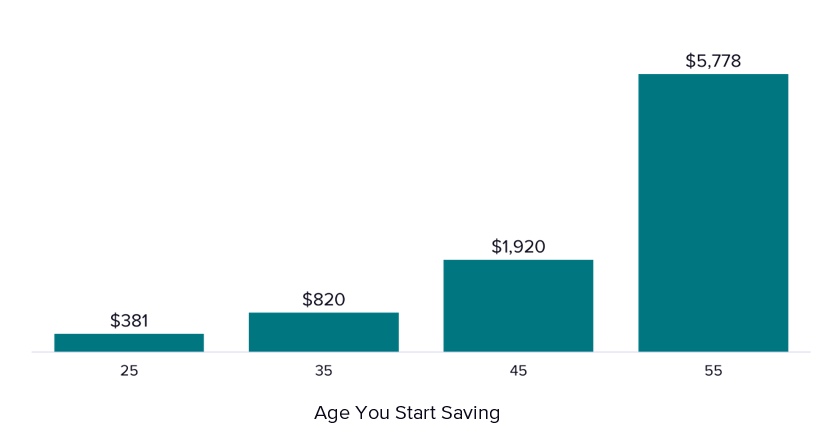

Saving when you’re young can have major benefits for your overall financial plan. As shown in Figure 1 below, starting at age 25, if you save just $381 every month, you’ll reach $1 million by the time you turn 65, assuming a hypothetical 7% compounded rate of return. But the longer you wait to save, the more you need to put away every month to reach that same goal.

Figure 1. Monthly Savings to Reach $1 Million by Age 65

Note: This is a hypothetical example and is not representative of any specific situation. Your results will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing.

The benefits of compound interest are great for those who had the foresight or ability to start in their 20s, but there are many people who simply weren’t able to save consistently when they were younger. How can you begin to catch up if you started saving later in life? Here are a few tips:

1. Find Out How Much You’ll Need in Retirement

The first thing you should do is figure out your retirement goals and dreams. Then, you can run a retirement planning calculator to give you a sense of how much money you’ll need to make those goals a reality. This can also give you a realistic idea of how long you’ll need to work, how much you need to save now, and the level of income to expect when you do reach retirement.

From here, you can also estimate your “retirement paycheck.” While not a traditional paycheck, using this strategy can:

- Analyze current assets

- Forecast potential growth

- Estimate Social Security benefits

- Project future taxes

This will give you a solid estimate of your income in retirement. If you see that it’s less than what you need to pay for the retirement you want, you know that you’ll need to make some changes to your financial plan.

2. Adjust Your Retirement Plan Contributions Accordingly

Once you have a sense of how much money you will need in retirement (and where you anticipate it coming from), work toward maxing out your retirement plans. For 2021, contribution limits to 401(k)s and IRAs are $19,500 and $6,000, respectively. A Traditional IRA can allow you to reduce your taxable income this year by making pre-tax contributions (but you pay taxes when funds are withdrawn), while a Roth IRA is funded with after-tax dollars, and qualified withdrawals of earnings from the account are tax-free.

Additionally, if you’re age 50 or older, the IRS allows you to make what are called catch-up contributions. This is an additional dollar amount that you’re allowed to contribute to your accounts. For a 401(k), you can contribute an extra $6,500, and for either type of IRA, you can contribute an extra $1,000.

Depending on your current level of savings, you may need to be more aggressive with your asset allocation. Typically, portfolios become more risk-averse the closer investors come to retirement. An overly conservative portfolio that is too heavily weighted in bonds may not generate the type of returns you need to reach your financial goals. Working with a financial advisor can help you understand how much risk is appropriate for you to take and build a portfolio tailored to your needs.

3. Determine When to Start Drawing from Social Security

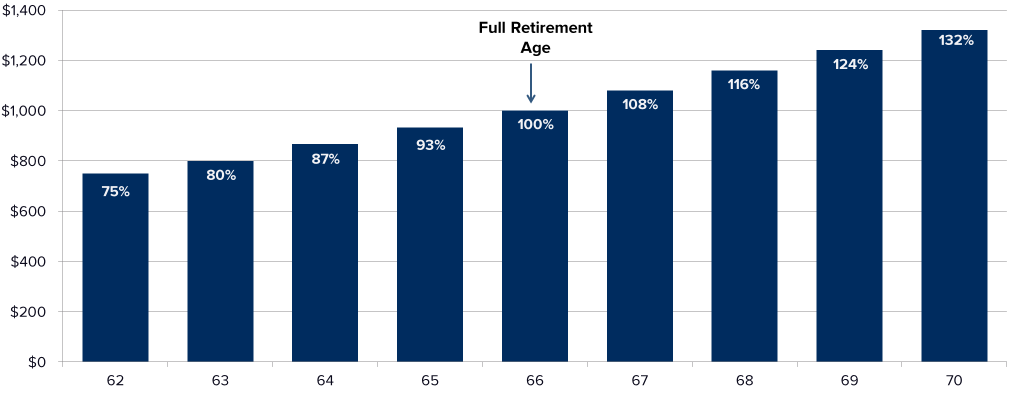

In addition to the money in your retirement accounts, Social Security is likely to be a critical component of your retirement plan. Electing to claim Social Security benefits once you reach full retirement age (FRA) gives you 100% of your potential benefit.

However, as shown in Figure 2 below, by waiting until age 70 to claim Social Security, you can actually receive a permanently increased benefit. Conversely, claiming earlier will yield a permanently reduced benefit, so when you decide to claim is very important.

Figure 2. Early vs. Late Social Security Benefit Election

If you started saving for retirement later in life, the most important thing to remember is that it’s never too late to start–no amount is too small to put away. Depending on your age and when you expect to retire, you may have many years to harness the power of compounding interest, so speak with a financial advisor to find out what you should do to start saving for the retirement of your dreams.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Asset allocation does not ensure a profit or protect against a loss.