For the period October 1 – October 31, 2024.

Executive Summary

Global equity and fixed income markets retreated in October, reflecting the uncertainty of policy implications leading up to the U.S. election. Now knowing the outcome, as we enter a historically strong season for equity markets, we note that seasonality has been even stronger in past election years, which bodes well for investors.

What Piqued Our Interest

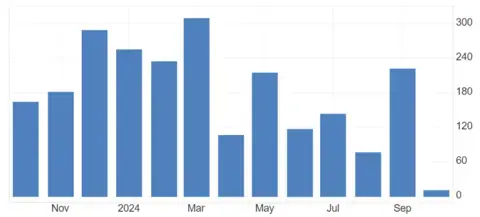

On the heels of a surprisingly positive jobs report in September, the October payrolls report massively undershot expectations and came in essentially flat. In the lowest reading since December 2020, only 12,000 jobs were created, according to the BLS report, as the unemployment rate remained at 4.1% and the participation rate showed little change at 62.6%—and within a relatively tight range for most of the past year. Average hourly earnings growth remained at 4.0% on an annual basis, and the average workweek held steady at 34.3 hours. The weaker-than-expected report all but guaranteed a rate cut at the Fed’s meeting on November 7, as the Fed Funds Rate was lowered to 4.50-4.75%. All signs currently indicate an additional 25-bp cut at the December FOMC meeting, but as always, the trajectory of future rate cuts is data dependent, so it may change in the coming weeks.

Figure 1. United States Nonfarm Payrolls

Source: Trading Economics, Bureau of Labor Statistics

Even as the labor market showed signs of slowing, in aggregate, the U.S. economy continues to show signs of resilience. Third-quarter GDP came in at a healthy 2.8%, and early estimates for Q4 are currently at 2.3%, according to the Atlanta Fed’s GDPNow indicator. Both readings suggest that the “soft landing” scenario, by which the Fed switches from a restrictive to accommodative monetary policy without pushing the economy into a recession, remains to be our base case. Supporting this argument, the Institute for Supply Management’s Services PMI, which surveys non-manufacturing businesses in the U.S., surged to 56 in October—its highest reading since August 2022. Any reading over 50 indicates that the broader services industry is expanding, as 14 of the 16 underlying industries reported higher growth. This expansion continued despite two major hurricanes and a port strike last month, both of which impacted the labor market and the economy in various ways.

Market Recap

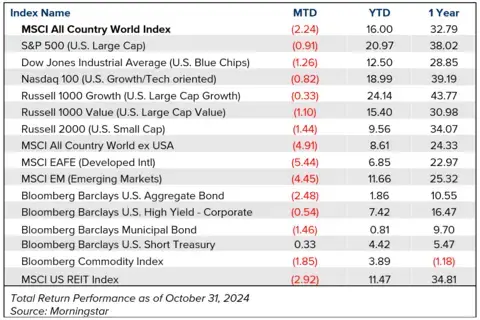

After five consecutive monthly gains, the S&P 500 edged lower in October by a mere 0.91%. Even with the modest decline, the Large Cap index has still gained 20.97% year-to-date (YTD), reaching 47 all-time highs along the way. It has been an extraordinary and historically significant run for the U.S. stock market, especially for Large Cap Growth stocks, which continue to outpace smaller market-cap and value-oriented stocks. The Russell 1000 Growth Index is up 24.14% YTD and up over 84% since its low set in October 2022. Comparatively, the Russell 1000 Value Index is up around 39% since its low in 2022, while the small Cap Russell 2000 Index is up around 36% over the same period. This year, the Russell 2000 has shown bouts of strength but is still up “only” 9.56%—less than half of the Large Cap index.

International stocks mostly struggled in October as the developed MSCI EAFE Index fell -5.44% and now sits at just 6.85% on the year. Some of the weakness can be attributed to the strength of the U.S. dollar as the DXY Index gained around 3.25% last month on Fed expectations and the relative strength of the U.S. economy. Emerging market stocks fared slightly better but still pulled back by -4.45%, much of which was due to Chinese stocks recalibrating after a monster rally in September.

Meanwhile, fixed income markets also pulled back as the yield on 10-year U.S. Treasuries moved from 3.74% to 4.28%. However, because there are still little signs of credit distress, high-yield bonds continue to outperform the broader bond market. The high-yield index fell just 0.54% in October compared to -2.48% for the Bloomberg/Barclays U.S. Aggregate Bond Index.

Closing Thoughts

As we sit roughly three quarters of the way through Q3 earnings season, we have enough data to suggest that corporate earnings growth continues to be solid, even if somewhat weaker than average. Seventy-five percent of stocks so far have surpassed expectations (which is a bit below the average), but earnings are set to grow for the fifth straight quarter. In addition, five of the Magnificent 7 stocks that reported the last week of October had earnings surprises by more than 12.5%. The artificial intelligence (AI) secular growth theme continues to be a significant driver for the largest tech companies and the broader stock universe.

The AI tailwind and the resilience of U.S. consumers have both helped drive the U.S. economy forward, despite the lagged impact of higher interest rates, which, in the past, have caused recessions. One key reason is because both consumers and corporations locked in historically low borrowing costs prior to the rate hiking cycle, immunizing them from the fastest rate hikes in recent history. Another major factor is that even though monetary policy significantly tightened, fiscal policy (government spending) has arguably more than offset its impact.

Looking forward, one thing is clear: We know who the next President will be, and a GOP-led Senate has been confirmed, even as we await the final results for who will control the House of Representatives. Whatever your personal position, investors can be grateful that we now have greater clarity about what to expect from a policy perspective for at least the next two years. Meanwhile, the fourth quarter has traditionally been one of the stronger periods for equity markets—even more so in presidential election years. Research by Goldman Sachs recently mentioned that the median S&P 500 return from October 27 through December 31 is 5.22% since 1928, but that number increases to 6.25% in election years, going all the way back to 1928. While we don’t recommend making investment decisions based upon past results, the combination of favorable seasonality, greater certainty on future policy, and expectations for more rate cuts all contribute to our constructive view on markets going forward.

This information is not intended as a recommendation. The opinions are subject to change at any time and no forecasts can be guaranteed. Investment decisions should always be made based on an investor's specific circumstances.

2024-5706