When talking about retirement income, we often describe it as coming from three buckets. One bucket is any pensions you may be entitled to. Historically, these have been a critical part of retirement for many workers, but they are becoming less and less common. This means that the other two buckets will become more important over time.

The second is your own personal investments that you’ve accumulated while working. This may include income from tax-advantaged retirement accounts, taxable accounts and other alternative investments you may hold. With pensions becoming less common, more people find that they have to self-fund more of their retirement with their investments.

Sources of Retirement Income

The third bucket is your Social Security benefits. Some people may dismiss Social Security as only playing a minor role in their overall retirement income plan. The reality is that 50% of married, retired workers depend on Social Security to comprise at least half of their monthly income (that jumps to 70% for unmarried persons). What’s more, 21% of married couples and about 45% of unmarried persons rely on Social Security for 90% or more of their income.

With Social Security playing a critical role for so many retirees, it’s important to make the most of these benefits. Yet many retirees may be leaving money on the table. The SSA found a whopping 69% of current retirees are receiving reduced benefits. Over the course of their lifetimes, this could lead to hundreds of thousands of dollars in missed benefits.

In order to maximize your Social Security benefits, consider these key factors before you claim.

1. When You Claim Affects Your Benefits

You can claim your benefits as early as age 62. While it might feel great to begin receiving those monthly checks, consider that you’ll receive permanently reduced benefits (about 25% less) than if you waited until your full retirement age (FRA), which ranges between 66 and 67. Alternatively, if you delay claiming Social Security until age 70, you’ll receive up to 32% more than your FRA benefits.

2. Working Can Reduce Your Benefits

Working while collecting benefits could impact your monthly benefit amount. If you claim Social Security and haven’t yet reached your FRA, your benefits could be reduced dramatically based on your income.

During the years prior to reaching FRA, your benefits will be reduced by $1 for every $2 you earn over $18,240. The reduction becomes less severe the year you reach FRA; for every $3 you earn over $48,600, your benefits will be reduced by $1. The earnings limit of $48,600 only applies during the months prior to reaching FRA. For example, if you reach FRA in August, the limit of $48,600 only applies to income earned from January to July.

Once you reach FRA, none of your benefits will be reduced because you’re working, regardless of how much you earn.

2020 Retirement Income Limits

3. Social Security Benefits Are Taxable

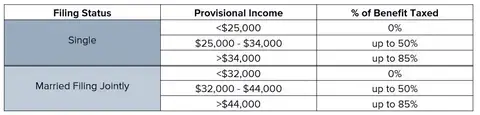

It’s often assumed after paying payroll taxes for decades that Social Security benefits are tax-exempt. For many retirees, it’s an unfortunate surprise that Social Security benefits are taxable. If your income is over $25,000 when filing single or $32,000 filing jointly, up to 50% of your Social Security benefits will be included in your taxable income. If you earn over $34,000 when filing single or $44,000 filing jointly, up to 85% of your benefits will be included in your taxable income. It’s important to note that these income thresholds are not currently indexed to inflation. This means that, over time, more and more retirees will have their benefits taxed.

How Social Security Benefits Are Taxed

These factors, along with your health, desire to retire earlier than FRA and family circumstances, can make the decision to claim Social Security incredibly complex. Working with a financial advisor can answer your questions and help you create a strategy to make the most of these powerful but often complicated benefits.