This morning, we woke up to the news that Russia has invaded Ukraine, as was widely anticipated in recent weeks. Early reports indicate that the invasion included attacks by land, air and sea, along with cyberattacks. Ukraine and Russia are large exporters of precious and industrial metals, grains and oil & gas. As of early this morning, prices for aluminum, palladium, nickel, wheat, gold and oil are up significantly as a result. U.S. Treasury rates have dropped as investors flee for other safe-haven assets.

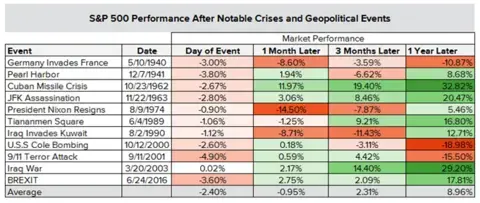

As we have said before, the market hates uncertainty. Geopolitical events can impact financial markets to the extent they impact the business cycle. Investors fear that a triple threat of higher inflation, interest rates and commodity prices could send equity markets spiraling downward. However, what we have seen historically is that markets often over-estimate the risk of conflict in the short term and price in a more negative scenario than is ultimately warranted, as shown in Figure 1 below.

Figure 1. S&P 500 Performance After Notable Crises & Geopolitical Events

Source: FactSet

It’s too early to know if the same is true in this case; only time will tell. But in our opinion, there are several indicators that suggest it’s not time to panic.

- Russia is a major oil & gas exporter with the rest of the world its customer. Cutting off Europe and others from supply means lost revenue for Russia. Further, Russia is not the only provider; supply can be brought online elsewhere, like the U.S., to help Europe and other impacted regions, should Russia choose to weaponize oil access. Yes, this news will impact the price of oil, but the factors discussed below will likely act as a ceiling on how far gas prices can go and how long Russia can sustain its position.

- If this conflict does impact the global business cycle negatively, it would likely slow economic growth and core inflation (non-commodities). Since interest rate hikes will have minimal direct impact on the price of commodities, this could enable the Fed to act far less aggressively than currently anticipated. Slower rate hikes and lower interest rates would add support to asset prices and economic strength.

- The majority of the world is united in opposition to Russia’s invasion of Ukraine. Actions like we are seeing from Russia are usually detrimental to the long-term interests of all parties involved. Human and financial suffering take a toll and increase pressure to resolve conflict. History tells us this can take years under extreme circumstances, but most often, these situations are resolved more rapidly (ex. Iraq invasion of Kuwait).

- Stock and bond markets moved meaningfully this morning, but thanks to widespread intelligence that Russian action was likely, the invasion didn’t come as a surprise. Investors appear to have anticipated this and seem to have priced in the risk of this outcome to some extent.

What’s still unknown, and questions that are certain to be on investors’ minds include, how long will this last? How far will Putin go? How deep will sanctions run? And will military action eventually be needed to counter this attack?

What this news means for the markets depends on what happens in the coming days, weeks and months relative to what investors are anticipating. Market declines—especially in the context of geopolitical conflict and then amplified by the 24-hour media—cause even the savviest investor’s stomach to drop.

In times like this, it’s critical to remember that markets are unpredictable in the short term but tend to reward investors over the long term. Remember the value of diversification; our portfolios are designed to mitigate risk through diversification, and they are performing as expected, as we’ve seen commodity and bond prices rise as equities decline.

Put another way, investors should avoid the impulse to time the market. The market’s best days often follow the largest drops, suggesting that panic-selling can lead to missed opportunities on the upside. Staying invested throughout turbulent times is key to recovering losses incurred during market corrections.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

Investing involves risks including possible loss of principal.