For the period August 1 – August 31, 2024

Executive Summary

After a brief bout of volatility to start the month, equities roared back to finish August near all-time highs, propelling us toward the first rate cut since March 2020. The Fed has signaled their intentions, as their focus has clearly shifted to the labor market, which is showing signs of slowing.

What Piqued Our Interest

While many were on vacation enjoying the final weeks of warm weather and long days, the financial markets went for a ride in August before closing the month near all-time highs. What started as the unwinding of a Japanese Yen carry trade—sparked by an unanticipated hike by the Bank of Japan—soon escalated when a weak July jobs report ignited concerns of a slowdown in the economy. The selloff was described as more technical in nature—that is, escalated by trading factors more so than underlying fundamental weakness. Even so, it was enough to capture the attention of investors that may have grown complacent in recent months.

There have been several other notable August selloffs in years past as volumes lighten up and investment professionals head to the beach: Most recently, in August 2015, the S&P 500 fell over 11% following turbulence in China and a precipitous drop in oil prices. In 2011, there was the infamous S&P U.S. credit downgrade on August 5, which spurred a bear market as the market ultimately fell over 20%. Perhaps most memorable was back in August 1998, when Russia experienced a financial crisis that resulted in a devaluation of their currency and instigated one of the most famous hedge fund failures, Long Term Capital Management. The market went on to lose just over 19% from its previous peak.

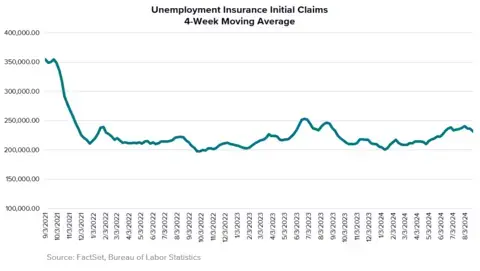

This time around, the market (thankfully) shrugged off the Yen situation and came to the realization that a recession is not imminent, despite weaker-than-expected labor numbers. The July payroll report resulted in an uptick of the unemployment rate to 4.3%, which triggered the “Sahm Rule” that says a recession follows when the three-month average unemployment rate increases 0.5% over its 12-month low. Since then, weekly unemployment claims have improved, suggesting that the labor market is not falling off a cliff—at least not at the moment. And while payrolls from April 2023 through March 2024 were revised lower by 818,000 (the largest decrease since 2009, which raised a few eyebrows), the adjustment resulted in just a -0.5% overall impact to payrolls, and the revision may likely have been overstated.

This all brings us to the Fed. They have been at the forefront of market attention for several years, responsible for the fastest rate-hiking cycle in modern history, and lately, they have been under scrutiny for holding rates too high for too long. The long-awaited first rate cut now seems inevitable at the September meeting, based on Fed Chief Jerome Powell’s statements at the Jackson Hole Economic Symposium last month. Powell didn’t mince words when he declared, “The time has come for policy to adjust,” while acknowledging the unmistakable cooling of the labor market. Recently, the July Job Openings and Labor Turnover Survey (JOLTS) report showed that job openings came in well below expectations and are now at their lowest level since January 2021. Having seen enough evidence that inflation continues to moderate, the Fed has clearly shifted their focus. Indicating that further weakening of the labor market would be problematic for the economy, they will now pivot toward a more dovish policy later this month.

Market Recap

After falling almost 10% from its recent peak, the S&P 500 ended the month of August higher by 2.43% and is now up 19.53% year-to-date (YTD). The Technology-heavy Nasdaq 100 Index fell over 15% from its peak in July but finished the month up 1.18% and slightly trailing the S&P 500 YTD. The Large Cap Value Index fared slightly better than Growth, helped by stronger performance from defensive sectors such as Consumer Staples (+5.94%), Health Care (+5.1%), and Utilities (+4.86%).

Losing sectors in August included Energy (-1.7%) and Consumer Discretionary (-0.97%), with the latter being the worst sector in the S&P 500 this year by a fairly wide margin. Developed International performed better than Emerging Markets, as the MSCI EAFE Index gained 3.25% vs 1.61% for EM. Lastly, the U.S. Aggregate Bond Index had a strong month at +1.44%, outperforming short-term Treasuries but slightly lagging the high-yield index.

Closing Thoughts

The S&P 500 has already produced over three dozen new record highs this year, which has left many U.S. investors optimistic about future market prospects. With rate cuts coming soon, bonds are also looking more attractive, and interest rate-sensitive stocks are already back in favor. Inflation appears to be under control, while lower rates will be well received by small businesses and homebuyers. The single greatest factor that could derail this string of optimism is a rapid deterioration of the labor market, long referred to as the dreaded “hard landing.”

Overall, the market appears to be pricing in continued moderate growth, but caution is growing more prevalent by the day. Election uncertainty is now upon us, and significant policy swings could alter the economic landscape in just a few months. We are also now in September, which has been historically one of the worst months for equities. J.P. Morgan recently noted that this century, the market has averaged -1.7% during September and has been even worse over the past five years (-4.2%). It seems entirely plausible that volatility could elevate in the weeks leading up to the November 5 election, but that doesn’t mean investors should be worried. A plethora of historical data suggests that markets can perform well no matter who wins the presidential election, and in the end, policies matter a lot more than politics. Our focus will remain on the fundamental strength of the economy and the market as we look for opportunities from policy changes to help improve our clients’ long-term financial plans.

This information is not intended as a recommendation. The opinions are subject to change at any time and no forecasts can be guaranteed. Investment decisions should always be made based on an investor's specific circumstances.

2024-5004