Stocks have been particularly strong in 2024 as volatility has been near multiyear lows. That trend has reversed in recent days, following the most recent labor data releases.

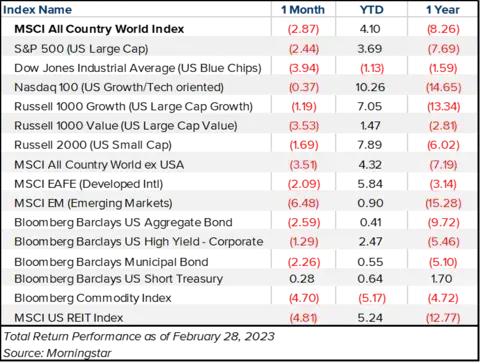

Even with the recent pullback, markets are still notably higher year-to-date (YTD). The recent volatility is a good reminder why diversification is so important. The tech-heavy companies and indices that have contributed the most over the past year are also those being most impacted by the risk-off sentiment.

Global equities are currently selling off on concerns over a slowing economy and labor market. The S&P 500, Nasdaq 100 and Russell 2000 all opened approximately -4% to -5% lower in Monday trading. The selloff is not contained to just U.S. equities: International equities are trading lower as well, and Bitcoin tumbled as much as 15%. Yields are falling as well, which means that investors are buying bonds (flocking to quality). The yield on the 2-year treasury has declined from Friday’s open of 4.15% to 3.72% on Monday, August 5, while the 10-year treasury fell from 3.98% to 3.68%

The selling began last week, after a weak jobs report fueled concerns that the economy may be risking a deeper economic slowdown, especially after this week’s Fed decision to keep rates at the current level of 5.25-5.50%. As of market close on Friday, August 2nd, the S&P 500 Index declined -5.7% (after reaching a high in mid-July), and the Dow Jones Industrial Average was down -3.6%. The Russell 2000 Index had a great month in July, up 10.1%, but declined -6.5% in the first 2 days of August.

Nasdaq 100 - Tech-Heavy U.S. Equities

The tech-heavy Nasdaq 100 has been hit particularly hard, falling into correction territory, down -11% through 8/1 since its peak in July. Flagship names such as NVDA (-14%) and AAPL (-8%) headlined Mega Cap stocks that were trading lower before the market opened on Monday. Markets are extending last week’s retreat as a wave of selling hit a fever pitch in Japan as traders rushed to unwind popular carry trades, powering a 3% surge in the yen and causing the Topix stock index to shed 12% and close with the biggest 3-day drop since 1959.

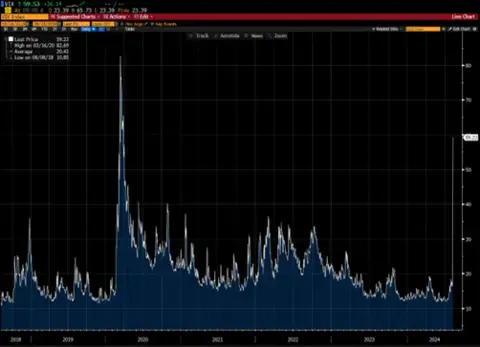

CBOE VIX Chart - Measures Market Volatility

az

The VIX Index, which is a measure of equity market volatility, has surged from 12 to 60 in just a matter of days. This is the highest level of volatility experienced since the height of the pandemic in 2020.

As recently as 8/1, Fed Futures predicted an 80% chance of a 25 basis points (0.25%) cut in September, and roughly 20% chance of a 50 basis points cut. In just one day, those odds have almost flipped to roughly 80% probability for a 50 basis points cut, and a 20% probability for a 25 basis points cut.

Recent Economic Data:

- Nonfarm payrolls rose by 114,000 in July compared to estimates for an increase of 175,000 and June’s increase of 206,000.

- The unemployment rate rose to 4.3% vs. 4.1% in the prior report.

- The weekly Initial jobless claims increased to 249,000 vs. 235,000 in the prior week’s report.

- Average hourly earnings were up 3.6% compared to 3.9% in the last payroll report which shows some relief on wage inflation pressures.

- ISM Manufacturing also came in lower than expected, at 46.8 vs 48.9 consensus and 48.5 last month (any number below 50 suggests contraction in the industry).

- At the same time, ISM prices paid showed a slight increase to 52.9 vs. 52.1, indicating that manufacturers are still experiencing cost pressures.

Key Takeaways:

This is a subtle reminder to be careful what you wish for. Investors have anxiously awaited lower interest rates but as rate cuts appear on the horizon, signs of a slowdown are reemerging which have increased volatility. While a 2024 recession is not in our base case the data clearly suggests that the labor market is cooling which could foreshadow a decrease in the rate of economic growth.

Equity markets in the U.S. and abroad have been particularly strong year-to-date, and corrections of this magnitude occur frequently in both bull and bear markets. The rotation from Large Cap Growth to Small Caps earlier in July, along with the recent selloff, reinforce why diversification is so important for investors. The Investment Management Team will continue to monitor the recent uptick in volatility and provide further updates as data materializes.

Advisory services offered through Wealth Enhancement Advisory Services, LLC, a registered investment advisor and affiliate of Wealth Enhancement Group®.

This information is not intended as a recommendation.

The opinions are subject to change at any time and no forecasts can be guaranteed. Investment decisions should always be made based on an investor's specific circumstances.

Investing involves risk, including possible loss of principal.