Industrial Average outperformed the S&P 500 Index in 2022, but this index of U.S. blue chip stocks was down -3.94% in February, taking the index negative for the year.

Internationally, the MSCI EAFE Index pulled back in February as well, down -2.09%. The U.S. Dollar weakened during the fourth quarter of 2022 when the Fed communicated it would slow its pace of interest rate increases, but it regained some strength in February as markets repriced for higher interest rates. Lastly, Emerging Markets declined -6.48% in February, as the narrative on the reopening of China that had fueled the move off the lows in the last three months was met with geopolitical tensions arising from suspected surveillance balloons in U.S. airspace.

Within Fixed Income, the U.S. Aggregate Bond Index declined -2.59% as the market repriced its expectations for additional rate hikes from the Fed. The futures market now projects a peak Fed Funds rate of 5.4% by July, up from the estimated 5.0% projection in early February. The yield on the 10-year Treasury climbed back from 3.4% at the start of the month to 3.9%. The yield was still below the October 2022 high of 4.2%, and the move on the 10-year Treasury was smaller than the move on the 2-year Treasury. This also led to the deepest inversion of the yield curve (at -90 bps) as measured by the difference between the 2-year Treasury yield and the 10-year Treasury yield. Municipals also declined in February, with the Bloomberg Barclays Municipal Bond Index down -2.26%. The high-yield index declined as well, down -1.29%, but as mentioned above, we have yet to see spreads widen much in 2023.

Closing Thoughts

We continue to expect that the markets will ebb and flow with the direction of expected monetary policy. Inflation has been more difficult to tame after years of low rates and excess liquidity. Volatility will likely remain more elevated than we would like as each economic data point is scrutinized for whether there need to be additional interest rate hikes or if there have been too many, especially if credit markets see signs of stress.

We expect the appetite for risk may continue to diminish if volatility remains high, especially when higher interest rates on money market funds and short-term Treasuries provide good yields and allow savers to get “paid to wait.” At the same time, we continue to look beyond the shorter-term volatility and believe there are opportunities for patient long-term investors who won’t have to time the markets for an eventual recovery.