The fall season is likely decision time if you’re a full-time employee with benefits. While most people equate open enrollment with health care benefits, this is an excellent time to reassess your overall benefit package in light of your retirement goals and added complexity of your financial situation as you approach retirement. Here are some things you should consider before you make your elections.

Review Your Options as Soon as Details Become Available

Make sure you take the time to review every option available as part of your benefit package and try to do so as soon as details are available. This gives you the maximum time to process and consider your options.

Also, find out if your company uses active or passive enrollment so you know what's required of you as soon as your enrollment window opens. In active registration, you need to select your benefits each year manually. In passive enrollment, the previous year’s choices will roll over automatically—unless you elect to make any changes.

Maximize Contributions to Your Retirement Savings Plans

If your employer offers any type of retirement savings plan, it’s something you’ll want to take advantage of. These plans are certainly popular, but they’re far from ubiquitous. According to data from the Bureau of Labor Statistics, as of March 2023, 67% of private industry workers had access to a defined contribution retirement plan, with 73% of those with access participating in the plan.

Employer-sponsored plans are ideal for a couple of reasons. They can make it easier for people to invest and save for retirement, and if your employer offers matching funds, that’s like getting free money. Additionally, it’s a good idea to reassess your plan contributions each year in case your employer match has changed. And, if possible, you should take advantage of your full employer match—if you’re not doing so already.

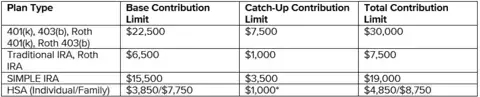

Open enrollment is also an excellent time to consider your long-term financial plan. If you're approaching retirement, it may be time to max out your contribution amounts depending on your account type. In 2023, the maximum amount employees can contribute to 401(k)s is $22,500. Or, if you’re over age 50 and already making the maximum contribution, consider making “catch-up” contributions above and beyond that limit to set aside even more savings for retirement. In 2023, the catch-up contribution limit is another $7,500, bringing the total amount that employees aged 50 and over can contribute to their employer-sponsored 401(k)s to $30,000.

Figure 1. Retirement Plan Contribution Limits, 2023

* Available during the three years before the normal retirement age. Limited to the amount of the base limit not used in previous years.

** Available only to those 55 and older.

Source: Internal Revenue Service

Also, double-check to see if your company has any investment opportunities you might have glossed over as you filled out your paperwork. Take advantage of any that make sense for your situation. For example, your employer may offer a Roth 401(k) option, and you may decide the tax-advantaged status of a Roth account is more appealing to you. And this could also be a good option if your income is too high to contribute directly to a Roth IRA.

Don’t Forget to Rebalance

Beyond your contribution amounts, this is also an excellent chance to look at your asset diversification and rebalance accordingly. If your plan did exceptionally well, you might be over-weighted, and your investments may no longer reflect your risk tolerance. If other investments did well, you might want to increase your tax-deferred account contributions.

Additionally, some plans might perform automatic rebalancing. This means that the plan will rebalance your portfolio on your behalf to achieve the proper balance of stocks and bonds. If you're someone who prefers to be a little more hands-off, this can be a helpful feature.

Consider How Deferred Compensation Plays into Your Plan

As you get closer to retirement, this could be an excellent time to take advantage of a deferred compensation plan—if one is available. Deferred compensation is what it sounds like: An employer will offer you the opportunity to defer a portion of your compensation for several years, putting off taxes on any earnings until you withdraw.

If this is something you are offered, you may have some questions about deferred compensation and its potential benefits. By deferring compensation, you can pay less in income taxes now and have more money later when you need it the most. In the case of many highly compensated employees, their expected income is much higher in the last few years of their careers than in the first few years of retirement. As such, you can expect to be in a lower tax bracket when you retire and the compensation is finally paid out.

Here’s how it works: Say you’re 60, single, you plan to retire at 65, and you make $550,000 per year. Your company allows you to defer up to 20% of your compensation over ten years. If you take the income now, you’ll pay a 37% federal income tax rate on that $550,000 of income for a total tax bill of $203,500. But if you defer until retirement and lower your annual income enough, you could be looking at a 24% tax rate for a total tax bill of $132,000—saving you $71,500 in federal income taxes.

As you enter your highest earning years and start thinking about what you want life to be like after you retire, you might find that you could use those tax savings and extra income to accomplish some of your retirement goals or check a few things off your bucket list.

Assess Your Health Care Needs Heading into Retirement

Your company's human resources department has probably kept you apprised of any substantial changes to your health care plan. But now is an excellent time to take stock of your overall health and consider what coverage you need as you get closer to retirement.

Health Insurance

Until you turn 65 and are eligible for Medicare, you’ll need some kind of medical coverage for yourself and your family. Whether this means electing to participate in your company’s health plan, your spouse’s company’s health plan, or purchase coverage from the insurance marketplace, you’ll need to figure out where your health insurance is coming from.

Additionally, it would help if you understood all the costs associated with your different options and your spouse's options. Does your plan offer dental? What about vision? How does that affect the cost of your plan? Does your spouse's plan provide the same benefits for cheaper? Are there discounts for enrolling in wellness programs, or will your plan reimburse you for a portion of a gym membership? These are all questions you need to ask as you try to find the most comprehensive plan for your situation.

Finally, you’ll need to take children and other beneficiaries into account. Are you expecting? Do you already have children? Depending on the age of your children and any preexisting medical conditions, you may need to scale up your coverage. And remember: You can keep adult children on your health plan until they turn 26.

Flexible Spending Account (FSA)

From there, you may also decide to open an FSA if your employer offers one. An FSA acts like a savings account that lets you set aside money on a pre-tax basis to pay for qualified medical expenses—even many that aren’t covered by health insurance. It’s also a tax-advantaged account, meaning it’s funded with pre-tax dollars taken out of your paycheck, and you can make tax-free withdrawals, if the withdrawals are for qualified medical expenses.

Additionally, however much you decide to contribute to the account for the year is available for you to use immediately, so if you plan, there's no fear of not having enough money in your account. However, since your employer technically owns your FSA, funds can't be rolled over from year to year. If you don't use all the money in your account, you lose it.

Health Savings Account (HSA)

Conversely, HSAs also act like savings accounts for qualified medical expenses, and they’re also tax-advantaged, but they have other benefits that FSAs lack. For one, you own your HSA account, so if you don’t wind up using the money to cover medical expenses for the year, those funds simply roll over to the next year and continue building. And even if you stop funding the account, you still have access to the account and can take out money down the road, so it can work well as an investment vehicle (although, it should be noted that funds in your HSA aren’t automatically invested).

Additionally, HSAs combine the most powerful elements of Traditional and Roth IRAs, meaning you get an immediate tax deduction on contributions. At the same time, any earnings and distributions are tax-free—provided they're used to pay for qualified medical expenses.

Because of this tax treatment, it’s recommended that if you can, you should wait to dig into your HSA until retirement. That way, you allow the funds to grow through compounding interest, which, after 20 or more years, could add tens of thousands of dollars to your account.

However, HSAs tend only to be available with a high deductible health plan (HDHP), so if you anticipate a significant surgery or potential health complications, this might not be the right time to switch.

Health Reimbursement Arrangement (HRA)

Finally, if offered, you may elect to participate in a health reimbursement arrangement (HRA). Where HRAs differ from HSAs and FSAs is instead of you funding an account from your paycheck, you simply pay for qualified medical expenses out of pocket, and then your employer reimburses you up to a predetermined dollar amount. Like HSAs, unused dollar amounts may be rolled over from one year to the next. And like FSAs, your employer funds and owns the arrangement.

Life Insurance

Many employers also offer life insurance as part of their employee benefits package. Life insurance can financially help your loved ones in several ways, and employers often pay for most—if not all—of the premiums, so it can be an excellent benefit for you and your family. However, there are some things to remember if/when you elect to take advantage of your employer-sponsored life insurance.

For starters, it may not provide full coverage, meaning you may not have enough life insurance. Should something happen to you, your employer-sponsored plan could have a few gaps in coverage that may leave your family in the lurch. Additionally, as an employee, you may be the only one covered. Your spouse may need to find their life insurance policy elsewhere. Finally, you will lose your coverage if your job situation changes. For all these reasons, you may consider supplementing your coverage with a personal life insurance policy.

Ensure Your Beneficiary Designations Are up to Date

You may have listed your beneficiaries when you first enrolled in benefits with your company. Beneficiary designations are found on different types of life insurance or retirement accounts like 401(k)s, 403(b)s, IRAs, and more. These designations are filed with whichever financial institution holds your account and dictate who will receive the benefits in the account when you pass away.

The critical thing to remember about beneficiary designations is that they supersede what’s in your will. So, while your will might name Person A as the beneficiary of your 401(k), if Person B is the name listed on the beneficiary designation, Person B will be the one to receive the benefits.

That's why it's important to review your designations on a regular basis because ignoring these designations or making other mistakes can be costly. We recommend reviewing your beneficiary designations at least once a year, and open enrollment gives you the opportunity to ensure your designations are up to date.

Since you first enrolled, have your life circumstances changed? Have you gotten married? Maybe you got divorced. Did you and your spouse have a child in the last year? Or maybe one of your children left home and became a multi-millionaire. This can be the perfect time to see who gets what.

Additionally, consider whether an even allocation distribution makes sense if your children are your beneficiaries. If you have brokerage and/or Roth IRA accounts in addition to your employer-sponsored plan, it might not—unless your kids are in the same tax bracket. That’s because your children won’t get an even amount if they're taxed differently by the IRS. This could lead to disputes and may not be an efficient safeguard for your financial legacy. This all needs to be considered as you review your beneficiary designations.

Review Your Overall Financial Plan and Estate Plan

Finally, open enrollment can be a great time to review your overall financial and estate plans. You should review your financial plan regularly, as your retirement is not a "set it and forget it" deal. Consider your open enrollment period for your annual checkup: Meet with your advisor, address recent life changes, discuss potential planning strategies, and ensure your investments remain aligned with your financial goals.

The same goes for your estate plan. You should review your estate plan regularly if you haven't had significant life changes. Aside from your beneficiary designations, you want to ensure your will is up to date, you have a power of attorney selected, and any possible medical directives and trusts are in order.

While this might seem like a lot to consider every fall, it becomes easier if you get into a habit of doing it annually. Making one or two adjustments to your plan every year is much easier than making significant changes every five years. And, of course, you don't have to do it alone. The advisors at Wealth Enhancement Group can help guide you through your open enrollment period and beyond to ensure you and your loved ones are taken care of.