There’s a lot to like about Roth IRAs. After all, who wouldn’t like the chance to have the money in your account grow tax-free? However, most retirement assets are held in tax-deferred accounts like Traditional IRAs. So, to take advantage of the potential tax-free growth that Roth IRAs offer, you need to get your money into a Roth IRA. And since there are limits to how much you can contribute to a Roth IRA, that can be easier said than done.

That’s where Roth conversions come in—and where financial planning services and experienced wealth planners can make all the difference. A well-structured Roth conversion strategy can help you manage required minimum distributions and ultimately preserve more of your retirement income.

While the tax-free earnings of a Roth IRA are well-known, the tax implications of a Roth conversion may not be. So, before converting all your funds into a Roth IRA, make sure you know what's involved.

But first, let’s quickly go over the two main types of IRAs: Traditional and Roth.

Roth IRA vs. Traditional IRA

Traditional IRAs are “tax-deferred” accounts, meaning they’re funded with pre-tax dollars. The taxes are paid at ordinary income rates when money is distributed, provided they are qualified (withdrawals before age 59 ½ may result in a 10% IRS penalty tax). Owners of Traditional IRAs must also take required minimum distributions (RMDs) at age 72.

Meanwhile, Roth IRAs are “tax-advantaged” accounts, meaning they’re funded with money already being taxed, so no tax is due when money is distributed. Additionally, there are no RMDs with Roth IRAs, which means you can withdraw them when it makes sense.

Roth IRA Contribution Limits

While a Roth IRA might initially seem like the better type of retirement account, there are, unfortunately, some rules that restrict how much you can contribute. In 2022, if you’re under age 50, you can only contribute up to $6,000 to a Roth IRA for the entire year. If you’re over 50, you can contribute an extra $1,000 in catch-up contributions.

Even then, the amount you can contribute is dependent on your income. If you’re single, your modified adjusted gross income (MAGI) must be less than $129,000, or if you’re married and file taxes jointly, your income must be less than $204,000. Contribution amounts begin phasing out as your income exceeds those limits. You can't put any money into a Roth IRA once your income reaches $144,000 as a single tax filer or $214,000 if you’re married and filing jointly.

What Is a Roth Conversion?

A Roth conversion is when you take money from your Traditional IRA, pay the total tax due—but without penalties—and move it into a Roth IRA. Doing this enables the money to grow tax-free, as long as specific requirements are met.

Take the first step towards financial security. Click here to schedule your free consultation with our experienced advisors.

What Is a Backdoor Roth IRA?

Additionally, performing Roth conversions allows you to work around those previously mentioned contribution limits—doing so is called a “backdoor Roth IRA.” While there are limits to how much you can contribute directly into a Roth IRA, there are no limits to how much you can convert. So, if you’re looking to contribute more than $6,000 into a Roth IRA in 2022, or if your income exceeds the contribution limit, you can still fund a Traditional IRA and perform a Roth conversion.

Paying Tax on a Roth Conversion

When you make a Roth conversion, you will pay taxes on that money. Additionally, this conversion is taxed at your ordinary income tax rate rather than the more tax-friendly long-term capital gains rate.

A Roth conversion can help you by allowing you to pay taxes when you're potentially in a lower bracket due to lower income. Because you won't need to take required minimum distributions (RMDs) and are unlikely to withdraw Social Security benefits as soon as you retire, your income will likely go down in those first few years. Once you start taking RMDs, you may jump into a higher tax bracket, meaning you'll pay more taxes on the income you may not even need.

When you start taking those RMDs, you can avoid paying a higher tax bill in the earlier years of retirement by paying taxes on your Roth conversion. Converting those funds to a Roth IRA can significantly reduce your RMDs from Traditional IRAs, allowing you to take what you need and stay in that lower tax bracket longer.

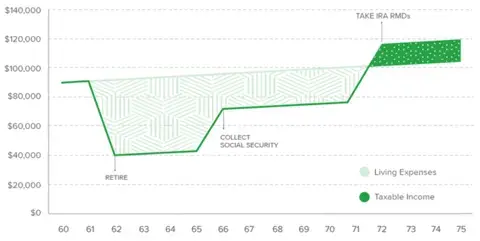

Figure 1. Retirement Spending Needs & Taxable Income

Figure 1 illustrates how your income changes relative to your spending needs throughout retirement and how Roth conversions can help lower your taxable income. The above hypothetical example considers a single retiree named Jane. Before retirement, Jane’s income is $90,000 per year, which, in 2022, puts her in the 24% income tax bracket. Jane plans to retire at age 62 when her taxable income drops to $40,000. Assuming income tax rates don’t change, this drop in income takes her down to the 12% tax bracket.

At age 66, when Jane files for Social Security, her taxable income rises to $70,000, pushing her up into the 22% tax bracket. At age 72, RMDs kick in, which causes her taxable income to jump well over $100,000—exceeding her actual living expenses and pushing her into the 24% tax bracket. This is where she gets taxed more on the money she doesn't even need. But between age 62 and 72, Jane has a window to perform Roth conversions that accelerate income into years where lower tax rates are possible.

Be Careful Your Back Door Roth Doesn’t Backfire

If you’re not careful, it’s possible that the Roth conversion itself actually pushes you into a higher tax bracket. Let’s look at how this might play out and how you can avoid such a scenario:

Susan is retired and single and reports $110,000 of income in 2022, placing her in the 24% tax bracket. She decides to convert $75,000 from her Traditional IRA to a Roth IRA. However, that extra $75,000 of taxable income pushes her to the 32% bracket. More precisely, the first $60,050 of the conversion is taxed at 24%, and the remaining $14,950—the amount that pushes her into the 32% bracket—is taxed at 32%.

The goal is to use Roth conversions to “fill up” your tax bracket while avoiding crossing the threshold into the next frame. So, a better option may be to spread the conversion out over several years rather than doing the entire conversion at once. Assuming tax rates remain the same, if Susan converts $25,000 each year for three years, she will stay in the 24% tax bracket and save more than $1,100 in taxes.

Is a Roth Conversion Right for Me?

The complexity of a Roth conversion should not be understated. Understanding your current tax situation and how the conversion will affect it are important factors to consider when making a Roth conversion. Consulting a tax expert or financial advisor may make this process easier and help you limit the tax burden on your conversion.

#2025-8589