For the period August 1 – August 31, 2023

Executive Summary

U.S. equity markets pulled back in August for the first time since February, ending a streak of five straight monthly gains. While we are not quite out of the woods just yet in terms of avoiding a recession, the soft-landing rhetoric continues to pick up steam.

What Piqued Our Interest

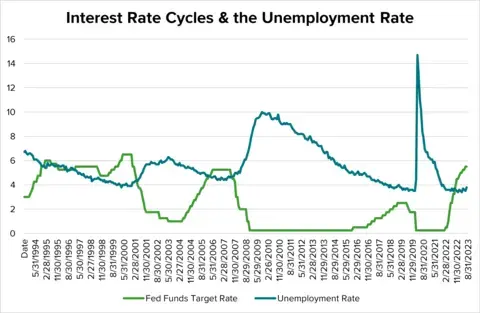

As kids return to classes, we thought it would be a good time to go “back to school” and revisit what we learned from previous rate-hiking cycles. It’s easy to forget that the impact of higher rates often has a pronounced-but-delayed impact, especially as it pertains to the labor market. Higher rates typically impact housing and other interest rate-sensitive sectors first, but it takes many months before employment gets impacted—and often not until the economy actually goes into a recession.

According to research by Piper Sandler, Fed rate hikes tend to lead year-over-year changes in payroll employment by roughly one year, and it takes an average of two years to push the unemployment rate up. Considering it has been roughly 18 months since the recent rate-hiking cycle began, it is still early to confidently assess the impact of higher rates on the job market. So, while there continues to be a growing narrative for a soft landing and calls for a downturn appear to be fading, we caution that it may still be too early to completely write off the possibility of a recession in 2024.

Case in point: The August jobs report released on September 1 clearly indicated that the long-robust labor market is beginning to cool off. As per the Bureau of Labor Statistics (BLS), monthly job gains are trending lower, as 187,000 jobs were added last month, but June and July figures were revised lower to 105,000 and 157,000, respectively. The unemployment rate unexpectedly climbed to 3.8% from 3.5% as more workers have entered the workforce, bringing the participation rate up to 62.3%, a level last seen in February 2020—before the full onset of the pandemic.

The BLS also recently released the Job Opening and Labor Turnover Survey (JOLTS report), which showed a significant decline in job openings in July, down to 8.8 million from 9.1 million in June, which is the lowest level since March of 2021. The consensus estimates were for an increase of nearly 9.5 million, so the report clearly surprised to the downside. Another key observation is the “quit rate,” which is now down to 2.3%—another level not seen since before the pandemic.

Source: FactSet and Bureau of Labor Statistics

Beyond the labor market, concerns about the economy and the longer-term impact of higher interest rates are starting to be felt across “big ticket” consumer sectors. The recent earnings season demonstrated that consumers are starting to pull back on more expensive items such as appliances, furniture, and electronics. Part of this is certainly a post-Covid normalization, but after years of unprecedented demand, it appears that further weakness in these consumer categories could lie ahead. As fiscal stimulus wanes, including the reinforcement of student loan payments, lower income consumers will be most impacted. The automobile sector may also see weakness, not only because of continued higher rates, but also due to the looming strike with the United Auto Workers Union. At some point, a deal will likely be reached, but a work stoppage seems inevitable, and the end result will likely be significant wage hikes, which only exacerbate the Fed’s sticky inflation situation.

Market Recap

Even though the market’s winning streak ended in August, most indices ended the month on a high note. The S&P 500 Index fell roughly 6% from its high in late July, then rebounded over 4% to end the month lower by just 1.59%. Performance was fairly consistent across the major U.S. indices, with the Dow Jones Industrial Average and Nasdaq 100 falling 2.01% and 1.50%, respectively. Small Caps, as measured by the Russell 2000 Index, experienced a deeper selloff and also recovered in the final week, however, they still declined by 5.0% in August. The gap between Growth and Value continued to widen last month, as the Russell 1000 Growth Index is now up 32.17% year-to-date relative to 5.88% for its Value counterpart. International indices fell as well, with the Emerging Markets index tanking 6.16%.

Fixed income continued to fall, as the Bloomberg Barclay’s Aggregate Bond Index has now declined four months in a row and is up just 1.37% this year on a total-return basis. The 10-year Treasury yield reached as high as 4.34% before settling at 4.09% to end the month, up from 3.29% in early April. Short-term Treasuries held their own, climbing 0.45% due to their lower duration and attractive yields north of 5%. High-yield corporate bonds continued their strong year by gaining 0.28% up to 7.13% in 2023. The spread of high-yield over 10-year Treasuries fell to 4.33%, its lowest level since June of 2022 and notably below its 20-year average of about 5%.

Closing Thoughts

As we move into the autumn months, we are often reminded that September is historically one of the worst-performing months for U.S. equities. Fortunately, when the market is already up double digits (like it is now), history trends favorably, and September has been positive more times than not. Not that the past is a valuable forecaster of future returns, but more important is that the market appears to be pricing in peak interest rates and possible cuts in early 2024. For now, the “bad news” of the labor market cooling is good news for stocks, but that sentiment may not last forever. We acknowledge that the U.S. could avoid a recession, but at the same time, we remain cautious of a weaker job market and inflation that still remains above target.