The cost of college has been rising well above the rate of inflation for more than a decade, but there are some signs that annual increases are moderating, according to the CollegeBoard. Its Trends in College Pricing and Student Aid 2021 survey reported a 1.6% average increase in total year-over-year (sticker) tuition and fees at full-time, undergraduate public four-year in-state schools (to $10,750, before inflation), and a 2.1% increase at private four-year colleges and universities (to $38,070, before inflation).

Is College Worth It?

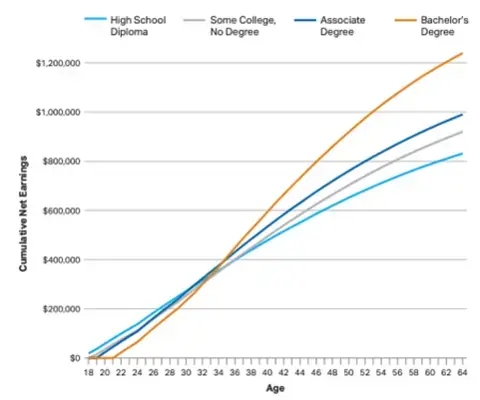

As the price of college continues to rise, more students and families are asking if college is worth it. According to the CollegeBoard, a non-profit organization whose mission is to expand access to college, the typical 4-year college graduate who enrolls at age 18 and graduates in four years can expect to earn enough relative to a high school graduate by age 33 to compensate for being out of the workforce for four years and for borrowing the full tuition (along with all fees, books and supplies) without any grant aid. The expected higher lifetime income really begins to accelerate after age 40, as the following chart illustrates.

Estimated Cumulative Full-Time Median Earnings (in 2017 Dollars) Net of Loan Repayment for Tuition and Fees and Books and Supplies by Education Level

Source: CollegeBoard, Education Pays: The Benefits of Higher Education for Individuals and Society, 2019.

Notably, 74% of private nonprofit four-year college students, and 60% of public four-year college students complete their education within six years, according to 2011-12 CollegeBoard data. Within both types of institutions, students with higher family incomes were more likely to complete a degree than their lower-income peers with similar high school GPAs.

Paying for college has been compared to buying a new or used car every year, but the sticker shock can be lessened if you plan ahead. Here are six tips to help get you started.

- Get your retirement in order first – Your kids will have access to more sources of college money than you will once you stop working, so make sure you’re on the right path for your own retirement before you set aside money for your kids’ or grandkids’ college.

- Start early – Even small contributions can add up if you give them time to grow. Investing just $100 a month for 18 years can yield $48,000, assuming an 8% average annual return.[1]

- Consider a 529 savings plan for potential tax advantages[2] – Although contributions are not deductible, earnings in a 529 plan grow federal tax-free, and qualified withdrawals are free of federal taxes (and more than 30 states offer full or partial tax benefits, too.) Lifetime limits range from $235,000 to $550,000 per beneficiary, depending on the plan.

- You, as the account owner, control how the funds are invested and distributed over the life of the account. You can also change the beneficiary to another qualifying family member.

- You can open a 529 no matter how much you make or the age of the beneficiary, which makes them particularly attractive vehicles for grandparents who want to lower the value of their taxable estates.

- The account owner can withdraw funds at any time for any reason, but keep in mind that the earnings portion of non-qualified withdrawals will incur income taxes and an additional 10% penalty.

- In 2022, you can elect to treat a 529 plan contribution of between $16,000 and $80,000 per individual beneficiary as if it were made over a five-year calendar-year period to qualify for the annual gift tax exclusion. (You do need to be aware of how these contributions will affect your gift- and generation-skipping limits in the same tax year, however.)

- Learn more about 529 plans here.

- Custodial accounts give the child more control over the money – Gifting assets through the Uniform Gifts to Minors Act (UGMA) accounts or transferring assets through the Uniform Transfers to Minors Act (UTMA) accounts can be a practical way to expand the universe of available investment options, but they come with a caveat. UGMA and UTMA accounts weigh more heavily on financial aid decisions because they are considered an asset of the child, not the parent. Plus, their tax benefits are limited when compared to a 529, and use of these funds for tuition at K-12 schools is limited to $10,000. The biggest consideration, however, is that the money saved becomes the child’s at a certain age (18 or 21, depending on the state), regardless of whether they go to college.

- Set up a Coverdell Education Savings Account for simpler needs – The Coverdell ESA offers tax advantages that are similar to those of the 529 plan, but limits contributions to $2,000 per year combined from all sources. If you’re contributing less than $2,000 a year, they can be simple to set up and manage. Keep in mind that there are phased income restrictions when setting up the account and no inflation adjustments. In addition, the funds need to be used up by age 30.

- Take advantage of federal tax breaks – Depending on your modified adjusted gross income, you may be able to take the “American Opportunity Tax Credit and Lifetime Learning Credit” in the first four years you pay tuition for higher education. You can get a maximum credit of $2,500 per student, and if the credit brings the amount of tax you owe to zero, you can have 40% of any remaining amount of the credit (up to $1,000) refunded to you.

Need more info on college affordability? Contact your financial advisor or visit the CollegeBoard’s website.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. Wealth Enhancement Group does not offer tax or legal advice.

[1] Hypothetical example is intended to illustrate the benefit of long-term investing. It is not intended to predict the return of any investment, which will fluctuate with market conditions. All investing involves risk, including loss of principal.

[2] Savingforcollege.com, The Top 7 Benefits of 529 Plans. https://www.savingforcollege.com/intro-to-529s/name-the-top-7-benefits-of-529-plans

This article was originally published in the Pioneer Press.