An incentive stock option (ISO) gives an employee the opportunity to buy shares of their company’s stock at a specific price, during a specific window of time.

ISOs can be a powerful investment tool because they allow you to purchase stock at a discount. However, they also come with risk—and potentially significant tax consequences.

In this article, we’ll discuss the basics of ISOs, the potential benefits, pitfalls to avoid, and how ISOs are taxed. We’ll also compare incentive stock options to non-qualified stock options (NSOs). Let’s dig in.

What Are Incentive Stock Options?

Incentive stock options are a type of compensation given to employees that allow them to buy shares of the company’s stock at a specific price. ISOs—also known as qualified stock options (QSOs)—are typically given to highly valued employees.

ISOs are not shares of stock. To obtain actual shares under a stock option, the employee must still purchase the stock. This is what differentiates stock options from restricted stock units (RSUs). When integrating stock options into your entire strategy, taking into account financial planning services can help you manage potential risks and improve their benefits.

As your ISOs vest (become available), you can purchase (exercise) a certain number of shares at the exercise price. Ideally, you’d wait to exercise your options until the market price of the stock exceeds the exercise price. However, don’t wait too long: If you don’t exercise your options before they expire, you’ll lose the benefit of the exercise price, potentially leaving money on the table. If you want to know more about how ISOs fit into your investment strategy, wealth planners can help you make informed choices.

The Benefits of Incentive Stock Options

First and foremost, ISOs provide an opportunity to purchase shares of stock at a reduced price. They also provide potential tax benefits.

For example, let’s say your company gives you the option to purchase 2,000 shares of stock at an exercise price of $10 per share. If the market price of the stock is $50 per share when your options vest, then you can buy $100,000 worth of stock for only $20,000.

However, a less obvious benefit of ISOs is the way they’re taxed. When a certain set of criteria are met, ISOs are taxed at lower rates than regular income. So, when you eventually sell the stock, if you meet these criteria, you’ll end up with even more money in your pocket.

Let’s unpack those criteria next.

Have questions about ISOs? Talk to a Wealth Enhancement advisor today.

How Are Incentive Stock Options Taxed?

ISOs are reported for tax purposes at two different times: when exercised, and when sold. How they are taxed when they are sold depends on whether the sale meets the criteria for what’s called a “qualifying disposition.” If they don’t, they’re considered “disqualified.”

ISOs and the Alternative Minimum Tax (AMT)

The first reportable event with ISOs occurs when you exercise your options. ISOs are counted as income when exercised solely for calculating the Alternative Minimum Tax (AMT). Note that the sale of stock acquired through ISOs also needs to be reported for AMT purposes. AMT calculations can get complicated very quickly—so if you are exercising ISOs, speak with your tax advisor first.

For now, it’s important to understand that when you exercise ISOs, the difference between the exercise price and the fair market value (FMV) on the day you exercise the options will count as income for calculating AMT. This is referred to as the “bargain element”.

How you are taxed on your gains at sale depends on how long you hold on to your shares. The name of the game is waiting, and how long you wait to sell your shares will determine if you trigger a qualifying or disqualifying disposition.

ISO Example: Tax Treatment of a Qualifying Disposition

The preferential tax treatment that makes ISOs so valuable comes from triggering what’s called a qualifying disposition. This happens when you meet two criteria, both of which are time-related:

- You sell the acquired shares at least one year after you exercised your ISOs.

- You sell the shares at least two years after the ISOs were granted.

If a qualifying disposition is triggered, then any profits you make from the sale of your stock are taxed at long-term capital gains rates. And since long-term capital gains rates are lower than income tax rates, this is where you can realize the benefits of ISOs.

To illustrate, let’s assume you are in the 24% tax bracket and exercised the following ISO:

- Grant date: January 1, 2021

- Exercise price: $20/share for 1,000 shares

- Exercise date: March 1, 2023

- FMV on exercise date: $100

- Sale date: April 1, 2024

- FMV on sale date: $120

In this example, you’ve met the requirements for a qualifying disposition, because:

- You sold the shares more than one year after you exercised the ISO.

- You sold the shares more than two years after you were granted the ISO.

Since this sale qualifies, the gain from the sale will be taxed at the long-term capital gains rate of 15% (based on your income).

| Figure 1. Tax Impact of ISOs–Qualifying Disposition | |

| Total Invested (exercise price) | $20,000 |

| Federal Income Taxes Due the Year You Exercise | $0 |

| Sale Price of Stock | $120,000 |

| Cost Basis | ($20,000) |

| Realized Profit (subject to AMT) | $100,000 |

| Long-Term Capital Gains Rate + Net Investment Income Tax (NIIT) | 18.8% |

| Capital Gains Taxes (based on $20,000 capital gain) | $3,760 |

| Net Profit from ISO | $96,240 |

Note: In this example, the individual is subject to the NIIT because their adjusted gross income (AGI) is above $250,000. The Net Investment Income Tax is an additional 3.8% on top of the 15% long-term capital gains rate. This example does not account for any AMT owed.

ISO Example: Tax Treatment of a Disqualifying Disposition

If you fail to fulfill either waiting period requirement, then you have a disqualifying disposition—and you lose the tax advantage of long-term capital gains rates.

To compare the impact of a disqualifying disposition, let’s use a similar fact pattern to the one above, again assuming you are in the 24% tax bracket:

- Grant date: January 1, 2021

- Exercise price: $20/share for 1,000 shares

- Exercise date: March 1, 2022

- FMV on exercise date: $100

- Sale date: February 1, 2023

- FMV on sale date: $120

Note that both the exercise date and the final sale date are different than those used above in our illustration of a qualifying disposition.

In this example, we meet one test for a qualifying disposition, because the final sale date was more than two years from the grant date. However, since we didn’t hold the stock for at least one year after the exercise date, this is a disqualifying disposition.

When a disqualifying disposition is triggered, then the “bargain element” (difference between FMV on exercise date and exercise price) is taxed as regular income, and the difference between the FMV on the exercise date and the sale date is taxed as capital gain. So, in our example, the bargain element of $80,000 is taxed at regular income tax rates, or 24%.

As for the capital gain, the rate you pay will depend on whether it is considered a long-term capital gain or a short-term capital gain:

- If held for at least a year, we meet the requirements for the more favorable long-term capital gains rates.

- If less than a year passed before the sale, then they are considered short-term capital gains and taxed as ordinary income.

In our example, we held the shares for 11 months, so they are taxed as short-term capital gains.

| Figure 2. Tax Impact of ISOs–Disqualifying Disposition | |

| Total Invested (exercise price) | $20,000 |

| Federal Income Taxes Due the Year You Exercise | $0 |

| Sale Price of Stock | $120,000 |

| Cost Basis | ($20,000) |

| Bargain element taxed as income | $80,000 |

| Income Tax (24%) | ($19,200) |

| Short-Term Capital Gain taxed as Income | $20,000 |

| Income Tax (at 24%) + NIIT (3.8%) | ($5,560) |

| Net Profit from ISO | $75,240 |

Note: In this example, the individual is subject to the NIIT because their adjusted gross income is above $250,000. The NIIT adds an additional 3.8% on top of the 15% long-term capital gains rate. This example does not account for any AMT owed.

Risks Associated With Incentive Stock Options

The biggest risk with ISOs is time—which also happens to be the greatest potential benefit. Stock prices are volatile. Of course, the hope is that when you decide to sell your shares, the fair market value of those shares has significantly increased. However, it’s also possible that the value drops, and that your ISOs are worthless.

Further, since ISOs come with such potentially lucrative benefits, it’s not uncommon for employees to “stock up” on company shares (no pun intended). With such a significant stock position in one company, you expose yourself to concentration risk. While it might seem like a good opportunity to buy all your options and invest heavily in your company, your fortunes could turn should the share price drop unexpectedly.

Difference Between ISOs vs. NSOs

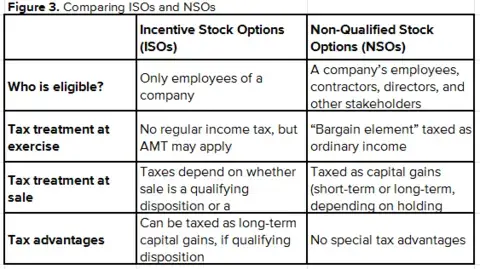

ISOs aren’t the only stock options on the block. There are two types of stock options: ISOs, which we’ve covered extensively, and NSOs, or non-qualified stock options.

These two types of options both allow individuals to buy company stock at a specific price over a specific period. However, they have a few key differences.

While a company might prefer to incentivize all of their stakeholders with the tax-advantaged ISOs, they can only offer ISOs to employees. NSOs, on the other hand, allow a wider range of stakeholders to benefit from stock options, including directors, contractors, lawyers, suppliers, and more.

What Should I Do with My Stock Options?

Wondering what to do with your options? Whether you’ve been granted ISOs or NSOs, that’s a question only you can answer. A strategic approach that considers factors like your cash flow, tax implications, portfolio diversification, and overall financial situation will give you the best chance of seeing the benefit of your ISOs.

There’s a lot to consider when it comes to ISOs. They can get complicated pretty quickly, so it’s a good idea to consult your financial advisor to learn more about how ISOs will interact with your specific situation. Your advisor can help you develop a strategy for how and when you want to exercise your options, so don’t hesitate to reach out.

The opinions voiced in this article are for general information only and are not intended to provide specific advice or recommendations for any individual.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

Stock investing involves risk including loss of principal.

#2024-5367