As inflation and interest rates surge higher, it's been a bumpy road for stocks and bonds alike. The global economy is undoubtedly slowing while the Fed is trying to play catch up to rein in inflation. While near-term risks remain elevated, we believe recession risk remains moderate, and investors should refrain from making rash investment timing decisions.

What Piqued our Interest

The tumultuous start to 2022 has now continued into the 2nd quarter. A significant global economic slowdown is unfolding due to the trifecta of the highest inflation in 40 years, the war in Ukraine, and a tightening of global central bank policy. In addition, China's lockdowns due to its no-Covid policy are sending continued shockwaves to the global supply chain. While the slowdown in the U.S. is less pronounced than in Europe and China, we are certainly not immune to its effects. Many were surprised that U.S. GDP declined by 1.4% annualized in the first quarter of 2022 when most were expecting ~ 1% gain. While the loss was mainly due to a decline in private inventory investments and defense spending, consumer spending did reasonably well despite the headwinds listed above.

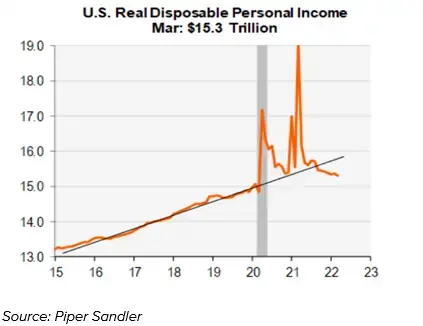

Headline PMI data shows that manufacturing has significantly cooled since the middle of last year. Looking beneath the surface, 'new orders' reached their lowest level since the pandemic peak, and 'order backlogs' dropped to their lowest level since November 2020. The good news behind this softening of data is that the economic slowdown could help dampen core inflation by year-end. Nominal disposable income growth is back to pre-Covid levels as higher prices drive down consumers' buying power. As spending behavior is shifting, if consumers want to spend on travel and leisure, they're going to have to cut back on all the goods and appliances which thrived during the pandemic.

Figure 1:

Some stay-at-home-sectors may begin seeing outright deflation in the coming months, which will help lower CPI. According to Piper Sandler, for example, used cars surged in 2020-2021 and have dropped 6% over the past 2.5 months. And Netflix, which reported it lost subscribers for the first time in a decade last month, is now floating price cuts. Housing, another big pandemic winner that surged due to low interest rates, transfer payments, and relocation factors, could be coming to a halt, if not decline. Mortgage rates are now above 5% and likely to climb higher, and the home price to median income ratio surpassed previous highs from the mid-2000s.

The labor market has also been notably strong, with unemployment now at just 3.6%. However, as many small business owners can attest, the gap between labor demand and supply is currently the largest in postwar history. This labor shortage has helped elevate job wages in recent months, but that trend may stall if corporate earnings begin to fade, as seems likely given the slowing economy. If wage growth declines to more normal pre-Covid levels, this could be yet another contributor to lower CPI by year-end.

Market Recap

April was a particularly tough month for both stocks and bonds. The S&P 500 fell almost 9% in April, its worst month since March 2020. The large-cap index declined for the 4th consecutive week as concerns about rising rates, persistent inflation, and the risk of recession edges higher. The tech-heavy Nasdaq 100 performed even worse, falling over 13% in April, its worst decline since the Financial Crisis, erasing last year's gain. The small-cap Russell 2000 index fell 9.91% as investors fled perceived riskier sectors.

The spread between growth and value stocks widened further, as the Russell 1000 Growth index is now -20% on the year relative to just -6.3% for the value index. International stocks performed marginally better than the U.S. in April, as the developed EAFE index and Emerging Market index dropped -6.47% and -5.56%, respectively.

Perhaps the most significant headwind for the market has been the velocity and magnitude of the bond yield backup. The 10-year Treasury yield surged from roughly 2.4% to 3%, a 60 bp move which resulted in another rough month for the U.S. Aggregate Bond Index, falling 3.79%. Lower duration bonds outperformed long duration due to the movement in rates, and tax-exempt Munis fell less than taxables in aggregate. Inflation-protected TIPS fell 1.99% last month and are "only" down 5% this year which is a sizeable improvement over treasuries.

As has been the case for every month this year (so far), commodities have been the top-performing asset class by a long shot. In April, the Bloomberg index gained 4.14% and is now 30.75% higher on the year. Crude oil was relatively flat, and both industrial and precious metals fell last month. However, natural gas surged almost 36%, and the Agricultural commodity index gained 6.3%, driving gains for the sector.

Final Thoughts

Prospects for the economy and the market have become more questionable recently, but we continue to believe that near-term recession risk appears to be low here in the U.S. Capex spending remains strong, and the negative detractors to first-quarter GDP appear to be outliers. Of course, as we have seen in the recent past, exogenous shocks can still create a recession at a moment's notice, but one cannot predict or position for this with a high success rate.

For the time being, the future path of both equities and fixed income will remain highly reliant upon the Fed's tightening policy for the remainder of the year. As of May 9th, an additional seven or eight rate hikes had been priced in by the markets, according to CME group, after the FOMC raised the Fed Funds Rate by 50 bps at their May 4th meeting. The market was relieved when Jerome Powell suggested that a 75 bp hike was not considered but should there be a surprise in an upcoming meeting, the market would likely react negatively.

Even if the markets do continue to falter, selling your stocks is still unlikely to be the best strategy over the long term. It may make you feel better (or smarter) in the short term, but the problem with selling is deciding when to get back in. History has shown us that staying in the market for the long run is the time-tested secret to investment success. Also, staying diversified in fixed income will play an important role even when bonds are facing headwinds as they are today. Over time the income component of bonds makes up the majority of the total return, and yields are again approaching respectable levels. We also know that fixed income survived during the rate-increasing period from the mid-1950s to the early-1980s, so knowing that we've been here before should give us some comfort.

The opinions voiced in this material are for general information only, are subject to change at any time without notice, and are not intended to provide or be construed as providing specific investment advice or recommendations. Any economic forecasts presented herein may not develop as predicted and there can be no guarantee that any strategies promoted will be successful. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Index returns reflect reinvestment of dividends and other income but do not reflect fees or other expenses of investing. Indices are unmanaged and are not available for direct investment. Past performance is not a guarantee of future results. Investing involves risk, including the possible loss of principal.