We all want our freedom. Many people in their working years are focused on financial freedom: the freedom to buy the things or experiences they desire, the freedom to travel in the style they have become accustom to, the freedom to pay for their child’s college education, or the freedom to purchase a vacation home.

The assumption is that freedom and money rise and fall together; more money means greater freedom, while less money means less freedom.

The challenge with this paradigm is that it frames freedom in a one-dimensional manner. The truth is that freedom has two factors: time and money. It is not only about our freedom to spend our money how we choose, but also about our freedom to spend our time as we see fit.

Varying Degrees of Financial and Time Freedom

Some people have an abundance of both kinds of freedom. They have all the money they need to purchase what they want, and they wake up each day with the freedom to do what they want. Sometimes these folks are retired, and they enjoy spending time with family and friends doing activities they enjoy. Others are still working, but their work is closely tied to their purpose and passion. They may have daily obligations, but those obligations are exactly what they want to be doing.

Many others are not so fortunate. They might have high-paying jobs that allow them to live the lifestyle they dreamed about when they were in their 20s. They may live in beautiful homes, take wonderful family vacations, send their kids to college, and still save for retirement. But the challenge is that they no longer find their work fulfilling. It lacks purpose, and it has become routine, even boring. They trudge off to work, dreading another day, with the belief that they are doing their job of providing for their family. They work their 40 hours a week, and they look forward to the day they can quit and start to really enjoy life.

For others, the situation is much worse. Their jobs require them to work very long hours. It is not uncommon for them to put in 10 to 12 hours at the office, and they spend another hour or two in the evening answering emails and catching up. They keep this pace a minimum of five days a week, and may even work on the weekends. To maintain this grueling schedule, they often give up their own personal time. They consistently sleep less than 7 hours a night. They rarely exercise. They almost never take time to pause and think about what matters most to them.

Are you one of these individuals? Has your job become routine and lost its sense of purpose? Are you working so hard you don’t have time to take care of yourself? Are your long hours creating emotional distance between you and the people you love the most? Have you been so focused on the daily struggle that you’ve lost sight of your retirement goals? Complete a quick personal assessment to take inventory of your financial and time freedom.

Personal Freedom Assessment

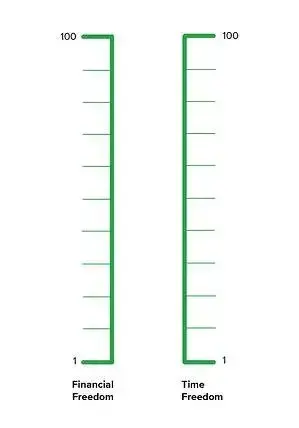

Draw two vertical lines on a sheet of paper. Label the first line financial freedom and the second line time freedom. Create a scale for each line from 1 to 100. Assume that the bottom of the scale represents virtually no freedom for this metric, and the top of the scale represents total freedom. Here’s what you should have on your piece of paper:

On a gut level, where do you feel you are on each scale?

Now ask yourself, how satisfied are you with your freedom in each area? If you’re totally satisfied with your time and money freedom, cultivate a sense of gratitude for your good fortune.

If, like most of us, you are not totally satisfied, where does your dissatisfaction lie? Do you have a shortage of money freedom or time freedom? Often, but not always, our two freedoms (money and time) have an inverse relationship. We can give up some money in exchange for more time, or we can give up some time in exchange for more money. If this is the case for you, are you willing to make that trade?

If you are, the next obvious question is, how? This is not an easy task. It requires you to be clear about what matters most to you and to be clear about what you are willing to give up. In many cases, you will need to understand the financial costs and benefits of your choices. You will need to answer questions such as, “How will my proposed trade impact my ability to retire comfortably?” or “How will it help to take care of my ailing parents?”

These are hard questions to navigate on your own. The good news is our Roundtable™ team of specialists can help. Our goal-based comprehensive financial planning walks you through evaluating your goals for retirement and devises a plan to help you get there.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.