Executive Summary

Inflation may have peaked but has remained higher than many expected. Economic data points have been softening, reflecting the impact of tighter financial conditions on aggregate demand. Despite this weaker fundamental backdrop for the economy, markets saw some reprieve as speculation grew that the Federal Reserve could moderate the pace of rate hikes in the coming months.

What Piqued our Interest

Equity markets attempted to rally once again heading into earnings season, and the Dow Jones Industrial Average ended October with a gain of 14.07%, its best one-month gain since January of 1976 and its tenth-best month of the last 100 years. All equity indices remain in negative territory for the year, but as noted by the Dow Jones Industrial Average return, bear market rallies can be quite strong. Meanwhile, the yield on a 2-Year Treasury note reached 4.5% during the month, the highest level since 2007. Central banks across the globe have continued to raise interest rates to tame inflation, but the predominant question for investors remains: how much further is there to go?

The Federal Reserve raised interest rates by 75 basis points at its meeting on November 2, taking the Fed funds rate from 3.00-3.25% to 3.75-4.00%. This was the fourth consecutive hike of 75 basis points, putting the U.S. central bank on its steepest rate hiking path since the early 1980s. These rate hikes have been the primary tool to combat inflation, which remains stickier and more persistent than expected. The latest measure of inflation, measured by the Consumer Price Index, was reported at 8.2%, down from the peak of 9.1%, but still too high for the Federal Reserve to change its course.

Historically, tightening cycles come to an end once the Federal funds rate is above the rate of inflation. With core PCE inflation (the Federal Reserve’s preferred measure of inflation) reported at 5.1%, and the Fed Funds rate at 3.75-4.00%, there are a few more interest rate hikes to go. However, the bond market has priced in a peak rate near 5%, and the most recent Fed policy statement emphasized that the Fed would take “cumulative tightening” and “lags” into account, which seemed to open the door for the possibility of a downshift to a slower pace of rate hikes. However, the timing of that possible downshift, as well as where interest rates will get to when the Fed stops hiking (the terminal rate), remains uncertain.

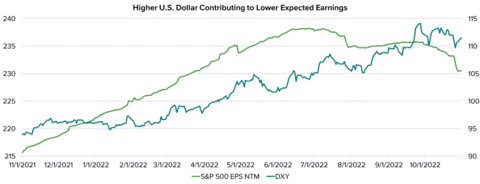

Figure 1. Higher U.S. Dollar Contributing to Lower Expected Earnings

Source: FactSet

With the backdrop of a hawkish Fed and higher interest rates, the U.S. dollar has been strong all year, up 16.6% in 2022. The strong dollar weighed heavily on third quarter earnings, especially for larger, multinational companies. The Financial Times estimated that the strong U.S. dollar could wipe more than $10 billion from corporate earnings. Additionally, Bank of America pointed out that foreign currency translation would negatively impact sales by as much as 3%, the biggest headwind since 2015.

Market Recap

Figure 2. Market Recap, November 2022

Despite these pressures, stocks rallied in October, with the MSCI All-Country World Index up 2.99%. Value stocks have outperformed Growth stocks this year, and this relative outperformance continued in October, as the Russell 1000 Value Index increased 10.25%, compared to the 5.84% increase for the Russell 1000 Growth Index. The Value index carries higher weights within sectors such as Energy, Financials and Industrials, which all had strong returns during the month. U.S. Small Cap stocks also rebounded, up 11.01% in the month. Year-to-date, U.S. Small Cap stocks were down -16.86% but outperformed some of the Large Cap indices. Commodities had given back some of their outperformance in prior months, but the Bloomberg Commodity Index was up 1.99% as crude oil rebounded.

The Fixed Income market was mixed in October, with the U.S. Aggregate Bond Index down -1.30% and Municipals down -0.83%, but TIPS were up 1.24%, and the U.S. High-Yield Corporate Index was up 2.60%. The fixed-income market has struggled with elevated volatility throughout the year. Although many are familiar with the VIX index (a measure of equity market volatility), the MOVE Index, which measures implied volatility of Treasury bonds, reached levels last seen during the pandemic.

Closing Thoughts

Slowing the economy down enough to get inflation back on a path toward 2% is requiring more interest rate hikes for longer than many first anticipated at the beginning of the year. Asset prices across stocks, bonds, real estate and commodity markets are recalibrating to this new economic backdrop where the cost of capital is no longer near zero. When interest rates were excessively low, savers were pushed towards taking greater risks in order to find income or yield. The silver lining of this new backdrop, in which bonds are generating yields over 4%, maybe that savers can dial back on this risk and still earn a solid return going forward.

Equity markets will likely still need to contend with the impact of tighter financial conditions, especially since aggregate demand may slow further in the coming months as this recessionary scenario gets more entrenched into expectations and corporations look to reduce costs through workforce reductions. Despite this expectation, equity markets will recover in time, and these valuation resets could provide opportunities for investors with long time horizons.