For the period April 1 – April 30, 2023

Executive Summary

Sensational headlines abound, with continued turbulence in the banking sector, recession fears, and the debt ceiling being top of mind this month. But equities continue to climb the wall of worries, with the S&P 500, NASDAQ, and Dow Jones all posting positive returns in April.

What Piqued Our Interest

We’re midway through the second quarter, and it’s been an eventful start to 2023, to say the least. Three notable regional banks have now failed (plus a fourth focused on cryptocurrencies), sending ripples throughout the economy. Investors are understandably concerned that the financial contagion will spread to larger systemically important banks, but the evidence suggests that this is not 2008, and it appears that a worst-case financial crisis scenario is unlikely.

With all three banks (Silicon Valley, Signature, and now First Republic), poor management and lack of foresight into the new, higher-interest-rate environment all played a key role in their demise. The most recent collapse of First Republic, which was highlighted by poor lending practices to lure high-net-worth clients, resulted in JPMorgan purchasing the bank, as the largest bank in the U.S. grew ever larger. Further consolidation of the too-big-to-fail banks may be inevitable.

The reality is that banks do fail from time to time, especially in an environment of rising interest rates. In the context of the entire $23 trillion U.S. banking system, the failure of three banks representing roughly $550 billion (2.4% overall) with mainly niche and affluent clientele is hardly a portent of doom for the industry as a whole. The market may already be looking past these concerns, but there is certainly the possibility of more bank failures to come, particularly among community and regional banks. There is also a high probability of an increase in regulatory oversight and stricter liquidity requirements for smaller and regional banks, and the treatment of held-to-maturity assets is likely to come under scrutiny.

On a more serious note, the clock is ticking towards a potential U.S. default due to the ongoing debt-ceiling debate. We’ve seen this brinksmanship before, so why does it feel different this time? Perhaps it’s the severe toxic nature of politics, or provocative statements from our country’s top officials and refusal to negotiate. According to a CBS News/YouGov poll on April 17, 54% of Americans opposed raising the debt ceiling, a fairly split level which is emboldening both sides to stand their ground.

The so-called X-Date—the date at which the Treasury can no longer meet its obligations such as interest payments and Social Security checks—could arrive as early as June 1. Time is running out for a clean bill to make its way through Congress, raising the probability of market volatility later this month.

The implications of an actual default could be quite severe. Back in 2011, when a deal was struck at the eleventh hour, the S&P 500 fell roughly 19% in the month leading up to potential default date. So far in May, the anxiety can be felt across both equity and bond markets, as the yield on the 10-year Treasury has declined to 3.35% as of May 4, down from a high of over 4% in early March. This is similar to what occurred in 2011, whereas despite concerns of U.S. defaulting, investors still fled to quality during August of that year, the 10-year Treasury falling from roughly 2.6% to a low of 1.82% the following month.

Market Recap

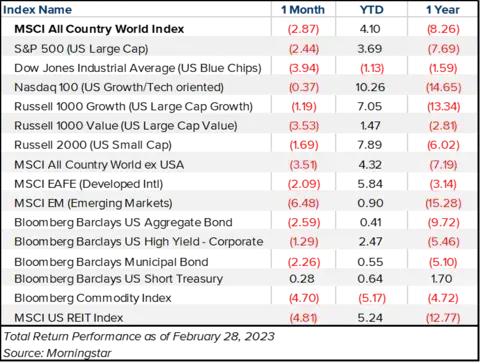

The S&P 500 returned 1.56% including dividends in April in spite of the ever-growing list of concerns. Blue-chips fared a bit better last month, as the Dow Jones Industrial Average gained 2.57%, but so far, this year has been all about the Tech-heavy Nasdaq. After significantly underperforming in 2022 (and following years of outperformance), the Nasdaq 100 Index is once again besting all major U.S. equity indices. However, it’s not just Technology that is outperforming—in particular, it’s the largest, most well-known names paving the way forward. For example, while the S&P 500 is up 9.17% on the year, the equally weighted version of the S&P 500 lost 2.13% in April and is only up 1.07% on the year, highlighting the substantial impact of stocks like Apple, Meta, and the like.

Volatility, as measured by the CBOE VIX Index, fell to its lowest level in over a year at the beginning of May, emphasizing how equity market participants appear to be looking past the banking concerns and other recessionary signals.

On the fixed income side, investors have been looking the other direction, driving longer-dated yields lower and further inverting the yield curve to its deepest level since 1981. The Bloomberg Barclay’s Aggregate Bond Index is now up 3.59% this year, slowly but steadily making up losses incurred over the past two years. High-yield spreads have yet to substantially widen this year. After a brief spike up to 560 basis points in March, spreads remained close to 500 in April, which is not far off the long-term average relative to 10-year Treasuries.

Closing Thoughts

As we’ve reiterated for the past several months, there are no shortage of signals that suggest a mild recession may be coming soon. The deeply inverted yield curve, signs of financial conditions tightening, and The Conference Board’s Leading Economic Index—which fell 4.5% over the six months from September 2022 to March 2023, with widespread weakness across the index’s components—all increase the probability of an economic downturn. And on May 3, the Fed remained on its vigilant path of fighting inflation, increasing the Fed Funds rate up to 5.0-5.25%, its highest level since 2007.

You’ve probably heard the phrase, “Sell in May and go away,” and if so, it shouldn’t surprise you that we are not advocates for this strategy. Yes, returns in the summer months have historically averaged less than those in the first and fourth quarters. However, the dispersion of returns greatly varies, and even against a wall of worries, the market always finds a reason to claw its way higher. And regardless of the time of year, markets have also remained resilient, even leading up to (and during) economic recessions.

Inflation is falling, but it may remain above its average for the foreseeable future. Even if it does, the compounding effect of earnings growth obtained through equities is the surest way to outperform inflation over the long run.