For the period January 1 – January 31, 2024.

Executive Summary

U.S. equity markets hit new all-time highs in January, even as market expectations for interest rate cuts from the Fed were recalibrated. The Fed wants to be confident that inflation is stemmed prior to their first rate cut, so all eyes will focus on economic data, which currently supports their decision.

What Piqued our Interest

Final 2023 GDP numbers were released at the end of January, and the report showed that real GDP rose 3.3% annualized in the fourth quarter. Although this metric is backward looking, it illustrates the strength of real final sales by consumers, the engine of the U.S. economy, and highlights its resiliency.

Similarly, the Institute for Supply Management’s manufacturing index, a measure of U.S. factory activity, rose to a 15-month high of 49.1 for January. This still indicates an overall contraction in activity, but it shows signs of growth beneath the surface. The survey’s new orders index showed the largest monthly advance in more than three years as production expanded for the first time in four months.

Additionally, economic data seen in the non-farm payroll reports showed that the labor market remains strong. With the most recent release, we saw that there were fewer end-of-year layoffs, producing strong January payroll gains across professional services, retail, and manufacturing industries. The report also showed that the unemployment rate remained below 4%, a level which has now been present for two years, the longest streak under 4% since 1967.

However, alongside better-than-expected growth, the post-pandemic years have been plagued by inflation. Although measures of inflation have declined, with the Consumer Price Index (CPI) reporting 3.4% and the Personal Consumption Expenditures Index (PCE) reporting 2.6%, price levels remain elevated for the average consumer. The jobs report also showed some wage inflation, with average hourly earnings up 0.55% month-over-month, equating to an increase of 4.5% on an annualized basis.

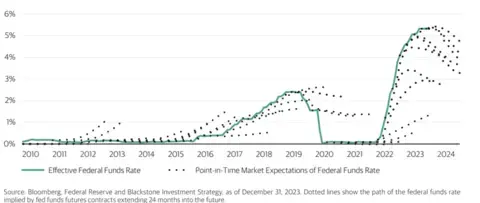

The strength of the economic data pushes back on the narrative of a slowdown in the economy, but it also pushes back on market expectations for the timing and magnitude of interest rate cuts. As the Fed indicated in December with their summary of economic projections, Federal Reserve members estimated that 2024 would end with the Fed Funds rate near 4.50 – 4.75%, equivalent to three cuts of 25 basis points throughout the year. Markets took this indication a bit too far with as many as six rate cuts beginning in March 2024 getting priced into interest rate futures markets. After the Fed’s meeting and press conference on January 31, the markets recalibrated to reduce the probability of a rate cut in March, but it still expects the Fed Funds rate to end 2024 near 4%, which is lower than the Fed’s projections. However, the chart below shows market expectations for the path of fed funds (dotted lines) and the actual outcomes (green line), indicating that market expectations can diverge significantly and are often unreliable.

Figure 1. Market Expectations of Fed Funds Rate

Beyond the macroeconomic data, companies continue to report fourth quarter earnings, which have seen mixed results relative to expectations. However, earnings are projected to show an overall increase of 1.8% over the comparable period in 2022. The weakness seen in Commercial Real Estate, Transportation companies, and other Industrial companies has been offset by strength in Health Care, Consumer Staples, and a few large Technology companies.

Market Recap

U.S. Large Cap indices climbed higher in January with the S&P 500 Index, Dow Jones Industrial Average, Nasdaq 100, and Russell 1000 Growth indices hitting all-time highs. Small Caps took a breather, pulling back nearly -4% after climbing 12% in December. Developed International stocks were also positive in January, up 0.6%, but Emerging Markets were down -4.6% as economic woes in China pressured the index, where China constitutes nearly 27% of the index.

In Fixed Income, index returns were slightly negative as longer-dated Treasury yields rose in January. The U.S. 10-year Treasury saw yields as low as 3.79% in late December, but yields climbed back near 4.17% by late January. The Bloomberg U.S. Aggregate Bond Index declined -0.3%, and the Bloomberg Municipal Bond Index declined -0.5%. Credit performed relatively better, with U.S. high-yield remaining flat during the month as spreads remained tight. The MSCI U.S. REIT Index saw a decline of -4.17% in January after being up over 9% in December.

Closing Thoughts

Whether or not interest rate cuts begin in March, May, or June, interest rate hikes look to be behind us. Given the strength of the economy and resilience of the labor market, the Fed has the flexibility to wait a bit longer in order to ensure they normalize rates without the fear of having inflation flare up again.

In the near term, the market will likely bounce around, reacting to each economic data release and news headline, but it is difficult to predict the exact path and magnitude of these reactions. We continue to champion a well-structured financial plan with a diversified portfolio as the wisest choice for long-term investing.