For the period November 1 to November 30, 2023.

Executive Summary

U.S. equity markets bounced back with historically strong returns in November as yields on longer-dated Treasuries declined. If inflation has been tamed and rate hikes are in the rearview mirror, a recession may be averted—but the era of interest rates anchored near zero may also be behind us.

What Piqued Our Interest

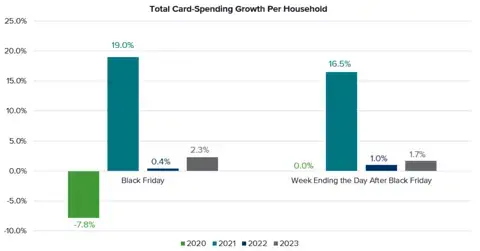

December’s here, which means the holiday season is in full swing. With Thanksgiving and Black Friday arriving earlier this year, the holiday shopping season has been going on for weeks, meaning consumers have had more time for holiday spending. According to JP Morgan, total retail sales surge by an average of about 17% in the last two months of the year. However, 2022 saw just 9% growth, which was one of the weakest in years, as inflation weighed on consumer spending. Data from Bank of America (as seen in the chart below) shows that the week following Black Friday has seen slightly higher growth in 2023 compared to last year.

Source: BofA Global Research

Since the summer of 2021, when the Consumer Price Index began reporting inflation numbers above 5%, many have been concerned that the only way the Fed would be able to suppress these high levels of inflation would be by tightening financial conditions to the point where the economy was thrust into a recession.

However, the CPI report in mid-November was at 3.2%, lower than expected and down from 3.7% in the prior month. Additionally, PCE inflation (the Fed’s preferred measure of inflation) declined to a rate of 3.5%. Although we still haven’t reached the Fed’s target rate of 2% inflation, the current momentum points to some price stability as we approach the targeted levels. These benign readings also go against the notion that inflation would remain stubborn and stickier. This provides support to why the Fed hasn’t raised rates since July, as well as the market narrative that believes the Fed is done hiking rates.

As we head towards 2024, we are now experiencing a decelerating rate of inflation, combined with economic growth that continues to come in above expectations, providing a constructive backdrop for markets. We remain cautiously optimistic, but we continue to expect economic growth to soften in the coming months. Despite the recent strength seen in third quarter GDP, which posted growth of 5.2% annualized, there are headwinds to continued economic growth, including fading fiscal stimulus, stagnating corporate revenue growth, retail inventories that are 10% above pre-Covid trends, and the dwindling consumer’s excess savings. 2023 saw economic growth surprise to the upside; we’ll see if it can continue into 2024.

With the Fed no longer needing to raise rates to push back on inflation and economists acknowledging an expected slowdown in growth, the markets have started taking wagers on when the Fed will cut rates. The magnitude and timing of Fed easing is ripe for debate in the coming months, with some participants expecting cuts as early as the first quarter of 2024. We expect the Fed to remain dependent upon the unfolding economic data, which leaves the path of interest rates somewhat uncertain for the time being.

Market Recap

The S&P 500 rose by over 9% during the month of November, its second-best November performance since 1980, according to Bloomberg. The index was brought back to the highs seen in late July and only 5% below the all-time highs seen in early 2022. The rebound in markets was broad-based, with the Dow Jones Industrial Average also up over 9% in November, taking the index to a new high for 2023. The Nasdaq 100 also hit a new high for 2023 and is up nearly 47% year-to-date. Both the DJIA and Nasdaq remain below their all-time highs, but similar to the S&P 500 Index, both indices are within close proximity. The strength of November’s performance pulled U.S. Value and U.S. Small Caps out of negative territory for the year, and a broadening out of the market (where more individual issues contribute to returns) is a positive development.

In fixed income, the yield on the 10-year Treasury retracted back to 4.3% after touching 5% in late October. The Bloomberg U.S. Aggregate Bond Index closed the month of November up 4.5%—its best month since 1985. With that, the index may skirt posting a third consecutive negative return, as year-to-date returns are up 1.6%. Municipal bonds rode the wave of improved fixed income returns, with the Bloomberg Municipal Bond Index up 6.35% in November, the sixth-best monthly return on record and the second-best November on record since 1981. Likewise, REITs were up over 10% for the month, again helped by lower longer-term Treasury yields. The only area that saw contraction was in Commodities, where oil has declined by over 18% since its highs in late September.

Closing Thoughts

If we are able to avert a recession—or a potential recession is mild, as many expect—we would note that Fed cuts to interest rates are unlikely to be too deep, leaving behind the era of near-zero interest rate policy. Despite the current excitement over potential interest rate cuts in 2024, we are still mindful of the possibility that investors can be whipsawed by macroeconomic data—especially when rates are high, as investors demand greater compensation for taking on risk.