After decades of paying payroll taxes, many people believe that their Social Security benefits are tax-exempt, but this simply isn't the case for a lot of retirees. In fact, the Social Security Administration estimates that 52% of beneficiaries paid income tax on their benefits in 2015 and 56% of all beneficiary families will owe income tax on their benefits from 2015—2050.

If your only source of retirement income is Social Security, your benefits just might be tax-free. However, if you have other sources of income beyond just Social Security, it’s very likely that at least some of your benefits will be taxable.

How Social Security Benefits Are Taxed

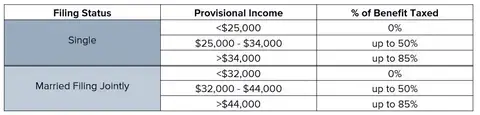

The income threshold to have your Social Security benefits taxed is relatively low. If your provisional income is more than $25,000 for single filers or $32,000 for married spouses filing jointly, your Social Security benefits will be taxed. Single filers who earn $25,000—$34,000 or married filers earning $32,000—$44,000 could have up to 50% of their benefits taxed. Further, individuals earning more than $34,000 or couples earning more than $44,000 could have up to 85% of your benefits taxed. No one is taxed more than 85% of their Social Security benefits, regardless of income.

Income Thresholds for Social Security Taxes

These thresholds have been in place since the mid-1990s and are not currently indexed for inflation. This means that every year, more and more retirees will likely have some portion of their Social Security benefits taxed.

Additionally, the Social Security income thresholds are based on your “provisional income,” which is different than your adjusted gross income (AGI). Your provisional income is the sum of 50% of your Social Security benefits plus income from:

- Job earnings

- Pensions

- Annuities

- Investment returns and dividends

- Interest from tax-exempt bonds

This provisional income adds a little wrinkle into figuring out how much of your Social Security benefits will be taxed. For example, let’s say you and your spouse have $30,000 in distributions from a Traditional IRA and $15,000 in Social Security benefits. Your provisional income would be $37,500, or $5,500 over the $32,000 cap. In this instance, $2,750 of your Social Security benefits (half of $5,500) would be included in your taxable income.

What to Look For

If you are close to a threshold, it may be beneficial to implement strategies that can lower your AGI and lower the amount of your benefits that will be taxed. Spreading a large capital gain over multiple years, contributing to a Traditional IRA, or increasing the amount you withdraw from a Roth IRA to cover your expenses can all help keep your AGI and your Social Security taxes lower.

Social Security is a critical component of retirement income for many retirees. Being prepared for a possible tax hit on your benefits can help increase the chances you’re making the most of Social Security.

To better understand how your Social Security benefits may be taxed, reach out to a financial advisor today.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.