In This Article:

- What is a 401(k) Plan?

- What is a 403(b) Account?

- What is an Individual Retirement Account (IRA)?

- What is a SIMPLE IRA?

- What is a Simplified Employee Pension (SEP)?

- What is a Health Savings Account (HSA)?

- What’s the Biggest Difference Between Traditional Retirement Accounts and Roth Retirement Accounts?

- What Contribution Limits Apply for Each Retirement Plan?

- What are the Pros and Cons of Each Type of Retirement Account?

- Which Account is Right for You?

- Frequently Asked Questions

Contributing regularly to a retirement plan can be the key that unlocks your future financial freedom, regardless of your stage of life. Yet, there’s a world of difference between recognizing the need to save for retirement and understanding which retirement account is right for you.

To help, this comprehensive guide explores different retirement account options, including 401(k) plans, 403(b) accounts, Individual Retirement Accounts (IRAs), Roth accounts, SIMPLE IRAs, Simplified Employee Pension (SEP) accounts, and Health Savings Accounts (HSAs). By reviewing the features of these plans, their contribution limits, and their similarities and differences, you can begin to make more informed decisions about your retirement savings.

What Is a 401(k) Plan?

A 401(k) is an employer-sponsored retirement savings plan that allows employees to contribute a portion of their salary on a pre-tax basis. With an employer-sponsored plan, your employer will make certain types of investments available to you—such as stocks, bonds, and mutual funds—and you can choose from the available investment options. In many cases, employers also offer matching contributions to a 401(k), meaning they’ll essentially add free money to your account when you contribute, increasing your ability to save.

Contributions to a 401(k) are tax deductible, so your taxable income (and potentially the taxes you owe) will be reduced in the years in which you contribute. Contributions also grow tax-deferred until retirement, at which point withdrawals are taxed as ordinary income. This allows you to defer taxes until retirement, when you are more likely to be in a lower tax bracket. That said, if you want to withdraw funds before age 59 ½, an early withdrawal penalty will apply. You must also begin taking required minimum distributions (RMDs) from these accounts by age 73 if you were born before 1960, and if you were born in 1960 or later, RMDs begin at age 75.

Check your retirement readiness with our Retirement Income Calculator

What Is a 403(b) Account?

A 403(b) account, also known as a Tax-Sheltered Annuity (TSA) plan, is an employer-sponsored retirement savings plan available to employees of public schools and tax-exempt organizations. Like a 401(k), contributions to a 403(b) account are made on a pre-tax basis, and earnings grow tax-deferred until retirement. Contributions to a 403(b) account are tax deductible as well, reducing your current taxable income in the years in which you contribute.

Like 401(k) plans, 403(b) plans charge a penalty for withdrawals before age 59½ and require you to begin making minimum withdrawals by age 73.

What Are Roth Accounts?

A Roth account describes the way in which your retirement account is taxed. As we’ve already covered, 401(k)s and 403(b)s are comprised of pre-tax contributions with earnings growing tax-deferred until you withdraw from the account, at which point your distributions are taxed as regular income. Roth accounts are instead comprised of after-tax dollars, meaning your contributions are taxed, but your earnings grow tax-free, and you do not pay taxes on your withdrawals, provided certain conditions are met.

Some employers will enable you to enroll in a Roth 401(k) or Roth 403(b) plan, so if you’re offered one of these types of plans, it’s important to understand how its tax treatment will affect your broader financial goals.

What Is an Individual Retirement Account (IRA)?

An IRA is a personal retirement savings account available to individuals, including those without access to employer-sponsored plans. There are two main types of IRAs:

- Traditional IRAs allow you to make contributions on a pre-tax basis, with taxes on earnings deferred until retirement. Like similar accounts, RMDs from a Traditional IRA must begin by age 73, unless you were born in 1960 or later, at which point RMDs begin at age 75.

- Roth IRAs allow you to make contributions with after-tax dollars—meaning you’ll receive no tax deduction in the years in which you contribute. On the plus side, qualified withdrawals from a Roth IRA, including earnings, are entirely tax-free. Additionally, Roth IRAs have no RMDs during the account holder’s lifetime.

Notably, while Roth IRAs are often used by people who don’t have access to employer-sponsored plans, some companies have begun to offer Roth versions of their employer-sponsored 401(k) and 403(b) plans.

What Is a SIMPLE IRA?

While 401(k) and 403(b) plans are popular employer-sponsored retirement accounts, they can be costly for employers to set up and maintain. Fortunately, more affordable plans exist for small business owners and self-employed individuals. One of those options is the Savings Incentive Match Plan for Employees (SIMPLE) IRA.

Like the larger employer-sponsored retirement accounts, contributions to a SIMPLE IRA are made on a pre-tax basis and become taxable on withdrawal. Early withdrawals (before age 59 ½) are subject to a 10% additional tax and any withdrawals within the first two years are subject to a 25% additional tax. Another defining feature of SIMPLE IRAs is that employers are required to make either matching or fixed contributions to the plan.

What Is a Simplified Employee Pension (SEP)?

A SEP is another type of IRA designed for small business owners and self-employed individuals. Because they allow for relatively large annual contributions, and allow contributions to vary from year to year, SEPs tend to be attractive for businesses with variable income. On the flip side, SEPs are entirely employer funded, meaning employees cannot contribute to these plans on their own. Withdrawals from a SEP are also limited, with funds generally locked in until retirement. Like Traditional IRAs, RMDs apply after age 73 for those born before 1960 or age 75 for those born 1960 or later.

What Is a Health Savings Account (HSA)?

A Health Savings Account is a plan specifically designed to help you put money aside for medical expenses. Similar to traditional retirement accounts, contributions to HSAs are made on a pre-tax basis with earnings growing tax-free. Unlike traditional plans, though, money saved in an HSA can be withdrawn tax-free if it is used for qualified medical expenses—although withdrawals for non-qualified expenses are subject to a 20% penalty.

After age 65, however, money withdrawn from an HSA for non-medical expenses is subject only to regular income tax. Thanks to this feature, some people use HSAs as retirement accounts to supplement their 401(k) or IRA accounts.

It’s worth noting, too, that not everyone is eligible to set up an HSA. To be eligible, you need to be enrolled in a high-deductible health plan (HDHP) with no other health coverage (including Medicare).

What’s the Biggest Difference Between Traditional Retirement Accounts and Roth Retirement Accounts?

The most significant difference between these accounts is in how they treat taxes.

With traditional retirement accounts—such as 401(k) plans, 403(b) plans, traditional IRAs, and both SIMPLE and SEP IRAs—contributions are made on a pre-tax basis, reducing your current taxable income. However, you will pay taxes on withdrawals during retirement and must begin making minimum withdrawals by age 73.

Conversely, with Roth accounts—such as Roth 401(k) plans, Roth 403(b) plans, and Roth IRAs—contributions are made using after-tax dollars, so you’re essentially paying tax upfront. This allows you to make qualified withdrawals on a tax-free basis. In fact, even your earnings can be withdrawn tax-free and, with no RMDs, your money can continue to grow tax-free for as long as you like.

Choosing between traditional and Roth accounts depends on your current tax situation and your expected tax bracket in retirement.

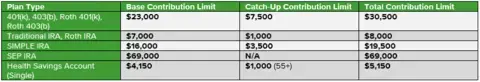

What Contribution Limits Apply for Each Retirement Plan?

Understanding the contribution limits for each retirement plan is crucial when planning your retirement savings strategy. For many retirement accounts, contribution limits change on an annual basis. Several of the accounts also allow people over the age of 50 to make catch-up contributions if they did not maximize previous year contributions, so they can accelerate their savings as they approach retirement.

For 2024, retirement account contribution limits are as follows:

Source: www.irs.gov

What Are the Pros and Cons of Each Type of Retirement Account?

In choosing the best way to save for retirement, it’s important to understand the advantages and disadvantages associated with different types of retirement plans. At a high level, here are some things to consider:

Which Account Is Right for You?

Choosing the right retirement account depends on your individual circumstances, including your current financial situation, long-term goals, and employment status. If you are looking for general guidelines, however, here are a few things to consider:

- 401(k) or 403(b): If your employer offers a matching contribution, it generally makes sense to take advantage of that free money. Consider these accounts if you have access to them.

- Traditional IRA: A Traditional IRA may be a good option if you’re looking for tax deductions and have no access to an employer-sponsored plan.

- Roth IRA: A Roth IRA may make sense for you during lower income years, if you anticipate being in a higher tax bracket during retirement, or if you want tax-free withdrawals. Keep in mind, however, that higher-income earners may not be eligible to contribute to a Roth IRA.

- SIMPLE IRA: These plans operate in many ways like a 401(k) or 403(b) plan, but they are only offered by smaller employers in an effort to encourage more businesses to provide retirement plans to their employees.

- SEP IRA: If you’re self-employed or a small business owner and want to make substantial contributions, a SEP IRA could be an excellent choice.

- HSA: If you have a high-deductible insurance plan and are looking for a way to either save for future medical expenses or defer withdrawals until after age 65, an HSA offers several tax advantages worth exploring.

Ultimately, however, the best retirement account for you will depend on your unique financial situation and goals. If you’re looking to create a solid retirement savings strategy that aligns to your individual circumstances, reach out to your financial advisor who can help tailor your retirement plan to your needs.

Check your retirement readiness with our Retirement Income Calculator

Frequently Asked Questions

Can I have both a traditional and Roth IRA? Yes, you can, as long as you don’t exceed the annual IRA contribution limit. For 2024, that combined limit is $7,000 (or $8,000 if you are over age 50). To strike the right investment balance between these two plans, it’s important to take your current and future anticipated tax situations into account.

What happens if I exceed the contribution limits for my retirement account? Exceeding contribution limits may result in penalties. For instance, excess contributions to an IRA will result in a penalty of 6% of the excess amount contributed for each year that amount remains in your account—so it’s important to keep track of annual contribution limits as they evolve.

Are there age restrictions for contributing to a 401(k)? You are allowed to contribute to a 401(k) as long as you remain employed and are receiving income. However, once you reach the age of 73, you must begin to take required minimum distributions. Failing to do so could result in substantial penalties.

Can I withdraw money from my retirement account before retirement age? While it is possible to withdraw money before you reach retirement, doing so can trigger early withdrawal penalties. For instance, withdrawals made from an IRA before age 59 ½ can result in a 10% penalty, in addition to regular income tax owed on the withdrawn amount. Penalty-free withdrawals may be allowed for certain exceptions, such as qualified medical expenses or first-time homebuyer expenses, but it’s important to understand the rules—and the long-term investment consequences—before withdrawing money early. Additionally, one unique feature of Roth IRAs is that contributions (but not earnings) can be withdrawn at any time, at any age, without taxes or penalties.

How often should I review and adjust my retirement plan? To make sure your retirement plan remains aligned with your evolving financial goals, it makes sense to review it on a regular basis. This is particularly important following major life events, such as marriage, childbirth, career changes, or economic shifts. Additionally, reviewing your retirement plan annually allows you to assess your progress, rebalance your portfolio, and make any necessary updates to ensure your plan continues to meet your needs and objectives.

This information is not intended to be a substitute for individualized legal advice. Please consult your legal advisor regarding your specific situation.