Planning for retirement is crucial for your financial well-being, whether you’re an employee, consultant, or business owner. As your career evolves and you start preparing for retirement, you’ll need to consider which type of retirement account is right for you.

SIMPLE IRAs (Savings Incentive Match Plan for Employees Individual Retirement Accounts) and 401(k) plans are two of the most popular options for saving for retirement amongst a sea of retirement plan types. Both provide tax advantages and are designed to help employees save for the future, but they, like all other types of retirement plans, cater to different needs and situations.

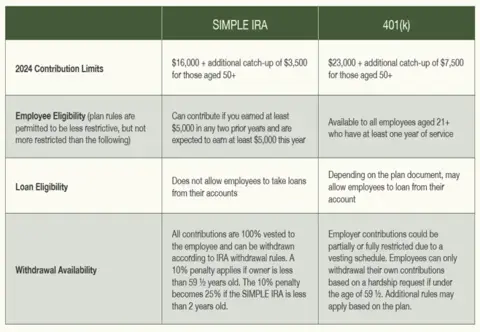

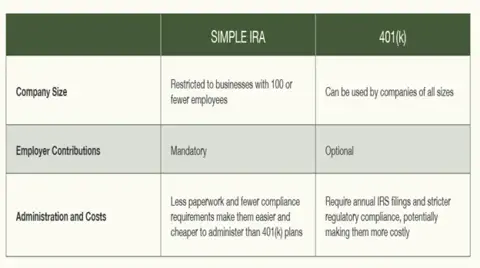

When comparing the two, there are key differences between SIMPLE IRAs and 401(k)s that both employees and employers should consider.

What is a 401(k) Plan and How Does it Work?

A 401(k) is an employer-sponsored retirement savings plan that allows employees to contribute a portion of their salary on a pre-tax, Roth (if your plan has a designated Roth account), and/or after-tax basis. Here’s how they work: employees can contribute a percentage of their earnings into their 401(k) account. If the contributions are made on a pre-tax basis, they reduce an employee’s taxable income (and potentially the taxes they owe) for the years in which they contribute. Contributions also grow tax-deferred until retirement, at which point withdrawals are taxed as ordinary income. This allows employees to defer taxes until retirement, when they are more likely to be in a lower tax bracket.

Alternatively, some plans offer a Roth 401(k) option, which allows for after-tax contributions and tax-free withdrawals in retirement. Though Roth contributions do not provide an immediate tax benefit, the growth accumulated on the contributions through the years is tax-free in retirement, making the Roth 401(k) option a powerful tool for younger individuals with longer time horizons.

One of the major benefits of a 401(k) is the potential for employer matching contributions. This feature sees employers essentially adding free money to employee 401(k) accounts to match either all or a certain percentage of their employees’ investments, boosting their retirement savings. However, it is not a requirement that an employer contribute to a 401(k) plan and employer contribution percentages can vary greatly plan to plan.

Vesting schedules are also often associated with employer contributions on 401(k) plans. A vesting schedule restricts all or a portion of the employer’s contributions until the employee fulfills a specific tenure in the company. It is key to remember that employee’s contributions are always fully vested.

Connect with a Wealth Enhancement advisor today to understand which retirement plan might be right for your business.

What is a SIMPLE IRA and How Does it Work?

A SIMPLE IRA is a type of retirement savings plan designed for businesses with 100 or fewer employees. Traditionally, contributions to a SIMPLE IRA are made on a pre-tax basis and become taxable on withdrawal. However, though not widely in use yet, the Secure Act 2.0 created the Roth SIMPLE IRA allowing employee Roth contributions to a SIMPLE plan and subsequent tax-free withdrawals in retirement.

Unlike a 401(k), employers are required to make contributions to their employees’ SIMPLE IRA accounts. This can be done in one of two ways: either by matching employee contributions up to 3% of the employee’s salary, or by making a non-elective fixed contribution of 2% of the employee’s salary, regardless of whether the employee contributes. Employer contributions are also immediately vested to the employee.

SIMPLE IRA vs. 401(k) Plans: Understanding the Differences

SIMPLE IRA and 401(k) plans share some commonalities, such as the ability to make tax-deductible or Roth contributions, defer taxes on earnings, and benefit from employer matching. However, to determine which plan meets your needs, it’s important to understand their key differences.

These differences can be grouped into two categories: those affecting employees and those affecting employers.

Which Plan is Better for You?

Deciding between a SIMPLE IRA and 401(k) requires careful consideration of each plan’s pros and cons. While both plans are designed to help you save for retirement, their differences can impact your decision.

SIMPLE IRA: Pros and Cons

The SIMPLE IRA is a straightforward, cost-effective retirement plan that caters specifically to small businesses. One of its most appealing aspects is its simplicity—there’s a reason “simple” in is the name. That’s why this plan tends to be popular among small business owners who want to provide their employees with retirement savings opportunities without getting bogged down by complex administrative tasks.

One of the main advantages of a SIMPLE IRA is that it’s easy to set up and maintain. The paperwork is minimal, and there are fewer compliance obligations compared to a 401(k). For businesses that lack the resources to handle extensive administrative duties, this can be a major plus. Additionally, the costs associated with maintaining a SIMPLE IRA are typically lower, which is attractive for businesses that want to minimize expenses.

That said, SIMPLE IRAs come with certain limitations. For starters, contribution limits are significantly lower than those of 401(k) plans, which may not provide enough room for high earners or those who want to maximize their retirement savings in a short time. Furthermore, employer contributions are mandatory. While this tends to benefit employees, it may pose a financial strain on smaller businesses, particularly those with fluctuating cash flows. In particularly difficult business years, an employer can lower their contribution from 3% down to 1%, as long as it does not occur more than 2 out of 5 rolling years.

401(k): Pros and Cons

The 401(k), on the other hand, is often seen as the gold standard of retirement plans, offering robust benefits that can be tailored to the needs of both employers and employees. With higher contribution limits, employees can put aside more funds for retirement more quickly.

401(k) plans also offer greater flexibility when it comes to employer contributions. This allows companies to tailor their contribution strategy based on their financial health and strategic goals. This flexibility can be advantageous for companies that experience variable earnings through the year, as they can adjust their contributions accordingly. Employers can also go above and beyond with 401(k) plans by offering customized profit sharing for employees.

However, the enhanced benefits of a 401(k) come with added complexity and costs. Small business owners may find these administrative responsibilities burdensome, especially if they lack dedicated HR or financial staff.

The Bottom Line

Deciding between a SIMPLE IRA and 401(k) depends on your vantage point—whether you’re an employee seeking to maximize retirement savings or a business owner balancing cost, administrative ease, and employee benefits.

For smaller businesses with limited resources, a SIMPLE IRA is often the more practical choice. On the other hand, if your business is growing or if you’re looking for a retirement plan that offers greater savings potential and flexibility in contributions, a 401(k) may be the better route. Exploring these two types of retirement plans may be only the start to finding the right type of plan for your business.

Ultimately, the decision comes down to weighing simplicity against flexibility, cost against potential savings, and mandatory versus optional contributions. Assess your business’s current financial position, consider the long-term benefits for your employees, and think about how each plan aligns with your strategic goals. By doing so, you can choose the retirement plan that not only meets your current needs.

If you’d like to explore your retirement planning options, or learn more about which retirement plan might be right for your business, speak to a Wealth Enhancement advisor today.

Advisory services offered through Wealth Enhancement Advisory Services, LLC, a registered investment advisor and affiliate of Wealth Enhancement Group®. Wealth Enhancement Group is a registered trademark of Wealth Enhancement Group, LLC.

#2024-5390