One of the most important challenges facing today's business owners is how to plan strategically for both the daily demands of running a business and its long-term success.

In times of rapid change, owners must navigate current economic uncertainties while laying the groundwork for a prosperous future–for yourself, your business, and your family.

Growing a successful business can be exciting and energizing, but that sometimes causes owners to overlook what happens at their career's curtain call. Business owners are often laser-focused on growth and only consider how to manage the sale or transition of their business near the end of their careers.

In fact, research shows that the importance of an exit strategy often goes unrealized until an exit is imminent. This oversight can have dire consequences for the future.

Fortunately, business owners don’t have to face the challenges of crafting an exit plan by themselves. Today, it is relatively easy to assemble a team of specialists led by a financial advisor who is certified in both financial planning and exit planning.

In fact, many financial advisors are becoming Certified Exit Planning Advisors (CEPA) as well and specialize in the formation and operation of exit planning teams. The CEPA designation is the most popular exit-planning credential, with more than accredited 3,000 CEPAs in today’s marketplace.

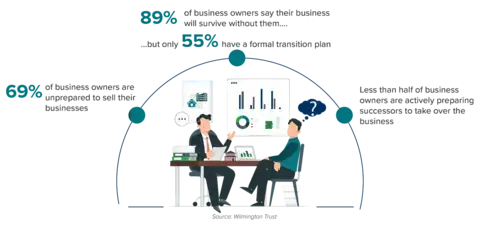

Business Owners Aren't Focusing on Their Exit Strategies

While an unwavering focus on business growth can drive success, it can also take its toll on the lifetime value of your business. With a clear exit strategy in place, whether it's transferring the business or selling it, owners can be better prepared, and less stressed, when the time comes.

Having an exit plan in place early in the lifecycle of the business can help to optimize its overall value. Not having a plan in place means owners can find themselves in suboptimal situations if economic conditions suddenly take a downturn at an inopportune time.

The Current State of Exit Planning

Craft Your Plan with a CEPA

Although research broadly shows that many business owners are unprepared, it’s not difficult to get started. Working with a Certified Exit Planning Advisor (CEPA) can help answer some of the most important questions of your career as a business owner.

What Is a CEPA?

According to the Exit Planning Institute, a CEPA is a holistic advisor who helps business owners align diverse goals while building transferrable value in their company. This way, owners can always be prepared to capitalize on the transition of their company, whether the timing of that transition is planned or unplanned.

Should You Consult a CEPA?

Owning a business without the advice of a certified exit planning advisor is like scaling a mountain without a Sherpa. You might be able to make it up and down on your own, but wouldn't you prefer an experienced guide? When you're equipped with the right tools, knowledge, and strategy, your business can reach the pinnacle of its potential value when it's finally time to exit.

How Can a CEPA Help?

One of the primary goals of a CEPA is to help business owners maximize their business's value under a variety of different circumstances. While maximizing the dollars and cents is essential, the benefits go beyond the financials.

- Succession planning: If you wish for someone to take over your business when you retire, you'll need to start planning for it. CEPAs help you start this structured process early so that your potential successors can be prepared to cultivate the business's long-term success.

- Contingency planning: Former President Dwight Eisenhower said, "Plans are useless but planning is indispensable." While we intend our exit planning contingencies to be as directly usable as possible, the practice of regularly thinking about your potential exits is where the money is made.

- Emotional aspects: Exiting a business that you've nurtured from its inception can be emotionally difficult. CEPAs understand the challenges that come with this journey and help to streamline the transition to address financial and emotional aspects.

- Working with the RoundtableTM: At Wealth Enhancement Group, we understand that running a business isn't a simple task. Your finances exist in a complex web of interconnected structures with diverse priorities. That's why we approach your plan with specialists who apply their highly skilled perspectives to every angle of your financial life.

Putting a CEPA to Work for You

Successful exits don’t happen by chance. They're typically the result of careful planning, informed decision-making, and strategic timing. Because the exit planning process encompasses legal, financial, and organizational aspects, it is best executed by a team of specialists over several years. At Wealth Enhancement Group, our advisors work with a team of financial specialists for each facet of your exit planning.

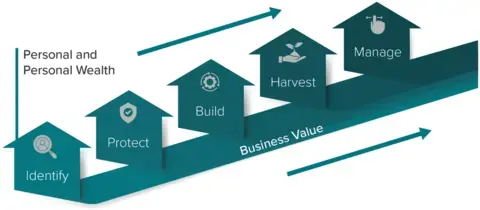

The CEPAs at Wealth Enhancement understand the intricacies and nuances of exit planning and follow a proven methodology called "The Five Stages of Value Maturity” to align your personal wealth and business value to optimize both.

The value of using the Five Stages includes:

- Identifying the necessary steps to grow your business for maximum value

- Providing an assessment (known as a Value Maturity Index) to track your success

- Protecting your company’s short- and long-term value through de-risking

- Moving from quarterly and annual success metrics to lifetime value

- Understanding your options when you step away from running your business

- Balancing your personal and business wealth to optimize both

- Preparing your company to be as attractive as possible for sale or transfer

Content Courtesy of Exit Planning Institute

Every business is unique, and the complexities of ownership can play out in very different ways depending on how prepared your business is for your eventual exit. That's why we design your exit plans to be tailored specifically to you, your priorities, and your desired outcomes. Whether you are 25 years, or 25 months from a potential exit, it makes sense to understand your business value and plan to make the most of it.

Ready to embark on your journey toward long-term financial success, and optimize the value of your business and personal wealth? Reach out today and schedule a free, no-obligation meeting with one of our experienced advisors.