For the period June 1 – June 30, 2024.

Executive Summary

Positive returns in the Growth and Technology sectors helped cap off another strong quarter for the market, but they have further intensified the high concentration of market leadership. Investors appear content with modest rate cut expectations, while growth and inflation have moderated.

What Piqued Our Interest

From an investor’s perspective, there’s a lot to feel positive about as we tie a bow on the first half of 2024: U.S. equity markets are trading near all-time highs, the rate of inflation is declining (albeit slowly), and the labor market remains strong. Perhaps most importantly, the Federal Reserve has communicated that the next move for interest rates is likely to be lower—at least based upon the data we have available now. In aggregate, this has created positive momentum and suggests that the path of least resistance for the markets remains to the upside.

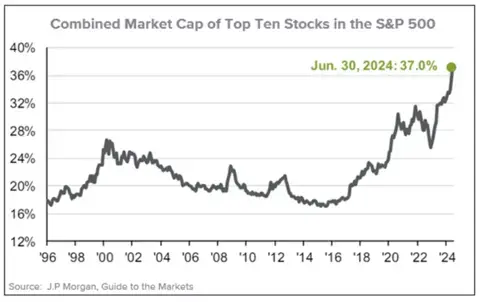

So, what could go wrong? U.S. equity valuations remain well above historical averages, which suggests that a pullback may be overdue—but the same could have been said for most of the past decade. The S&P 500 was trading at 21.1 times forward earnings as of June 30, significantly above the 20-year average multiple of 15.9. However, the top ten weighted stocks in terms of market capitalization have an average price-to-earnings (PE) ratio of 30.3, while the remaining stocks in the index are at 17.6, which is much closer to the overall average.

The impact of artificial intelligence (AI) on the markets cannot be ignored. The potential applications of AI have been a huge tailwind for producers of semiconductors and the Technology sector in general. The S&P 500 Information Technology sector has gained 28.24% so far this year, followed closely by the 26.68% return of the Communication Services sector (which holds stocks like Meta and Alphabet). However, no individual stock has contributed as much to the overall performance of the S&P 500 than Nvidia, which has gained over 150% this year and is solely responsible for roughly a third of the market’s performance this year.

This has resulted in significant concentration in the market unlike anything we’ve seen in decades. Even during the late-1990s dotcom era, the market cap of the top ten stocks was only 27% of the index, which pales in comparison to today’s level of 37%. Granted, today’s market leaders are way more profitable than their ‘90s counterparts, as the top ten stocks make up 26.8% of the S&P 500 earnings, according to J.P. Morgan. However, these stocks now have significantly outsized earnings expectations, which could lead to significant repricing if they fail to live up to them.

Market Recap

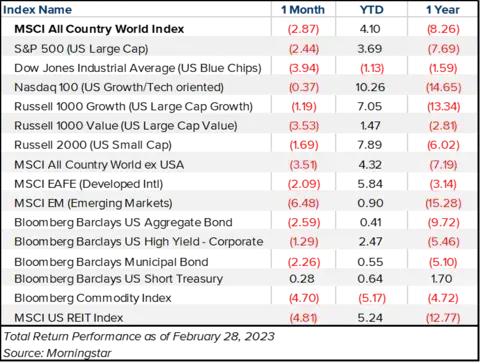

Beyond U.S. Large Cap Growth, equities mostly struggled in June. Both the Russell 1000 Growth and the Nasdaq 100 Index gained over 6%, but the Russell 1000 Value Index declined, as did Small Caps and Developed International stocks. The “blue chip” Dow Jones Industrial Average gained just 1.23% and is up only 4.79% this year, compared to 17.47% for the Nasdaq 100. Small Caps, as represented by the Russell 2000, have had an up-and-down year and sit at just +1.73% on the year. The lingering effects of higher interest rates and inflation, coupled with uncertainties surrounding future tax policy, have been detrimental for smaller stocks.

International stocks were mixed, as the MSCI EAFE Index fell -1.61%, but the Emerging Markets Index gained 3.94%. On the year, the blue-chip Euro Stoxx 50 Index has performed well, up around 9% in Euro terms, which is a bit weaker when translated into USD terms. Emerging Markets have performed a tad better on the year, but individual country performance has varied. China’s Shanghai Composite Index is virtually flat on the year, while Taiwan and Korea have been strong. The continued strength of the U.S. Dollar versus most currencies has further strengthened stocks denominated in dollars.

Closing Thoughts

Even with the narrow band of leadership in the market today, we have continued confidence in the markets for the rest of the year. July has historically been one of the strongest months for equities, as the S&P 500 has been positive in July for nine consecutive years, while the Nasdaq Index has been positive for 16 years. This, of course, is not indicative of what will happen this year, but we also note that a strong first half of the year usually bodes well for the second half. Bank of America recently noted that the S&P 500 has rallied between 10% and 20% 26 times since inception, and of those times, the market gained 88% of the time in the second half, with an average return of +8.6%.

It’s important to not get over exuberant about the state of the markets. After all, complacency is an investor’s worst enemy. The historic performance of Nvidia and other tech leaders cannot and will not last forever, and those who are overextended will feel the pain most of all. If your goal is to grow your assets and minimize drawdown potential, it’s important to opportunistically rebalance and redistribute risk exposures.

Economic growth is moderating but is not falling off a cliff. The labor market remains strong, and high-income earners are keeping retail spending afloat. Until we see data that suggests otherwise, we believe the soft-landing narrative appears most likely. At least one rate cut is still priced into the market by year-end, which appears to be good enough for most investors. We still have multiple uncertainties looming, most notably the November elections, so managing risk remains paramount. Stay grounded and look for opportunities beyond Mega-Cap Technology to help grow your portfolio and reduce the probability of massive drawdown.

This information is not intended as a recommendation. The opinions are subject to change at any time and no forecasts can be guaranteed. Investment decisions should always be made based on an investor's specific circumstances. Investing involves risk, including possible loss of principal.