For the period July 1 – July 31, 2024.

Executive Summary

Volatility returned to markets as investors grappled with mixed economic data, political headlines, second-quarter earnings, and central bank policy meetings. Despite the challenges, the totality of data suggests that the U.S. economy is still expanding, as investors eagerly await the Fed’s next move.

What Piqued Our Interest

There’s an old quote that says, “There are decades where nothing happens, and there are weeks where decades happen.” The last few weeks have seen a substantial amount of news and market moves. As we entered the second half of the calendar year, U.S. equity markets were climbing to new highs, inflation looked to be trending down, and everyone was focused on Artificial Intelligence (AI). Markets may have been in a good place on the surface, but political headlines, economic data, corporate earnings, and central banks introduced some near-term uncertainties.

On July 13, there was an assassination attempt on former president Trump, which ignited his voter base and increased his position within the polls. With that, many began to speculate about his economic agenda during a second term with expectations for further protectionist foreign trade policies, including the possibility of significant tariff increases on China.

A week later, President Biden withdrew from the presidential race and endorsed Vice President Kamala Harris, shaking up the political backdrop once again. With implications for economic agendas and policy changes at stake, politics continue to make headlines and potentially impact markets.

Prior to grappling with these changes in the political landscape, investors had been wading through market-moving economic data. On July 11, the Consumer Price Index (CPI) came in softer than expected, showing a month-over-month decline of -0.1% and a year-over-year print of 3.0%, down from the prior month’s 3.3%. With this softer inflation print, markets began anticipating imminent rate cuts, prompting a rotation within markets. Small Cap stocks and cyclical sectors benefited the most from this rotation.

July also brought second-quarter earnings season, and the last three weeks of July saw 75% of S&P 500 companies report revenues and earnings. Most of these companies beat consensus expectations, and according to FactSet, the companies in the index are on track to grow earnings by 11.5% on a year-over-year basis.

At the end of July, the Federal Reserve decided to keep interest rates unchanged, but comments suggested that the committee was open to cutting rates at their next meeting in September if the inflation data continues to cooperate. The Fed indicated that they are attentive to both sides of their dual mandate that includes both stable inflation and maximum employment.

At the same time, on the other side of the Pacific, the Bank of Japan raised interest rates by 15 basis points to 0.25%. The Bank of Japan seemed to be going against the global trend and looked to tighten policy, while many are already cutting rates or contemplating cuts.

On August 2, the Bureau of Labor Statistics reported that July payrolls increased by 114,000—way off of consensus expectations for 175,000 payrolls to be added, and a marked slowdown from the 206,000 that were added in June.

The greater-than-expected moderation in the labor market, coupled with investors who believed the Federal Reserve may have missed the opportunity to cut rates in July and global market reactions to the unwind of the very popular “carry trade” (where investors borrow yen given its low interest rates, convert to U.S. dollars, and purchase risk assets), caused a spike in volatility not seen since the days of the pandemic.

Market Recap

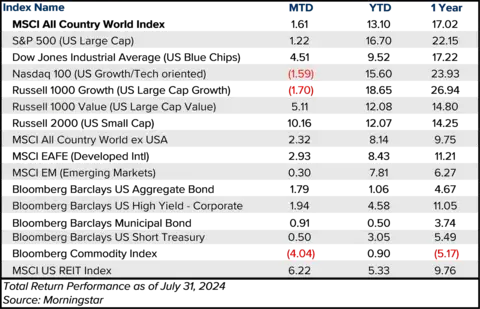

U.S. equity market returns in July were mixed, with the S&P 500 Index up 1.2%, capping the first seven months with a year-to-date return of 16.7%. Value stocks were back in favor in July, up 5.1% compared to their Growth counterparts, which saw a decline of -1.7% during the month. From a sector standpoint, interest rate-sensitive Utilities, Real Estate, and Financials outperformed (up over 6% each), while Tech and Communication Services saw declines during the month. Additionally, Small Cap stocks had a great month, up 10.2%. Developed International stocks also outperformed the S&P 500 Index and are seeing solid returns of over 8% this year.

In fixed Income, credit spreads remained tight, and the U.S. Aggregate Bond Index was up 1.8% in July. Municipal bonds also gained in July by 0.9%, and high-yield corporate bonds were up 1.9%, bringing the year-to-date (YTD) returns up to 4.6%. The recent volatility in markets was even more beneficial for bonds, and YTD returns for the Bloomberg Barclays U.S. Aggregate Bond Index were at 3.2% as of the market close on August 2. Commodities had a tough July, down 4.0% in the month but the MSCI U.S. REIT Index benefitted from the lower rate expectations, returning 6.2% in July.

Closing Thoughts

After months of anxiously awaiting lower rates, and with most expecting cuts as soon as September, signs of continued moderation in the economy have increased volatility in markets. Growth scares and corrections in markets happen, and 10% corrections have occurred in 63% of the calendar year returns since 1928.

Global financial markets are facing increasing challenges: Just as inflation risks have abated, the probability of a recession has been calibrated slightly higher as investors question whether a September rate cut will be too late. The bull market in Technology and the promise of AI have witnessed a shakeout, and the market as a whole has quickly repriced for all these risks.

We continue to evaluate the totality of the data in front of us, and while economic growth is slowing, the economy is not contracting, and a 2024 recession is not in our base case. Even with this volatility in the markets, we have seen strong YTD returns, and this current bout of volatility is a good reminder why diversification is so important.

The opinions are subject to change at any time and no forecasts can be guaranteed. Investment decisions should always be made based on an investor's specific circumstances. Investing involves risk, including possible loss of principal.

There is no guarantee that asset allocation or diversification will enhance overall returns, outperform a non-diversified portfolio, nor ensure a profit or protect against a loss.