For the period September 1 – September 30, 2024.

Executive Summary

Despite recent bouts of volatility, equity markets marched higher, ending the third quarter at all-time highs. The Fed began a recalibration of interest rates with a 50-basis point cut, as they see balanced risks to both inflation and employment.

What Piqued Our Interest

In recent months, markets have been paying more attention to the softening labor markets. The monthly non-farm payroll jobs report we get on the first Friday of each month have weighed on markets.

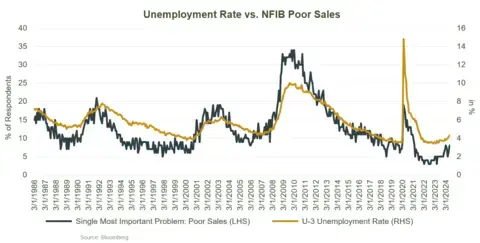

Higher unemployment can be a result of companies laying off workers as their outlook for revenue growth sours. Thus, it is no surprise that the unemployment rate tends to track closely with the percentage of respondents to the National Federation of Independent Businesses (NFIB) small business survey, who state that poor sales are their single most important problem. The NFIB is a nonpartisan, nonprofit organization that represents small and independent businesses in the U.S. With small businesses accounting for over 40% of the U.S. economy, it is another gauge to monitor the health of the underlying economy.

As seen in the graph below, the number of respondents who site poor sales has risen recently but remains slightly below pre-pandemic levels.

Having seen enough progress of moderating inflation, the Fed finally cut interest rates by 50 basis points (0.50%) at their meeting on September 18—a decisive move aimed at bolstering the labor market and sustaining economic growth. This rate cut aligns with a shift in focus back toward the labor side of their dual mandate of price stability and maximum employment. At this stage, upside risks to unemployment appear greater than upside risks to inflation, justifying the Fed’s moves. However, economic growth has remained steadfast, and though the labor market has weakened in recent months, 4.2% unemployment is still relatively low by historical standards.

Market Recap

September is historically one of the worst months of the year for equity markets, and when the month began, it seemed as though we were following the script of historical averages. However, equity markets ended the month in positive territory, with the S&P 500 Index ending the month in positive territory for the first time in five years. On a year-to-date (YTD) basis, we are seeing double-digit returns across all equity markets, with the S&P 500 up 22%, Emerging Markets up nearly 17%, and International Developed markets (MSCI EAFE Index) up 13%. Within the S&P 500, the Utilities sector overtook the Technology sector as the best performing sector on a YTD basis, up 30.6% vs. 30.3% compared to the Technology sector. Across the Pacific, China announced a series of monetary policy measures to support their economy, which has been battered by declines in their real estate market. Within the stimulus package, China announced a 30-basis point cut to their midterm policy rate, a 50-basis point cut to the interest rate on existing mortgages, and a lower down payment requirement on second home purchases, to name a few. Markets cheered these measures, as it reflects a shift in Beijing’s stance on stimulating economic growth, and the MSCI China Index surged over 20% in the last few weeks of the quarter.

In fixed income, yields declined during the quarter, and the Bloomberg U.S. Aggregate Bond Index was up 5.2%, bringing the YTD return to 4.5%. Credit spreads remained tight, and high-yield corporates were up 1.6%, bringing the YTD returns up to 8.0%. Municipal bonds also gained in September by 1.0% and are up 2.3% YTD. Commodities gained nearly 5% in September, also helped by the economic stimulus package announced by China.

Closing Thoughts

After months of anxiously awaiting lower rates, the Fed delivered on rate cuts and looks to be in a position to support the economy, even as labor markets moderate from here. Despite this support, market volatility can rise with new headlines, such as the recent ones out of the Middle East and the escalating conflict with Israel and Iran. Additionally, the dockworkers strike impacting major East Coast ports may reignite inflation concerns. Lastly, the U.S. presidential election draws closer, and investors may stay on the sidelines until after we know the outcome. New uncertainties and concerns arise, but over time, markets have climbed the wall of worry to post new record highs.

This information is not intended as a recommendation. The opinions are subject to change at any time and no forecasts can be guaranteed. Investment decisions should always be made based on an investor's specific circumstances.

2024-5306